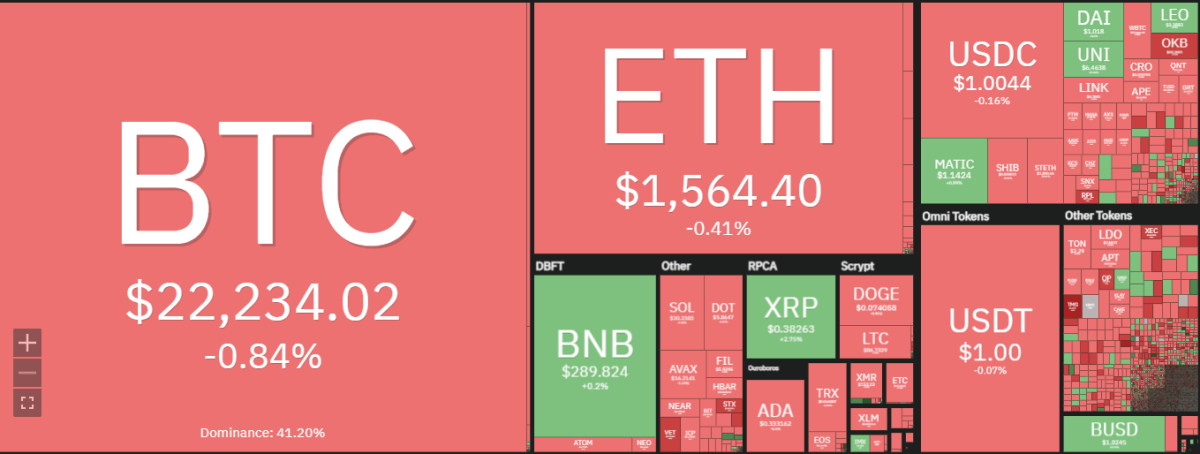

Today Ethereum price analysis is showing that the coin is in a downward trend after a bullish pressure that lingered around the market for the past month. The coin has been below the support level of $1,543, which is a clear indication that bearish pressure is getting stronger in the market today.

In today’s trading session, despite the downtrend, the bulls were seen trying to break through the downtrend line and push the price higher; however, the lack of momentum didn’t allow them to break this resistance.

The current resistance levels have been set at $1,589, with ETH/USD struggling to breach it after numerous attempts. This could be a sign that the market is not yet ready to move up, as bearish pressure has been dominant so far. In addition, the recent decline in volume indicates that traders may be losing interest in ETH and are looking for alternatives.

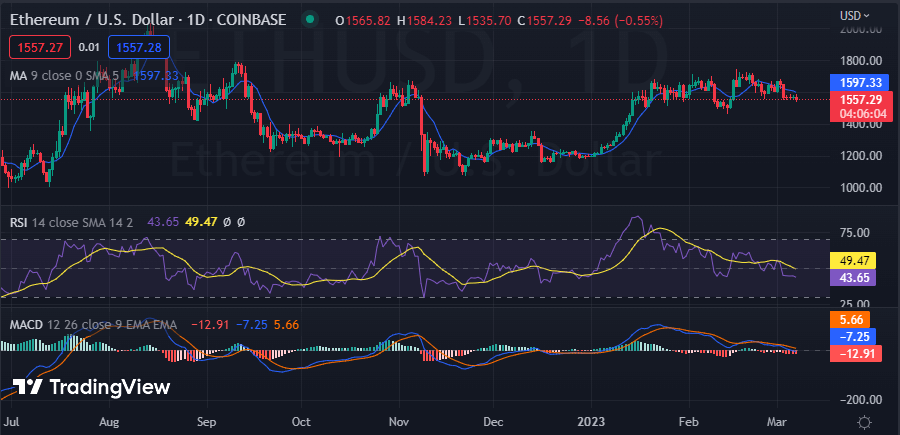

Ethereum price analysis 1-day chart: Bears mount pressure on ETH price

The one-day Ethereum price analysis confirms a decreasing trend for the day as the selling momentum is constantly intensifying for the most part of the day. The situation has been going quite favorable for the bears for the past week, and the price experienced a sharp drop during the last 24 hours as well. Currently, the market value of ETH/USD is at $1,557, losing almost 1.02 percent value during the last 24 hours, and further loss can also be expected if the bearish dominancy continues.

Looking at the market capitalization, it is hovering around $190 billion and has a 24-hour trading volume of over $6 billion. This indicates that despite a few trades, the liquidity for ETH is still healthy and could be an option for traders in case of a bearish run.

Looking at technical indicators, the MACD line appears to be headed down and is below the signal line, which signifies a bearish market in the near future. The MACD histogram also seems to be in the bearish zone, with a red candle being formed. The 50-day moving average is also trading below the 200-day moving average, which could be a sign of further bearishness.

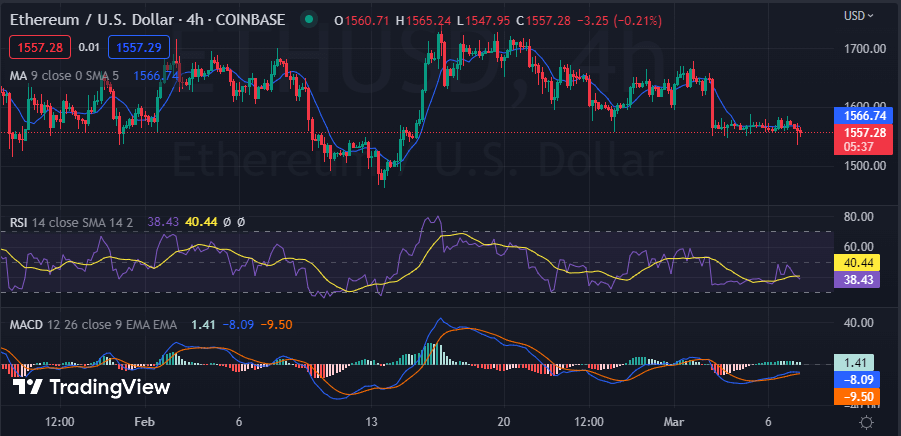

Ethereum price analysis: Recent developments and further technical indications

The hourly Ethereum price analysis confirms a downward trend for the market. The price function has been downwards since yesterday. The price level has decreased from $1,580 to the current level of $1,557 and is still trying to decline further. The bearish pattern is likely to continue in the near future, given that recent developments haven’t done much to change the overall bearish outlook.

The selling pressure is currently dominating, with 50-SMA and 200-SMA trading in the negative zone. The relative strength index (RSI) is also trading at the oversold zone, which could indicate that a bearish market may prevail in the coming days. The RSI has crossed below level50, indicating further downside pressure. The MACD indicator is moving on a negative trajectory, and the blue line is crossing below the red line. This could mean that ETH/USD is likely to fall further in the near future.

Ethereum price analysis conclusion

In conclusion, Ethereum price analysis is still struggling to find its footing and looks set to remain in a bearish trend for the near future. Traders should exercise caution when trading ETH/USD and keep an eye on the market’s movements. It is likely that if bearish pressure continues, ETH/USD could further test the support levels and dip even lower.