Coinspeaker

Ethereum Gas Fee Drops to 5-year Low amid Massive L2 Adoption

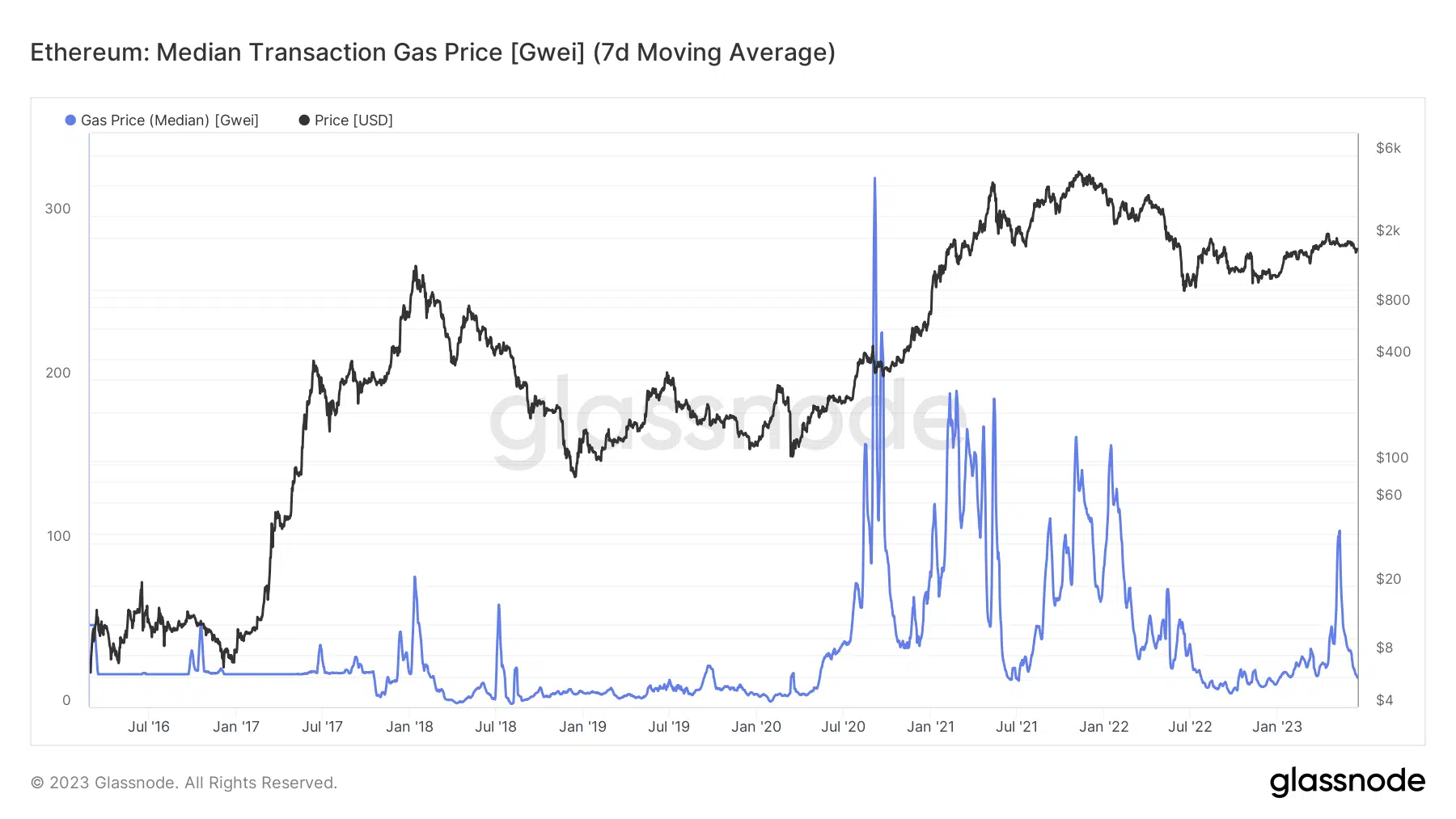

Sending an Ethereum (ETH) transaction just got cheaper, suggesting that the protocol is getting less traffic than it did in the past. Precisely, the median price to send a transaction on the Ethereum blockchain plummeted to 1.9 gwei, with low-priority transactions dropping to around one gwei or lower. This marks a five-year low amidst a surge in activity on Layer-2 networks.

Ethereum Dencun Upgrade Brings Gas Fee Reduction

According to Dune Analytics, the median gas price dropped on August 10. Such levels have yet to show up since mid-2019, and there has been an almost 98% drop from its year-to-date high of 83.1 gwei recorded in March. The popular Ethereum Dencun upgrade happened in the same month, and nine Ethereum Improvement Proposals (EIPs) went live.

