ETH price broke down as the wider market corrected, but derivatives data shows traders bullish stance on Ethereum.

Ether (ETH) price dropped to $3,337 on Dec. 26, erasing gains from the previous two days. This movement followed a 4% decline in Bitcoin (BTC) and triggered $34 million in liquidations of leveraged ETH longs (buyers). Investors grew more risk-averse as signs of weakness emerged in the United States job market.

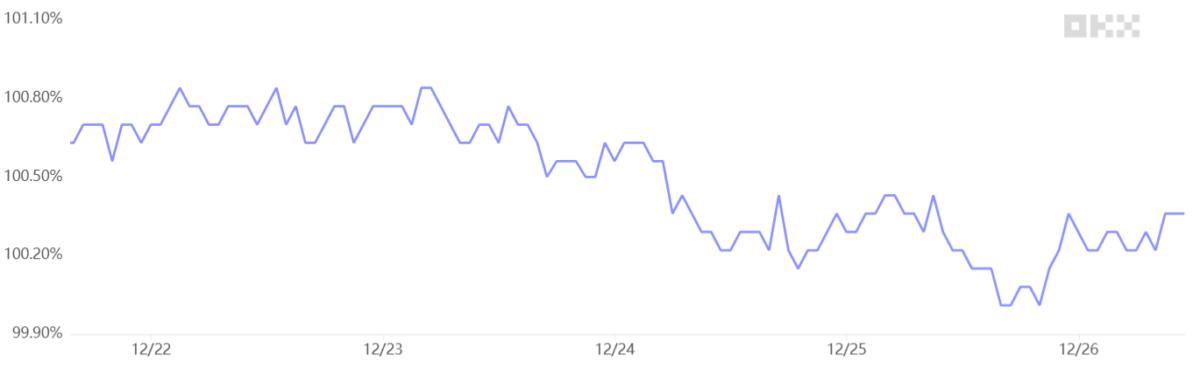

Despite the failure to maintain prices above $3,500 over the past week, Ether derivatives markets retained a neutral to bullish stance, suggesting $4,000 remains within reach. Notably, stablecoins in China are trading at parity with the official US dollar rate, indicating no significant outflows from cryptocurrencies in the region.

USD Tether (USDT) vs. USD/CNY. Source: OKX