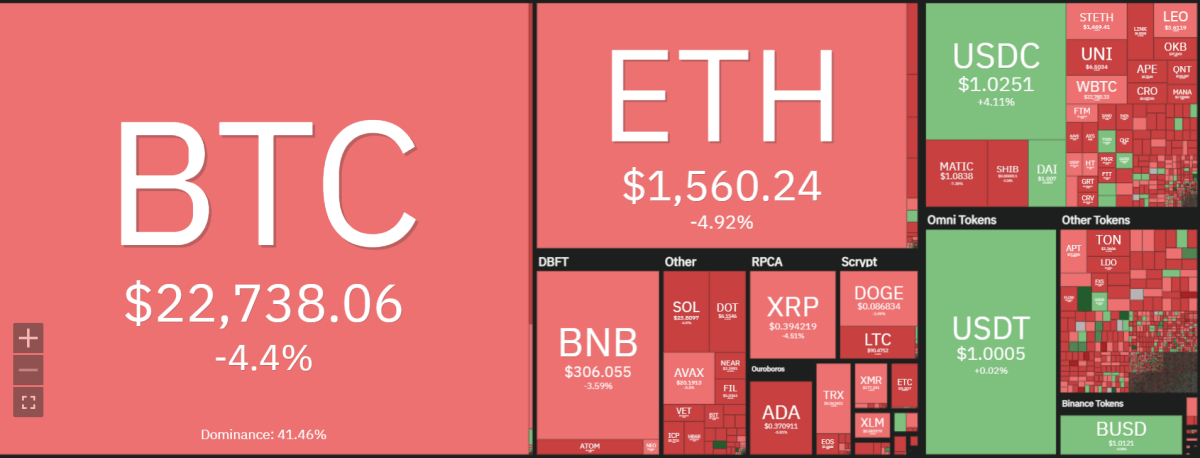

Ethereum price analysis for today reveals the bulls have run out of steam after facing a sharp selloff during the second last day of the bullish month of January.ETH price has moved back below the $1,600 mark after enjoying a bright start to the month. ETH rose to an all-time high of around $1,651 in mid-January before retracing sharply and declining by over 4.82 percent.

At press time, Ethereum is trading at around $1,558.85 after opening the daily trading session above $1,650. Ethereum price analysis suggests that the second-largest cryptocurrency is trading above all its major daily moving averages, including the 10-day and 20-day EMA.

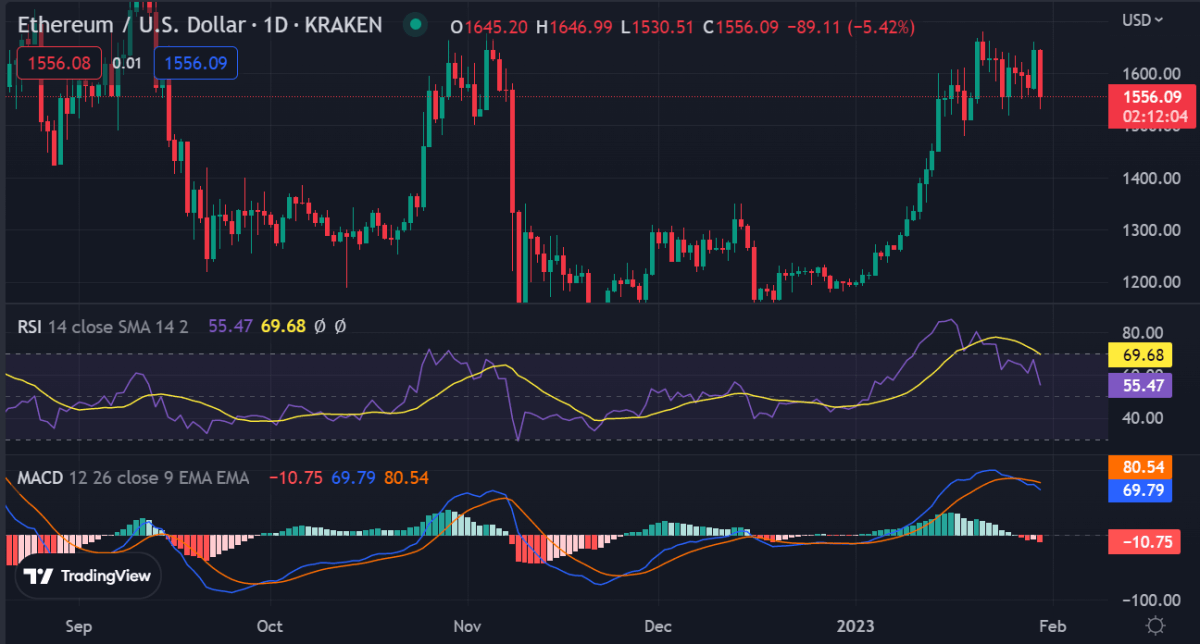

Ethereum price analysis on a daily chart: Bears strike back and push price below$1,600

The daily chart Ethereum price analysis shows that the bulls have been losing momentum since touching a high of around $1,651. ETH has now declined by over 4.82 percent and is trading below the $1,600 key support level. The current support level is at $1,450 where it has sought refuge from the bears’ attack.

The technical analysis is pointing to a bearish momentum continuing for the next few sessions. The Relative Strength Index (RSI) is below 50 which suggests that the bears have taken control of the market in the short term. The MACD indicator is also trending downwards, strengthening the bearish momentum while the Stochastic Oscillator is currently below the 50 levels and pointing down.

Ethereum price analysis shows that ETH has been in a strong bullish trend in recent months, rising from $415 to an all-time high of over $1,650 before retracing sharply. The current bearish momentum suggests that ETH may continue trading within a rangebound channel until fresh buying pressure enters the market.

Ethereum price analysis on a 4-hour chart: Selling pressure sets in

The 4-hour chart Ethereum price analysis shows that the bears have taken control of the market after a period of consolidation. ETH has fallen below all its major daily moving averages and is currently trading below the $1,600 key support level.

The technical indicators are pointing to further losses in the short term, with both RSI and MACD trending downwards. However, the Stochastic oscillator is currently in the oversold region and may signal a potential reversal in the near future.

Bears seem to be increasing their selling pressure and pushing ETH prices lower. If the bears continue to dominate, ETH could fall back into the $1,450 support zone. The Fibonacci retracement levels also signal some support at the 23.6 percent level, which is currently around $1,450.

Ethereum price analysis conclusion

Ethereum price analysis for today shows the bears have overpowered the bulls and pushed ETH prices lower. The daily chart analysis reveals that ETH is now trading below the $1,600 key support level. The bulls will be looking to make a strong comeback in the near future and defend the Fibonacci retracement level of 23.6 percent, which is around $1,450. The technical indicators are also pointing to a further decline in the short term and ETH could fall back into the $1,400 support zone if the selling pressure continues.

While waiting for Ethereum to move further, see our Price Predictions on XDC, Cardano, and Curve