One of these EIPs introduced data blobs, also known as proto-dankshrading. This feature aims to decrease transaction costs for Layer-2 blockchains. Apart from proto-dankshrading, the Dencun upgrade promised to reduce Ethereum gas fees to almost negligible figures.

In April, Dune Analytics data also showed that Ethereum’s gas fees dropped to their lowest level in three years.

The Ethereum ecosystem focuses more on scaling L2s, which can handle transactions more cheaply. To achieve this feat, an abstraction process away from the layer-1 Ethereum blockchain is carried out. Markedly, it still uses the L1 to verify that the transactions occurred.

Gnosis co-founder Martin Köppelmann took to X on Aug. 10 to weigh in on the plunge of the Ethereum gas fee. “Ethereum needs to get more L1 activity again,” Köppelmann wrote.

Basefee right now at a multi year low of ~0.8 GWEI. 23.9 would be required to offset staking rewards. IMO Ethereum needs to get more L1 activity again and even if it sounds counterintuitive at such low rates, raising the gas limit can be part of a strategy. pic.twitter.com/RaTkzKOx1r

— Martin Köppelmann 🦉💳 (@koeppelmann) August 10, 2024

He believes a gas fee of at least 23.9 gwei is required to fund staking rewards. For context, these savings rewards are payouts given to those who help validate blockchain transactions.

“Even if it sounds counterintuitive at such low rates, raising the gas limit can be part of a strategy,” Gnosis co-founder added.

Ethereum L2s Records High Performance

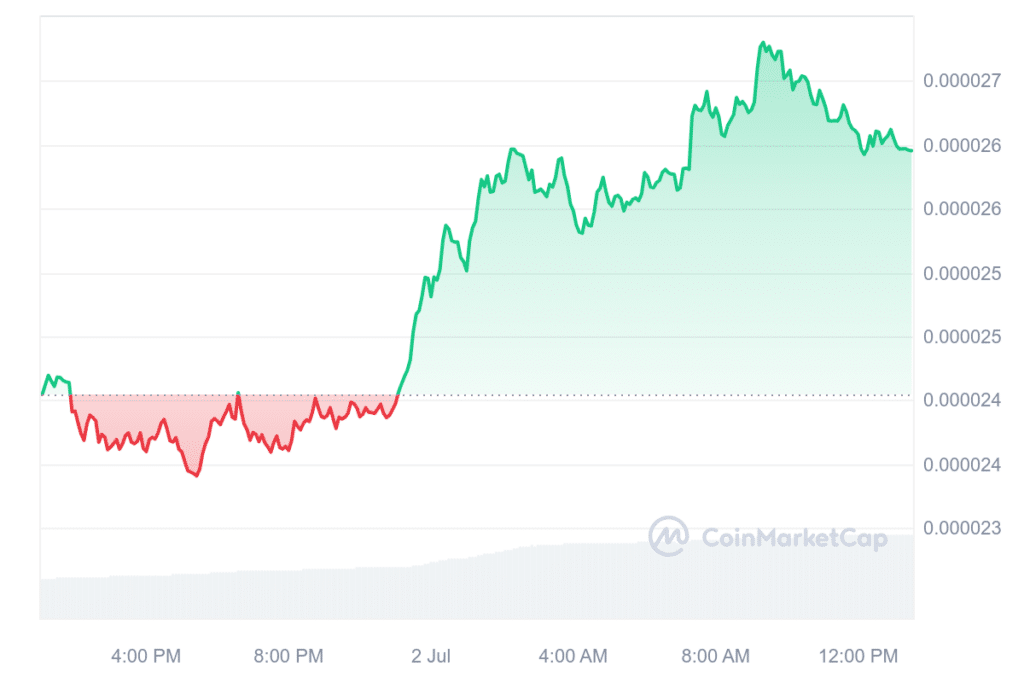

Generally, Ethereum’s L2 activity is way better than that on the Base blockchain from Coinbase Global Inc (NASDAQ: COIN).

L2Beat data showed that Base recorded more than 109 million transactions in the last 30 days compared to Ethereum, which has seen only 33 million. Base records these huge figures almost a year after Coinbase launched it. In March, the crypto exchange announced its plan to move the USDC stablecoins belonging to its customer and corporate accounts to Base.

L2s like Arbitrum and Taiko saw an additional 97 million combined transactions over the last 30 days.

Currently, less Ethereum is used in transactions or as payouts to stakers. This sentiment has caused its supply to grow significantly. Almost 13,400 ETH worth approximately $34.1 million have been added to Ethereum supply in the last seven days.

Ethereum Gas Fee Drops to 5-year Low amid Massive L2 Adoption