Traders appear less confident in Ether's ability to "weather" the upcoming macroeconomic events compared to Bitcoin, according to a crypto analyst.

Traders are anticipating much more significant price swings for Ether (ETH) compared to Bitcoin (BTC), with significant macroeconomic events on the horizon, according to a crypto analyst.

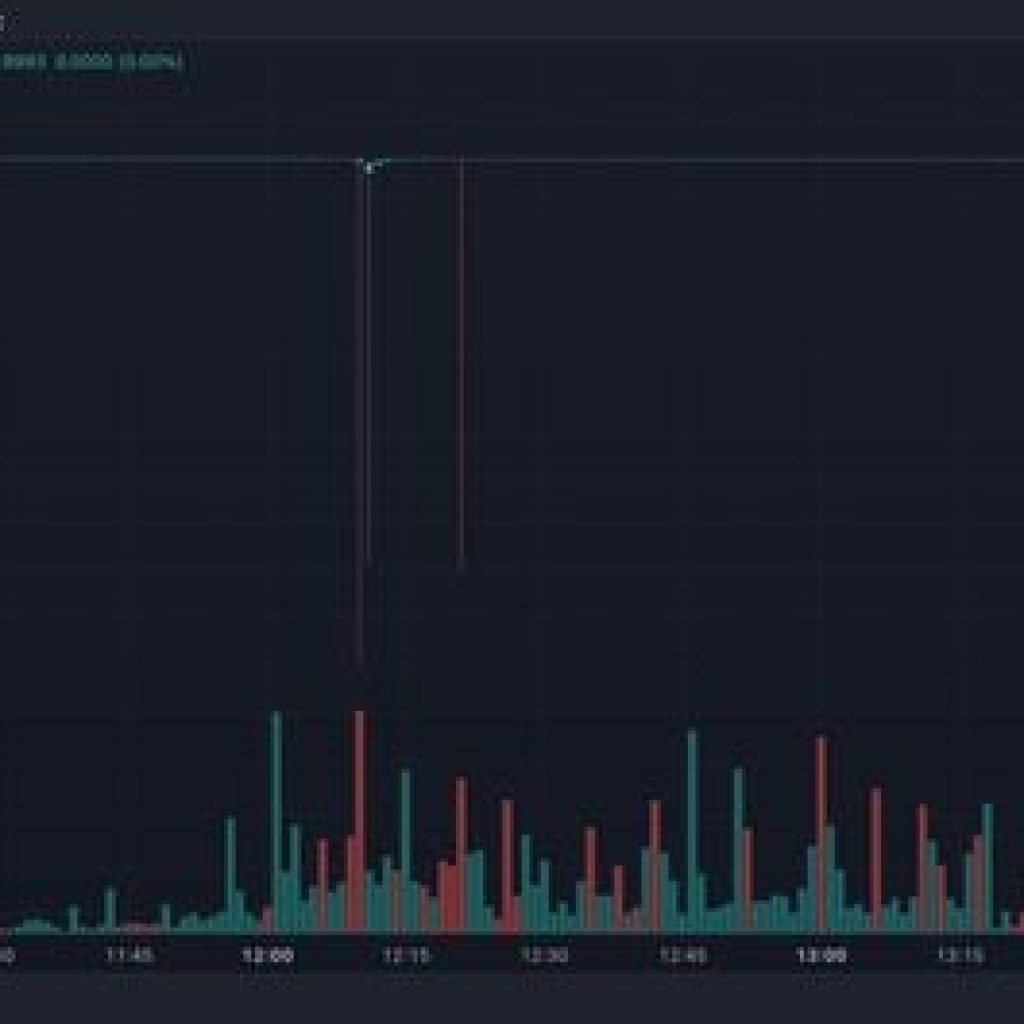

Derive founder Nick Forster pointed out in an Oct. 2 analyst note viewed by Cointelegraph that there is an anticipated spike in Ether forward volatility—which is the expected future volatility of Ether’s price—from Oct. 25 to Nov. 8, coinciding with the United States presidential election on Nov. 5.

Forster highlighted that the US election may have a “significant impact” on the price of ETH due to its ties with the decentralized finance (DeFi) ecosystem, which may “face regulatory scrutiny” depending on whether a pro-crypto candidate is elected president.