In a groundbreaking move towards reshaping the landscape of financial institutions, experts predict that the banks of the future will utilize generative artificial intelligence (AI) to exert influence over customers’ financial decisions. This complex technology, described as both exciting and daunting, has the potential to permeate every aspect of banking, according to Tom Merry, head of banking strategy at Accenture.

As the UK banking industry explores the integration of generative AI into its operations, the implications range from designing personalized financial products to training staff and managing social media platforms.

Banks embrace generative AI for next-gen banking

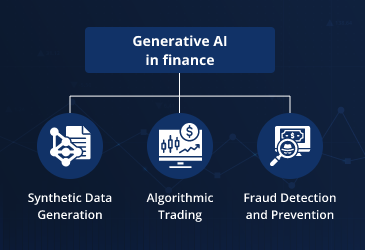

As the financial sector navigates the evolving landscape of artificial intelligence, an increasing number of banks are testing the waters of generative AI. This innovative approach, distinct from conventional predictive models, involves the creation of entirely new concepts based on extensive data sets.

While AI has long been utilized in the banking industry for tasks like fraud detection and risk analysis, generative AI opens up new possibilities. The technology, exemplified by chatbots like ChatGPT and Google’s Bard, is gaining traction, prompting curiosity and, in some cases, wariness among banking leaders.

Unlocking personalized financial experiences

Generative AI could usher in a paradigm shift in banking by leveraging personal spending and banking data to craft tailor-made products for customers. The concept of “nudging” customers through online banking to make informed financial decisions is on the horizon, potentially improving their financial resilience. The ability of AI to analyze voice patterns could extend to detecting caller sentiment, enabling banks to identify vulnerable or distressed customers and enhance engagement.

While the potential benefits of generative AI in banking are enticing, trust emerges as a critical factor in its widespread adoption. Peter Rothwell, KPMG’s UK head of banking, emphasizes the necessity for customers to trust that their data is used responsibly for their benefit.

The delicate balance between utilizing data to assist customers in managing their financial outcomes and safeguarding trust, data security, and reliability remains a focal point. For instance, a credit card application might prompt the bank to recommend a short-term overdraft based on the customer’s financial situation, raising questions about the underlying trustworthiness of such personalized suggestions.

AI’s potential to gauge a person’s understanding of financial products can be a powerful tool in identifying potentially vulnerable customers. Eligible, an AI platform for banks, conducted a poll revealing that nearly a quarter of UK individuals received no personalized communication from their banks, leading them to ignore financial information. Zahra Hassan, Eligible’s co-founder, suggests that AI’s transformative power lies in turning customer support from reactive to proactive, allowing early identification of potential financial struggles.

The changing landscape of banking

As traditional banking institutions grapple with the evolving financial landscape, the shift towards mobile banking is evident. Major high street lenders in the UK have closed numerous branches, reflecting the changing preferences of consumers. KPMG UK’s research indicates that a significant portion of UK consumers, around 20%, have not visited a bank branch in the past year.

This shift is accompanied by a growing reliance on simple-to-use mobile apps, with over a third of adults considering it the most crucial interaction with their bank. The interplay between technological advancements, changing consumer behaviors, and the integration of generative AI paints a dynamic picture of the future of banking.

In the ever-evolving arena of banking, the integration of generative AI poses both promise and challenges. As banks harness the power of AI to reshape financial decision-making, the pivotal question emerges: Can the industry build and maintain the trust necessary for widespread adoption? The convergence of technological innovation, personalized experiences, and the changing preferences of consumers sets the stage for a transformative journey in the financial landscape.

How will banks navigate the delicate balance between leveraging AI for customer benefit and ensuring data security and reliability? The future unfolds as financial institutions embark on a journey into the realm of generative artificial intelligence, shaping the way we interact with and trust our banks.