Coinspeaker

Ethereum Network Activity Rises Amid Crypto Bearish Outlook Fueled by BTC’s Dip Below $63k

The total crypto market cap slipped over 3 percent in the past 24 hours to hover around $2.4 trillion on Monday, June 24, during the early European session. The bearish crypto sentiment escalated following the ebbing of the spot Bitcoin ETF demand in the last few weeks. According to the latest crypto oracles, Bitcoin price closed last week trading around a crucial support level of about $63k.

The flagship coin had since dropped another 3 percent in the last 24 hours to trade around $62,800 at the time of this writing. Consequently, the altcoin industry, led by Ethereum (ETH), has turned extremely bearish as traders fear a possible regulatory bombshell on Solana (SOL). Additionally, the uncertainty over monetary policies in the United States amid the ongoing geopolitical tension between the G7 nations and the BRICS movement.

Ethereum Network Activity on the Rise

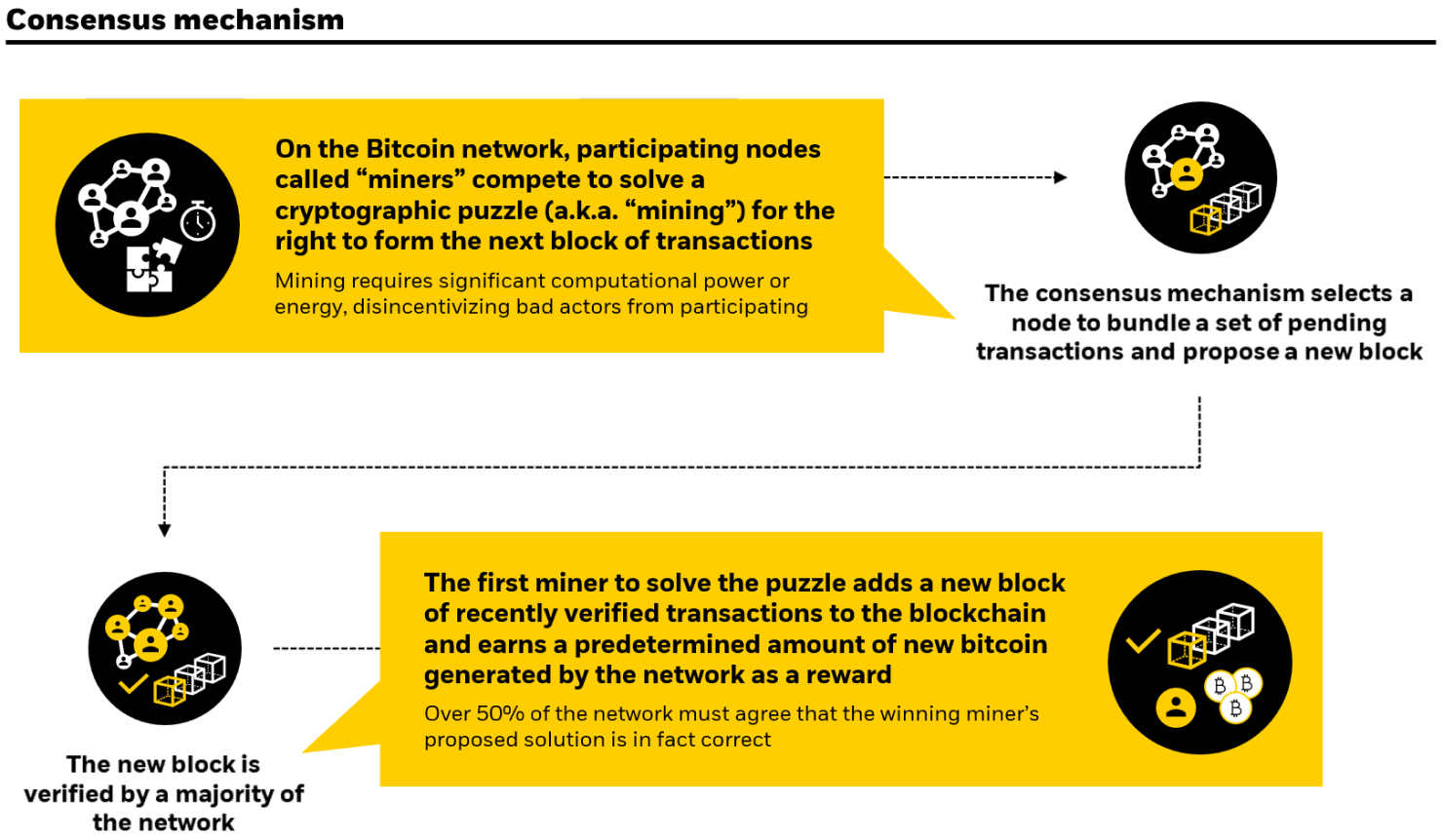

As Bitcoin price signaled further midterm pain in the near term before the anticipated parabolic rally, more investors have turned their attention to the altcoin market, especially Ethereum. The escalated crypto cash rotation is fueled by the notable adoption of Ethereum’s web3 protocols by institutional investors.

Already, BlackRock Inc. and Fidelity Investments have set aside funds for their respective spot Ether ETFs ahead of the highly anticipated listing.

As a result, speculation on Ethereum price action has significantly increased despite the ongoing crypto market correction. Moreover, Ethereum price against the US dollar is expected to reach a new all-time high (ATH) in a similar fashion as Bitcoin performed following the approval and listing of spot BTC ETFs earlier this year.

According to on-chain data analysis provided by Santiment, the Ethereum network registered more than 617k active addresses in the past week, which is the highest in the last three months. Interestingly, the Ethereum CME Futures Open Interest (OI) has gradually risen in the past few months, signifying notable demand from institutional investors.

