A variety of bullish factors back Ethereum’s recent rally to $2,500.

Ether (ETH) price witnessed a 10% price increase in the first 9 days of February, breaking above $2,450 for the first time in three weeks. This movement was aligned with the broader cryptocurrency market's bullish momentum and significantly influenced by the macroeconomic environment.

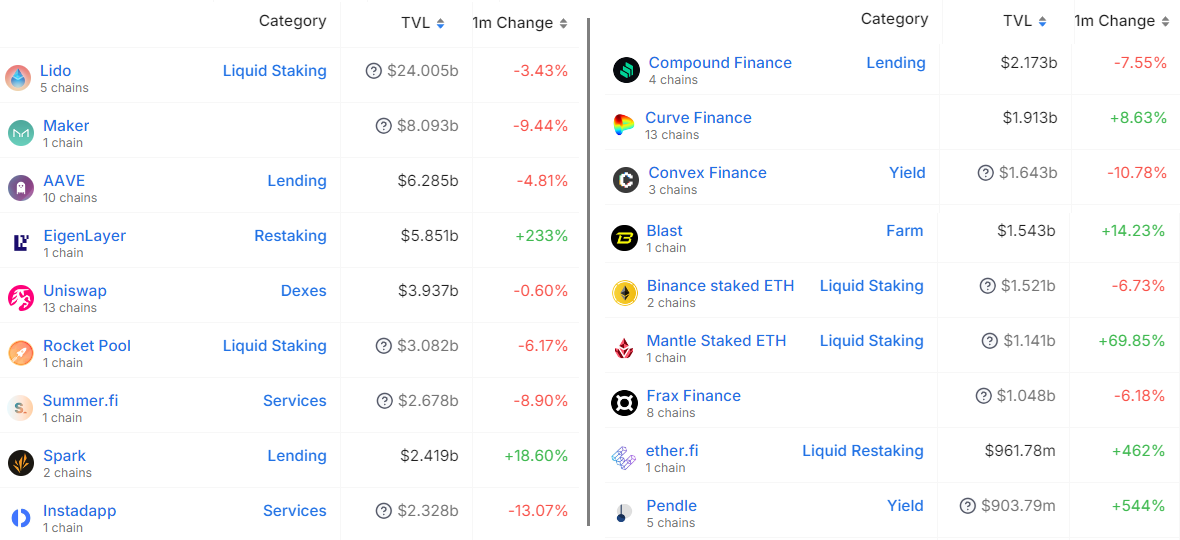

Despite the reasons behind Ether's rally, investors are growing more bullish as the deposits on the Ethereum network increase. However, is this momentum sufficient for a sustainable rise above $2,800?

On Feb. 4, United States Federal Reserve (Fed) Chairman Jerome Powell emphasized the need for a more sustainable public debt path in an interview. In 2023, U.S. debt service costs represented 2.4% of the economy's gross domestic product (GDP), and projections indicate a potential increase to 3.9% in 2034, as reported by the Congressional Budget Office. These projections prompt the Fed's policy interest rate to decrease, according to Neil Irwin, author of Axios Macro.