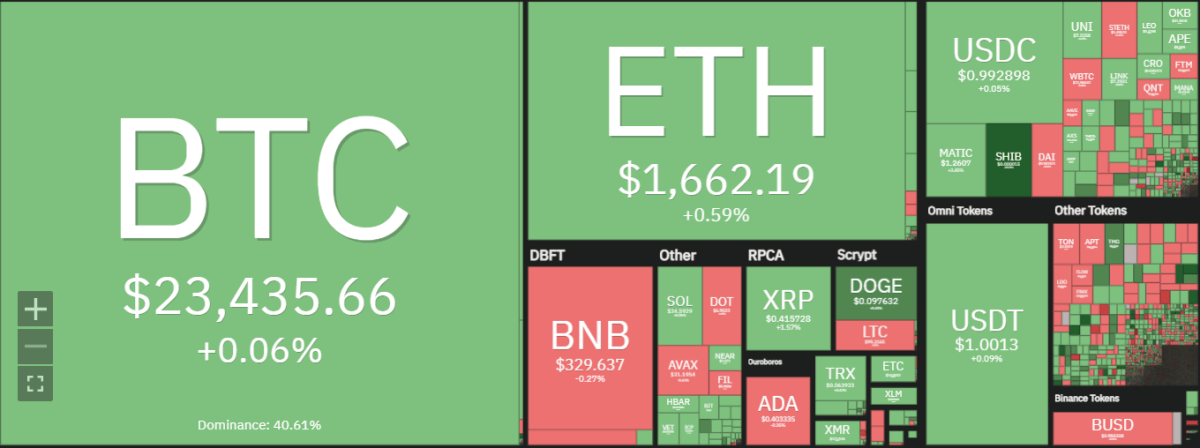

Ethereum price analysis for today shows that the bulls are maintaining their upper hand in the market as ETH/USD is trading around $1,676. The market has been following a bullish trend for the past few weeks, and the price has undergone a significant improvement. A similar trend was observed today as well, as the bulls took hold of the market by taking the ETH/USD value up above $1,650.

ETH/USD has recently faced a resistance level at the $1,690 mark. This is a crucial psychological barrier that needs to be broken in order for the bulls to continue their upward trend and take the price higher. If the buyers manage to take control of this level, then ETH/USD could easily reach new levels of resistance, such as the $1,700 mark.

The ETH/USD pair is currently in an uptrend and the bulls are expected to maintain their control over the market with buying pressure continuing to increase. The trading volume for the pair still remains low, with the buyers struggling to meet the demand of the market. Currently, the 24-hour trading volume of the pair is around $5.98 billion, while the market cap of Ethereum stands at $205 billion.

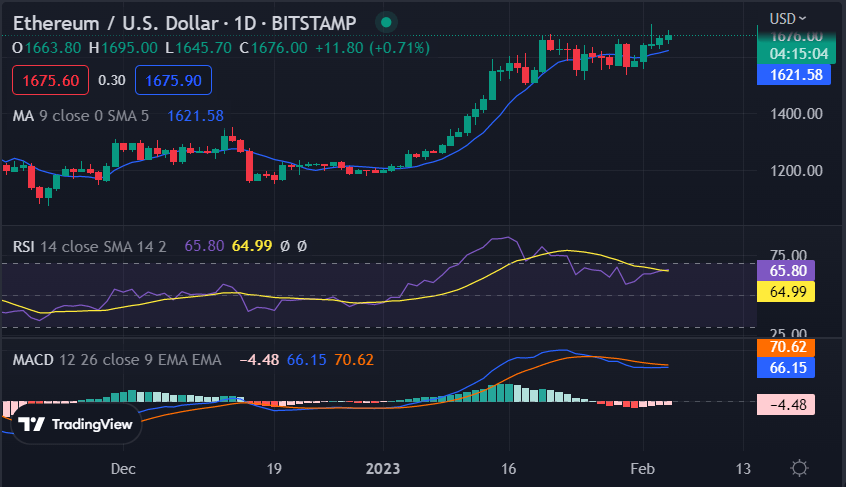

ETH/USD 1-day price chart: Bullish recovery is on the way as price levels rise to $1,676

The daily Ethereum price analysis is confirming an upward trend for the crypto pair, as the bulls have been leading the price chart even today. The past few weeks have proved to be quite favorable for the buyers. Today’s trend has yet again proved to be on the supportive side, as the price has increased up to the $1,676 level gaining 1.30 percent value during the last 24 hours.