Institutions are now bidding on ETH

Ethereum CME futures OI is rising just

like it happened with BTC before the

ETF trading started.Time for $5,000 ETH soon ?

GIGA BULLISH

pic.twitter.com/JPZZ2GqBoF

— Ash Crypto (@Ashcryptoreal) June 23, 2024

What Next for Crypto?

The crypto market is expected to remain in a correction mode for the coming months until the buyers establish control. Notably, if Bitcoin price drops further towards $60k, the altcoin industry is expected to shed between 15-20 percent.

CRYPTO MARKET: WHAT NEXT?

Here will show a big picture of the

market via 4 charts: BTC, ETH, Total

Crypto Mcap, and ALT Mcap.Bitcoin: BTC price is trading below $65,000 and has been in a downtrend channel for the last two weeks. However, it is still in a BULL trend in the… pic.twitter.com/mqNqwVGokF

— Ash Crypto (@Ashcryptoreal) June 22, 2024

According to a popular crypto analyst alias Ash Crypto, the crypto industry will consolidate in the next 6-9 months before kickstarting the next mega altseason.

Midterm Ether Price Targets

As with the rest of the crypto industry, Ethereum price is in a macro bull run, which began late last year fueled by heightened adoption by institutional investors. According to a popular crypto analyst alias Captain Faibik, Ethereum price in the 8-hour time frame has been forming a falling wedge pattern that is often followed by a bullish breakout.

$ETH Falling Wedge formation on the 8hrs timeframe Chart..!!

A Successful Breakout could send it back above the 4,000 so Keep an eye on it..#Crypto #ETH #ETHUSDT #Ethereum pic.twitter.com/BN5zhtdVcm

— Captain Faibik (@CryptoFaibik) June 23, 2024

” alt=”” />

As a result, the crypto analyst believes Ether’s price could drop towards $3,300 before rebounding beyond $4k.

Ethereum Network Activity Rises Amid Crypto Bearish Outlook Fueled by BTC’s Dip Below $63k