Ethereum price analysis reveals the bearish momentum is on the rise once again as the price experience falls during the last 2 hours, as the bullish were unable to hold the price above the $1,175 mark. This is a quite discouraging sign for the buyers as now the price has dropped down to the $1,178 level. Chances of recovery seem low as the bearish momentum is on the rise.

The current resistance level for the Ethereum price is found at $1,194 and if it fails to break above this level then there is a possibility of further decline in the price. The next support level is seen at $1,175 and if it fails to hold then ETH can drop down to $1,150.

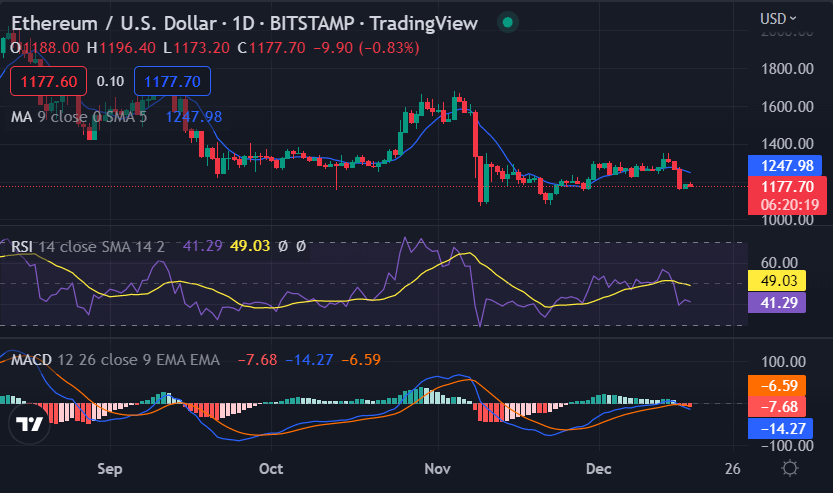

ETH/USD 1-day price chart: Bearish momentum pulls price back to $1,194

Ethereum price analysis on a daily chart shows that the bulls are having a hard time regaining control of the market. The digital asset has lost nearly 0.04% of its value at the time of writing, and it remains to be seen if the bulls can turn things around. The Market for ETH/USD opened at $1,178 today, and buyers pushed the price up to a high of $1,194 before losing momentum as the sellers took control.

The technical indicators are still bearish with the RSI currently trading at the 49.03 level, which shows that there is still some room for prices to fall further before reaching oversold territory. The MACD, on the other hand, is giving a bearish signal as the histogram is falling and is about to cross below the zero line. The MACD line is clearly below the red signal line and seems to be gaining strength. The 200 SMA line is well placed below the current market price, which is a sign that the path of least resistance is still to the downside.

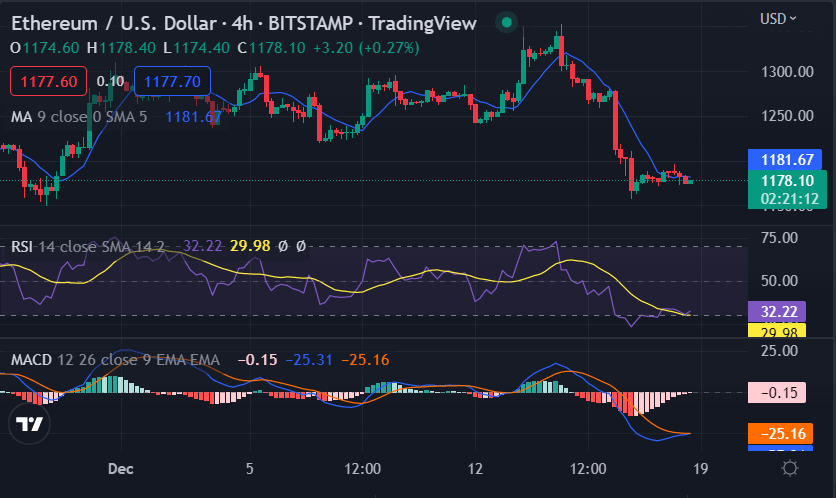

Ethereum price analysis: Market moves downward

The 4-hour timeframe for Ethereum price analysis shows a bearish trend as the price has undergone a decline again despite the upwards price function during today’s session. The next few hours will be crucial for the market as the next few candlesticks will provide more insight into the market’s short-term trend. The market decline shifted to the bearish sentiment as indicated by the RSI line which is headed below the 50 levels. The RSI indicator is currently trading at 29.98 and heading toward the oversold territory which is another sign that prices are likely to fall further in the short term.

Ethereum price was stuck in a critical juncture of sideways trading before the bears won the battle and prices succumbed to selling pressure. The MACD indicator is also signalling a further decline as the histogram is falling and about to cross below the zero line. The moving average lines are also in favour of the bears as the 100 SMA is below the 200 SMA in a bearish alignment.

Ethereum price analysis conclusion

The market for Ethereum price analysis is currently in a bearish trend as sellers have taken control of the market. The technical indicators are also signalling further declines which means that investors should be cautious and wait for the market to show signs of reversal before entering any positions. The next few hours will be crucial for the bulls as they need to turn things around or else the bearish trend will continue.