Data shows the Ethereum open interest has seen a sharp rise recently, a sign that short holders may be piling up on the futures market.

Ethereum Open Interest Has Shot Up Recently

As pointed out by an analyst in a CryptoQuant post, the ETH open interest has spiked as the cryptocurrency’s price has been declining, a pattern that has also been seen a few times in the past month.

The “open interest” here is an indicator that keeps track of the total amount of Ethereum futures market contracts that are currently open on all derivative exchanges. This metric naturally counts both long and short contracts.

When the value of this indicator goes up, it means that the futures market users are opening up more positions right now. Usually, whenever more positions appear, more leverage also emerges in the market, which is something that could instigate more volatility in the asset’s price.

On the other hand, the metric’s value decreasing could lead to the cryptocurrency turning more stable, as it implies that some holders are closing up their futures position currently.

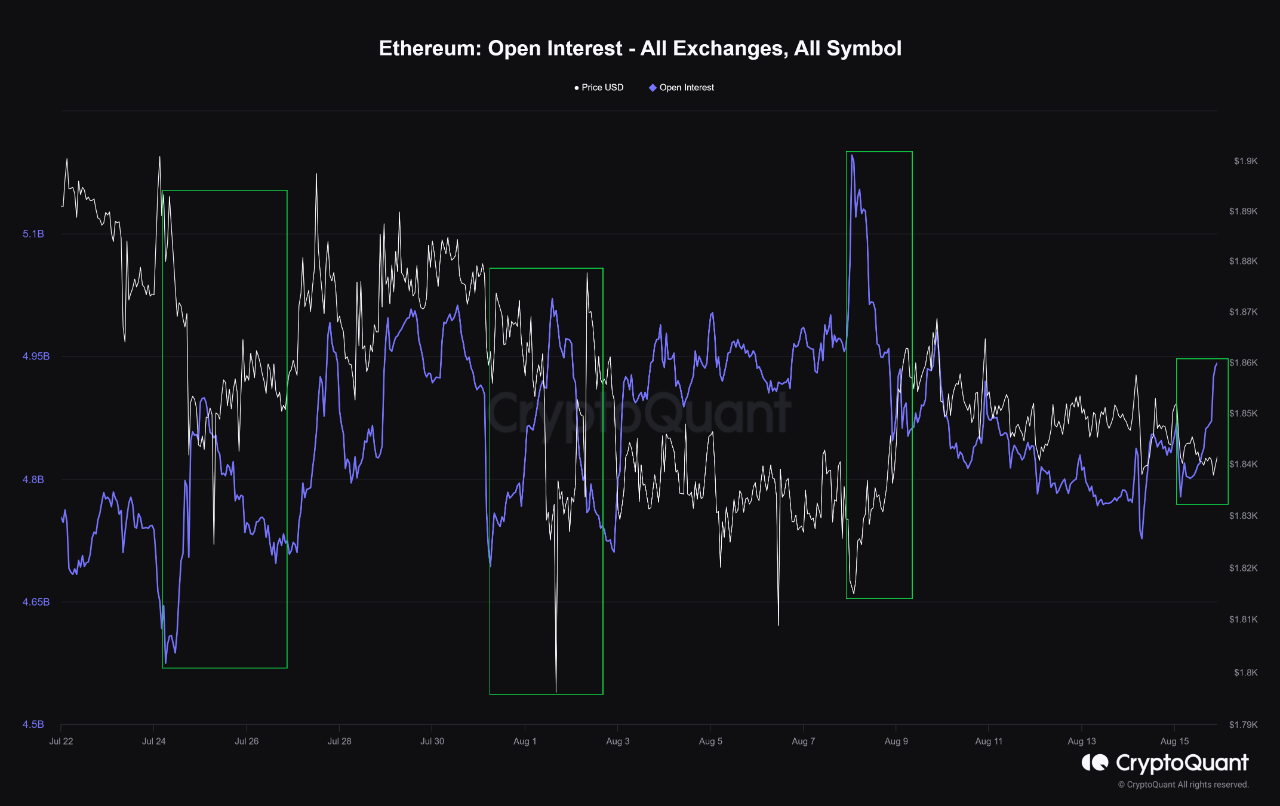

Now, here is a chart that shows the trend in the Ethereum open interest over the past month:

As highlighted in the above graph, the Ethereum open interest has observed a rapid uptrend during the past couple of days. In this same period, the ETH price has taken a hit, suggesting that it’s possible that these new positions on the futures market have come from short holders.

In the chart, the quant has also highlighted previous instances similar to the current one, where the open interest registered a rise as the price of the cryptocurrency slammed down.

It looks like there have been three occurrences of this trend during the past month and each of these was shortly followed by the asset’s value going through a surge as the open interest, in turn, wound down.

The sharp open interest plummets in these instances would imply that the price surges perhaps caused what’s called a “liquidation squeeze.” In a squeeze, a mass amount of liquidation takes place at once, caused by a sharp swing in the price.

The liquidations in these events only end up providing further fuel for the price move that ignited them to begin with, thus resulting in even more liquidations. In the aforementioned instances, a short squeeze would have taken place, meaning that the majority of the contracts that were liquidated were shorts.

It’s possible that the current open interest rise could go a similar way for Ethereum if the contracts amassing on the market are indeed short ones. Any price volatility that arises out of this, however, would only be temporary, as the price surges in the past month already showed.

ETH Price

At the time of writing, Ethereum is trading around $1,800, up 2% in the last week.