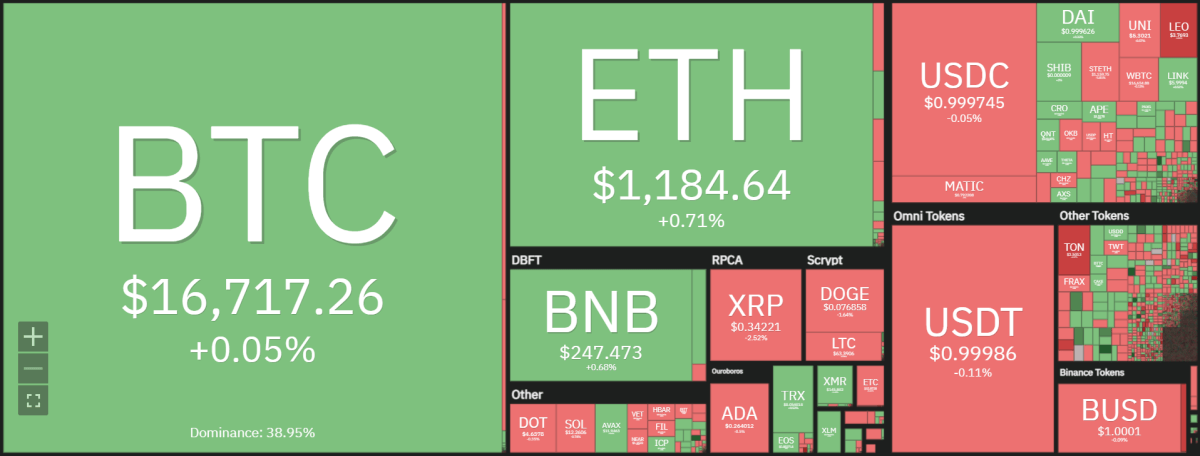

Ethereum price analysis for today shows ETH/USD opened the daily trading session at a low of $1,177 and is exchanging hands at $1,184.66.The total value locked in Ethereum-based smart contracts also decreased by decentralized finance by 4.49% in 24 hours.

In the wake of the FTX fracas, authorities are straining to expeditious new legislative actions in the digital currency realm. Ethereum’s collapse has been part and parcel of a general decrease which led to an alarming 39.90% dip in Ether transaction costs over the last month.

ETH/USD daily chart analysis: ETH/USD trades above the $1,100 support

Ethereum price analysis on a daily chart indicates ETH/USD price is trading above the pivotal $1,100 support level. Ethereum’s price continues to remain strong and looks poised for a bull run toward $1,200.On the other hand, If immediate resistance of $1,187 is breached then ETH/USD bulls may be on track to test $1,200.

The Moving average lines are showing a slight bullish slope as the 50 MA line is above the 100 and 200 MA lines. The RSI is still neutral but on a positive note, it looks set to break into oversold territory soon.

Ideally, if ETH/USD continues its upward trajectory then the $1,200 target price could be reached within the next 24 hours. The Fibonacci retracement level of 61.8% at $1,197 will be critical for the bulls to break in order for Ethereum price analysis to remain biased towards the north.

The Moving Average Convergence Divergence (MACD) also shows a hint of a bullish trend yet to be confirmed. The overall market sentiment for Ethereum remains positive, with the possibility of ETH/USD breaching $1,200 in the short term.

Ethereum price analysis on a 4-hour chart: Bearish momentum slowly recedes

On a 4-hour chart, Ethereum price analysis shows bearish momentum slowly receding as the bulls take control of the market. The bullish trend is being propelled by an increase in buying pressure. The RSI and MACD line also show signs of a potential reversal as they remain marginally above their midlines signaling neutral territory.

The moving averages are also showing a slight bullish slope as the 50 MA line is above the 100 and 200 moving averages.

The crucial $1,187 support level must hold to remain bullish in Ethereum price analysis otherwise the trend will reverse back to bearish momentum.

Ethereum price analysis conclusion

Overall, ETH/USD remains positive and could potentially breach $1,200 if buyers maintain control of the market. Ethereum is likely to hold above the $1,100 key support level in the short term and continue on its upward trajectory. The technical indicators on the 4-hour chart are giving a potential bullish trend signal which must be confirmed in order for the bulls to target $1,200. The crucial $1,187 support level must hold to remain bullish otherwise the trend will reverse back to bearish momentum.