Coinspeaker

Ethereum Node Validators Withdraw $320M ETH, Raising Security and Price Concerns

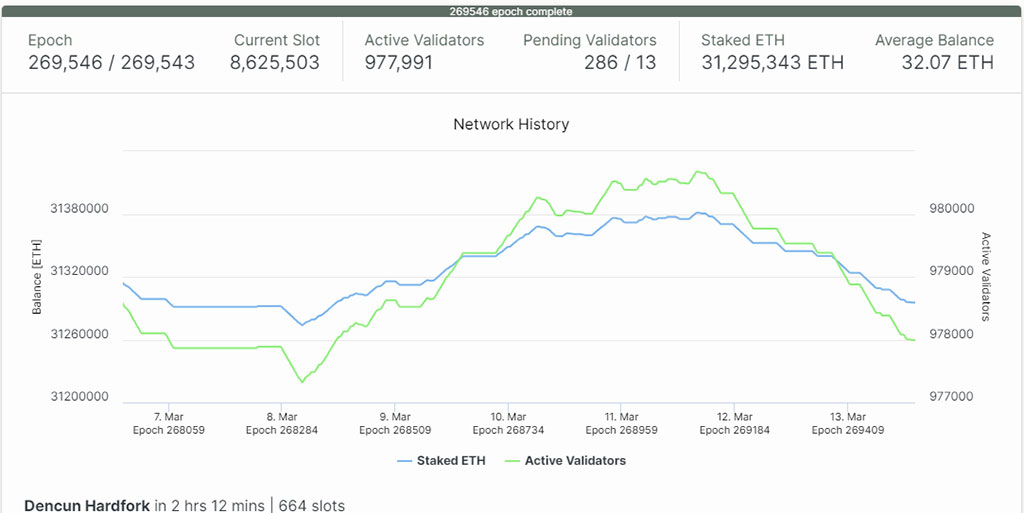

The Ethereum network is facing a significant event as a large number of node validators withdraw a substantial amount of ETH, totaling $320 million. This withdrawal has raised concerns about the security and stability of the network, especially with the highly anticipated Dencun upgrade on the horizon.

The timing of this mass exodus is particularly noteworthy, as Ethereum’s price has been experiencing a bullish trend. On March 13, the price of Ethereum reached a daily high of $4,078, representing a 15% increase for the month.

ETH staking deposits vs validators. Photo: Beaconcha.in

Withdrawals Raise Network Security and Price Concerns

The large ETH withdrawal by validators has raised security concerns for Ethereum. With fewer coins staked, the network is more vulnerable to attacks.

At the same time, there has been a surge in ETH deposits on exchanges. On March 11 alone, 62,096 ETH was deposited, indicating a growing supply available for trading as per data by Santiment. This increase in deposits is often associated with bearish price movements, suggesting more willingness by investors to sell their ETH holdings.

ETH exchange deposit transactions vs price. Photo: Santiment

Downward Pressure on ETH Prices

The recent withdrawal of ETH by node validators and a surge in exchange deposits raise concerns about potential downward pressure on ETH prices.

With over $320 million worth of ETH entering the market, there is a possibility of increased selling pressure and a short-term price correction. However, Ethereum’s strong fundamentals, including the upcoming Dencun upgrade, support long-term growth.

Despite these concerns, Ethereum’s price has remained stable around $4,000, supported by bullish sentiment in the cryptocurrency market driven by factors like institutional adoption and the popularity of DeFi applications.

Analyst Eye ETH Price to $5,000 Despite Resistance Concerns

Using IntoTheBlock’s data, analyst Ali Martinez has identified a substantial accumulation of buy orders within a supply zone. Approximately 600,000 addresses have acquired 1.63 million ETH in this area, creating a significant obstacle for Ethereum’s upward momentum.

Despite the challenge posed by the supply wall, market sentiment remains optimistic about Ethereum’s potential to reach $5,000. Some buyers may aim to break even, which could briefly slow down Ethereum’s upward momentum. However, the prevailing belief is that Ethereum has a strong chance of reaching the $5,000 mark.

Coinspeaker’s analysis of the Liquidation Heatmap supports this positive outlook. This tool forecasts where large liquidations might occur, providing insight into potential market movements. According to HyblockCapital’s data, breaching the $4,205 level could trigger significant liquidations. Conversely, a successful close above this level could pave the way for further price appreciation.

Ethereum’s price chart indicates minimal resistance up to $4,310 and a clear path to $4,860, potentially pushing it toward $5,000 with strong bullish momentum.

The Funding Rate, a key trader sentiment metric, stands at 0.068%, suggesting aggressive short positions but no rewards, indicating a likely upward price movement. Moreover, Ethereum’s network activity shows a significant uptrend, with 537,000 active addresses, reflecting growing interest and adoption.

Ethereum Node Validators Withdraw $320M ETH, Raising Security and Price Concerns