Fidelity Investments’ global macro director Jurrien Timmer warns that two factors could limit Bitcoin’s (BTC) move to the upside for a while.

Timmer tells his 167,000 X followers that Bitcoin’s adoption rate, coupled with high interest rates, could keep the king crypto from soaring beyond the $45,000 range in 2023 and most of 2024.

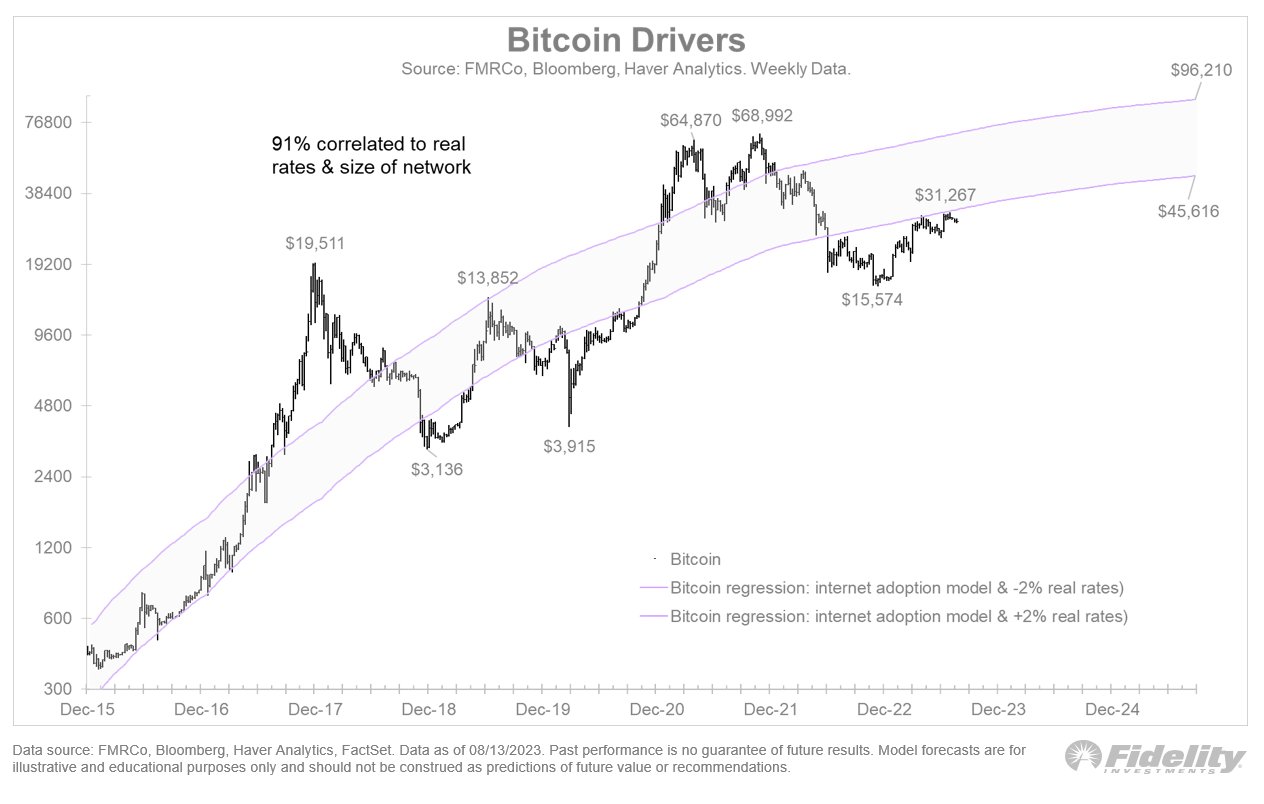

The analyst’s price prediction factors in a Bitcoin adoption rate based on the past adoption rate of the internet and the downward pressure of a real interest rate of at least 2%, which is nominal interest with inflation factored in.

“What’s next for Bitcoin? If real rates remain at +2%, and the adoption curve continues to grow in line with internet adoption a few decades ago, then the upside seems somewhat limited for now.”

Looking at his chart, Timmer believes Bitcoin’s move to the upside may only be to the $45,616 level towards the end of next year. However, if interest rates come down, his chart suggests Bitcoin could see a high of $96,210 before 2024 comes to a close.