The technical indicators of the Ethereum price analysis are presently supporting the bullish trend and are suggesting that ETH/USD can reach higher levels in the short term. The Relative Strength Index (RSI) is also near the overbought zone as it hovers at the 64.99 mark, showing that the buyers are in control of the price movements. The MACD lines also remain in a positive trend and are providing the necessary support to maintain an uptrend. The MACD Histogram is also in the green zone and confirms a bullish trend. The 50-day moving average is also moving above the 200-day moving average, which is an indication of a strong bullish market.

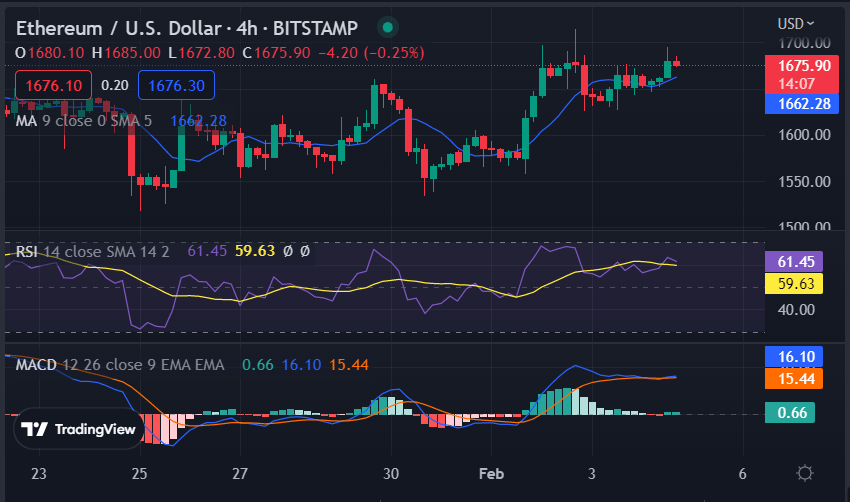

Ethereum price analysis 4-hour chart: Support for cryptocurrencies is present at the $1,647 mark

The 4-hour Ethereum price analysis is revealing that the buyers are still in control of the market and ETH/USD has managed to stay above the $1,660 level. The bulls have had a strong run today, taking the pair up to the $1,676 level. However, the buyers are now facing some resistance at this level and ETH/USD might find it difficult to reach higher levels in the near future. The buying is still strong and the price is likely to remain above the $1,647 level, which is acting as a support for the cryptocurrencies.

Looking at the indicators of the 4-hour chart, the MACD is presently in a bullish trend and is providing support to buyers. The MACD line is also above the signal line, which is an indication of further upside. The RSI has also been hovering near the overbought zone at 59.63, which indicates that ETH/USD may face some resistance soon. The 50-day moving average is continuing its upward trend and is above the 200-day moving average, which is a sign of a strong bullish market.

Ethereum price analysis conclusion

Overall, the Ethereum price analysis for today shows that the bulls are maintaining their upper hand in the market as ETH/USD looks to break through the $1,690 psychological barrier. The buyers have been in control of the market for the past few days and look set to continue their run, taking the ETH/USD value up to $1,676. The indicators are also providing support for the buyers and suggest that Ethereum could reach higher levels in the near future. Therefore, it is advisable to keep a close eye on the market movements and be ready to take advantage of any possible opportunities arising from this bullish trend.

While waiting for Ethereum to move further, see our Price Predictions on XDC, Cardano, and Curve