ETH’s rally is backed by increased on-chain activity and the markets’ anticipation of a network upgrade and spot ETF, but is this enough?

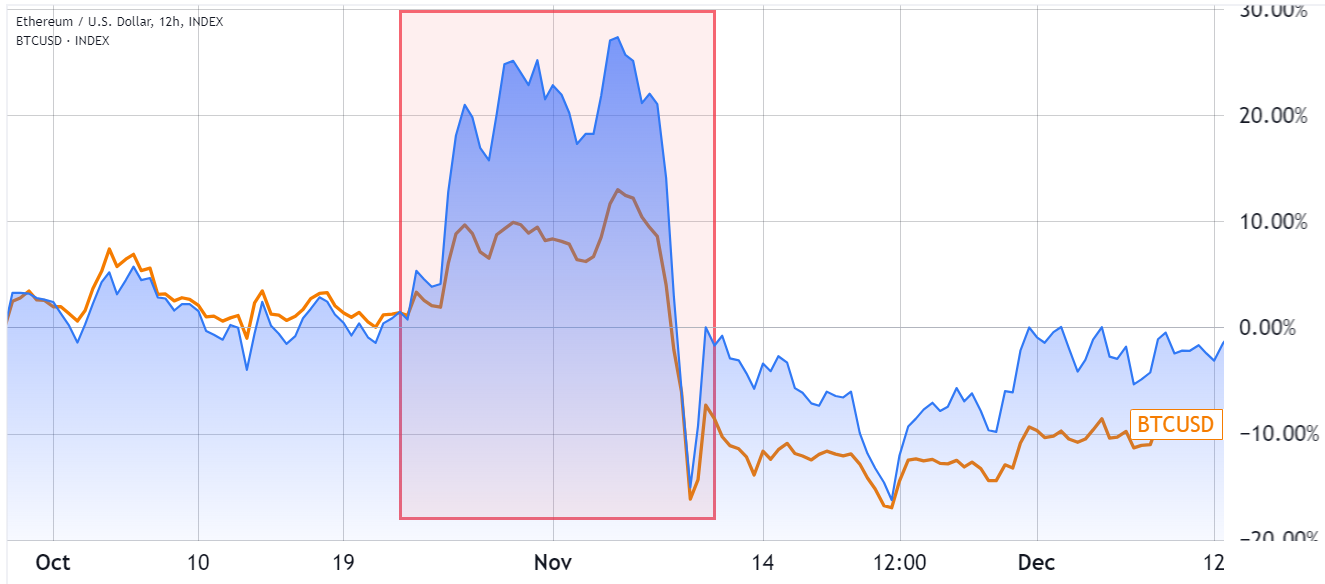

Ethereum's native token, Ether (ETH), rallied 20% between Jan. 8 and Jan. 11 but struggled to sustain the $2,600 level. The subsequent 3.5% correction down to $2,560 on Jan. 16 may have disappointed some bulls, but Ether's price has outperformed Bitcoin (BTC) by 19.5% since Jan. 8. Such gaps are quite uncommon and last occurred in October 2022.

Ether investors question if the $2,500 level will hold, given that the most obvious drivers are not expected in the short term, namely the Ethereum spot exchange-traded fund (ETF) and the planned Ethereum network upgrades. From a bullish perspective, these events present an opportunity for Ether to further decouple from the remaining cryptocurrency market, but they also present a risk if it either backfires or is postponed.

The price of Ether outperforming Bitcoin by 15% or higher in a week is not something common, at least in the past two years. Besides the high correlation between the two cryptocurrencies, 2023 was marked by disappointment with Ethereum's declining total value locked (TVL) and persistently high gas fees, paving the way for competing blockchains. Meanwhile, Bitcoin benefited from the anticipation of a spot ETF approval, especially after BlackRock joined the race in June 2023.