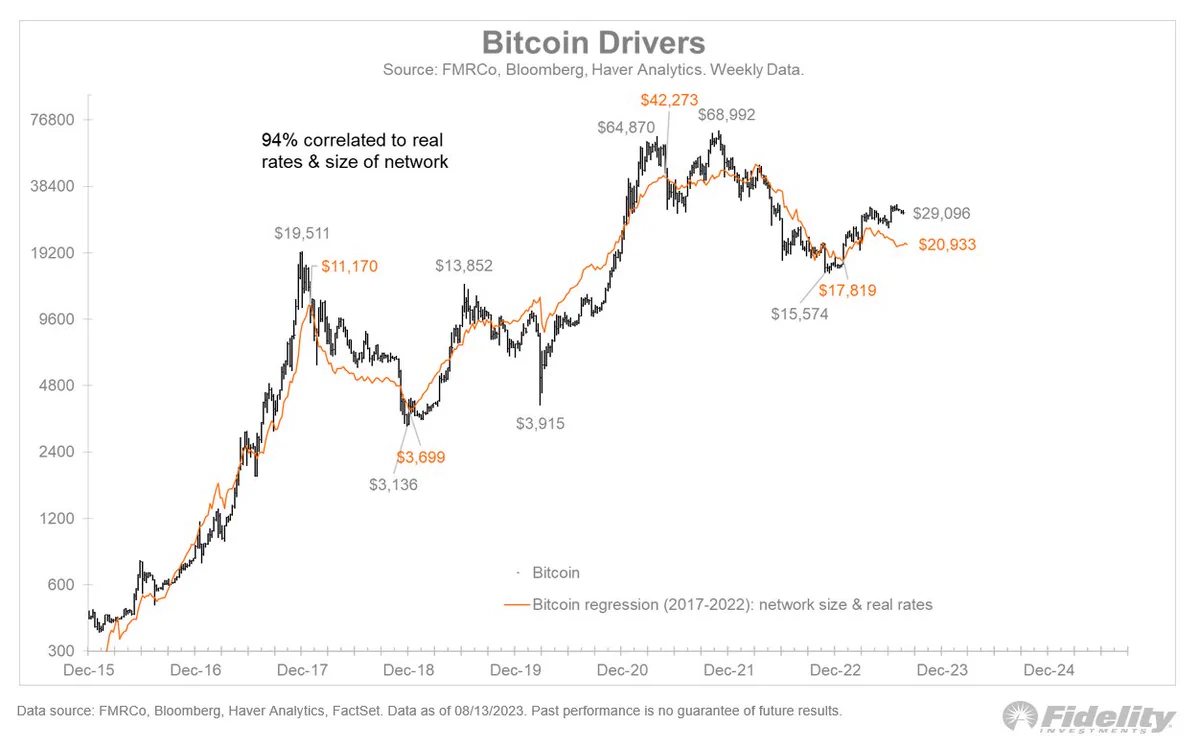

Based on the two factors, Bitcoin is currently overvalued and a market correction could bring the king crypto down to $20,933, according to Timmer.

“Bitcoin has been in a holding pattern near $30,000, and continues to trade somewhat ahead of itself, at least based on real rates (the still-negative term premium for bonds is relevant) and network growth.”

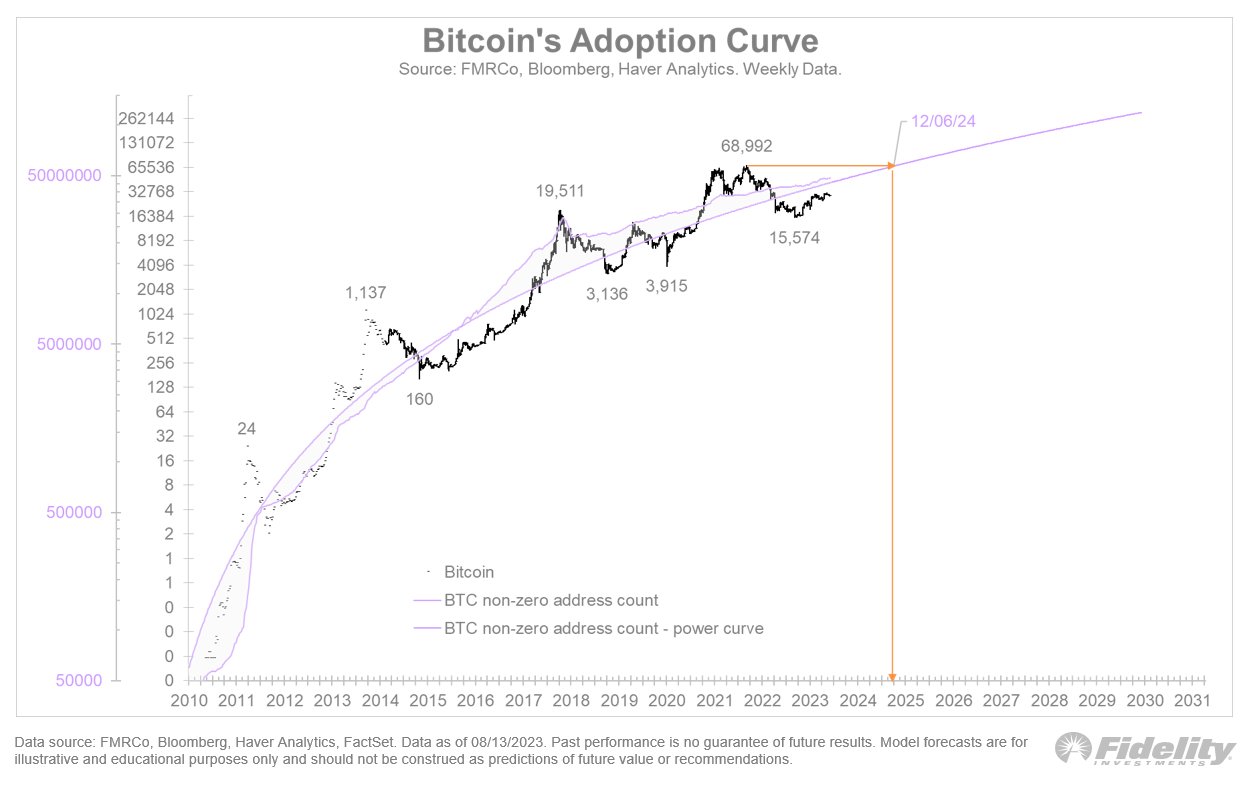

Timmer also models Bitcoin’s price action if it were to follow a typical power curve. The model shows Bitcoin returning to its all-time high of $68,992 in December 2024.

“If Bitcoin’s adoption curve continues to grow along the slope of a typical power curve, it could take more than a year to revert to the old highs.”

Bitcoin is trading for $26,013 at time of writing, down 7% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/thinkhubstudio/Andy Chipus

The post Fidelity Macro Analyst Issues Bitcoin Alert, Says Two Factors Are Likely To Limit BTC’s Upside Potential appeared first on The Daily Hodl.