Coinspeaker

Ethereum ETFs Fail to Boost Investor Interest, ETH Liquidity Drops 20%

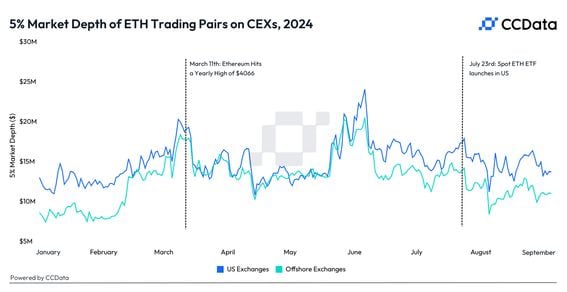

Ahead of the launch of the spot Ethereum ETFs in July, everyone was optimistic that the exchange-traded funds (ETFs) would usher in more liquidity into the asset class. However, things haven’t turned quite as expected as the Ethereum ETF flows have been almost nil or negative over the past few weeks.

Although the liquidity boost played an important role in the launch of spot bitcoin ETFs in January, the story with Ethereum ETFs has played out differently. Ever since the Ether ETFs debut on July 23, it turns out that the Ethereum order book liquidity has declined ever since, as per the data tracked by London-based CCData. All the spot Ethereum ETFs in the US have collectively witnessed $500 million in net outflows since launch.

The data shows that following the ETF launch, the average 5% market depth for ETH pairs on US-based centralized exchanges has dropped by 20% and currently stands at around $14 million. Similarly, on offshore centralized platforms, the market depth has dropped by 19% to around $10 million. This drop shows that it is now easier to move the spot Ether price by 5% in either direction, which could lead to a liquidity drop and greater volatility during large trades. Speaking to CoinDesk, Jacob Joseph, a research analyst at CCData, said:

“Although the market liquidity for ETH pairs on centralized exchanges remains greater than what was at the beginning of the year, the liquidity has dropped by nearly 45% since its peak in June. This is likely due to the poor market conditions and the seasonality effects in the summer, often accompanied by lower trading activity.”

Lower depth for the asset class usually indicates low liquidity and higher slippages while higher depth indicates strong liquidity and lower slippages.

ETH Price Faces Selling Pressure

Amid weak support from Ether ETFs, Ethereum (ETH) price has continued to face selling pressure slipping under $2,400 levels earlier today.

As of Friday, 125,000 ETH options will expire with a put-call ratio of 0.63, a max pain point of $2,500, and a notional value of $290 million.

The overall weakness in the crypto market this week is visible in the options data, with the max pain point aligning with recent price declines, indicating a lag in adjustments.

Ethereum ETFs Fail to Boost Investor Interest, ETH Liquidity Drops 20%