Ethereum price analysis is quite bearish today since the market does not have much liquidity now. Its market cap has gone down 3.08 percent. At the same time, the trading volume of Ethereum is currently at 49 percent. This has resulted in a volume-to-market cap ratio of 0.1039.

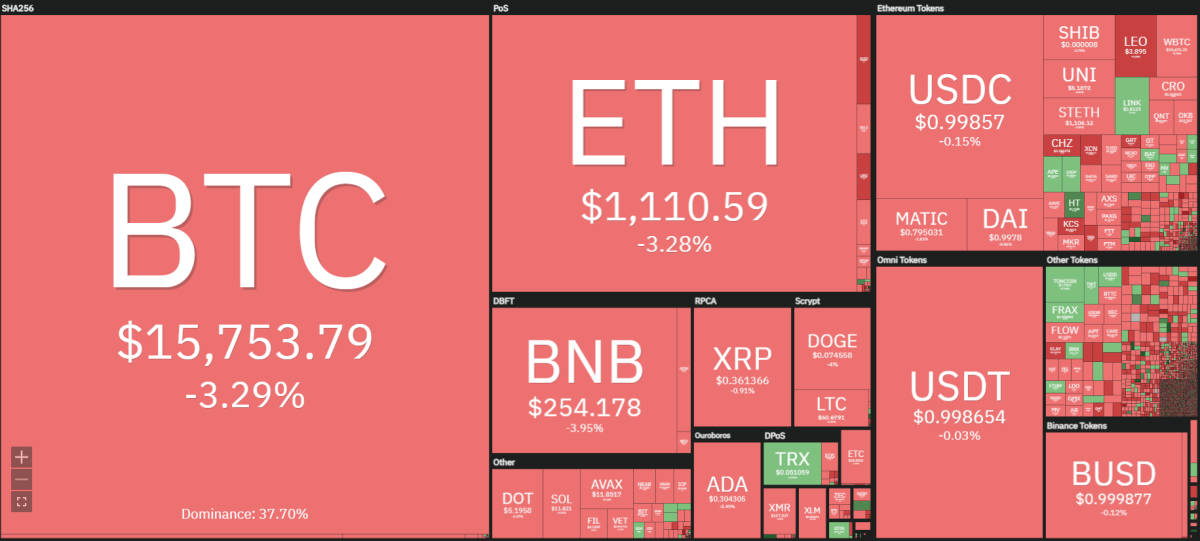

As the crypto heat map shows, both Ethereum and Bitcoin are currently down by nearly the same amount. The entire market is facing very negative sentiments since the bulls have given up for now. Bearish sentiment is apparent in all major and altcoins.

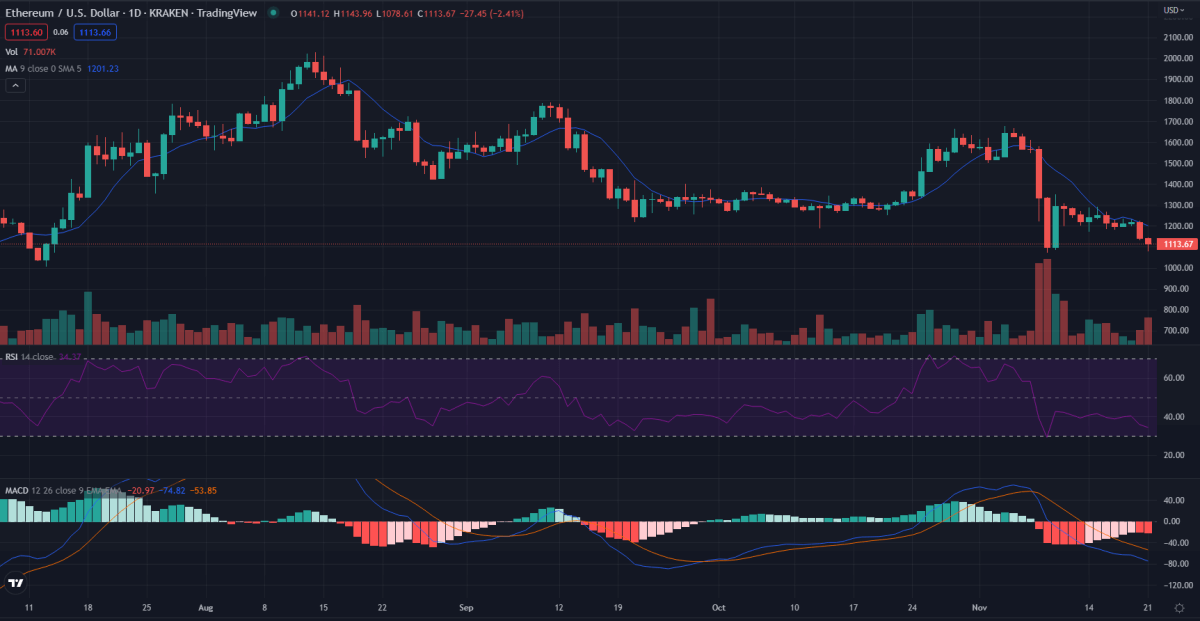

On the daily Ethereum price analysis chart, we can see that Ethereum is getting ready to retest the support at the $1070 mark. However, it has slightly retraced after touching $1078. Although it is important to note that the bearish sentiment is not over yet. It is still very much possible for Ethereum to break past the support line and move further down.

Ethereum 24-hour price movement

In the last 24 hours, Ethereum traded in a range before consistently forming a downtrend. It set a 24-hour low of $1078 while the 24-hour high was at $1143. But can Ethereum break past the support line? It looks like the support at $1070 is very strong. However, the bulls seem to have completely given up their control right now. So, it is very much possible for Ethereum to break lower.

4-hour Ethereum price analysis: Will Ethereum fall lower?

Well, the crypto market has always been very uncertain. Based on the current conditions, it is very much possible for Ethereum to break lower. The RSI line just barely recovered after touching 23. The MACD gives a slight indication of improvement, but it is not significant. The market is still very much bearish, and the negative sentiment has not ended yet.

Ethereum price analysis: Conclusion

Like always, long-term traders should avoid timing the bottom and DCA (dollar-cost-average) in Ethereum if they believe that it is going to lead in the future. However, short-term and leverage traders may not want to buy right now because the price can fall. The market is too uncertain right now. Its course will become certain after ETH/USD tests the support line once again.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.