Nigeria’s central bank has recently issued guidelines for banks dealing with cryptocurrency accounts, marking a shift in the country’s approach towards digital assets.

This development follows the central bank’s decision to lift its ban on banks operating accounts for digital currency service providers, a prohibition that had been in place until recently.

The Newly Introduced Regulatory Framework For Crypto Banking

The central bank’s new guidelines, detailed on their official website, stipulate stringent rules for banks dealing with cryptocurrency. Banks are prohibited from holding or trading virtual assets on their clients’ behalf. The rules allow only naira-based accounts, with no provision for cash withdrawals.

The decision reflects the central bank’s recognition of the growing global trend of virtual asset service providers, including crypto assets. The Nigeria Central Bank particularly noted:

Current trends globally have shown that there is need to regulate the activities of virtual assets service providers which include cryptocurrencies and crypto assets

Moreover, these accounts are barred from clearing third-party checks and are limited to only two quarterly withdrawals. These regulations suggest that the central bank is trying to introduce a more open environment for the digital currency market under strict control.

Nigeria’s Crypto Landscape: Adoption Growth Amid Economic Challenges

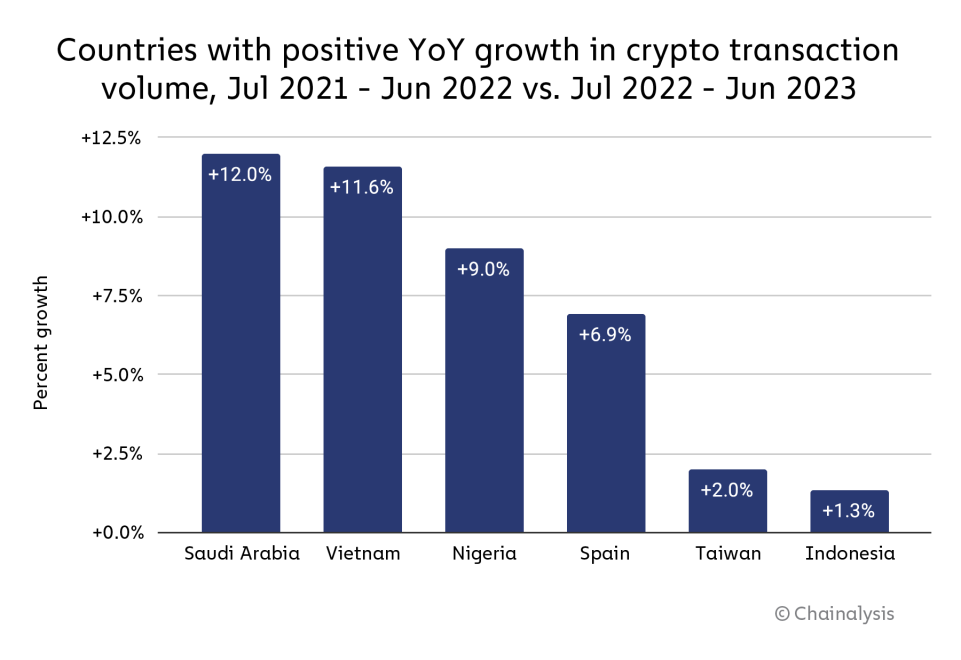

Nigeria, one of Africa’s most populous nations, has been a significant player in the global digital currency market. According to a recent report from Chainalysis, Nigeria saw a 9% year-over-year increase in crypto transactions, totaling $56.7 billion between July 2022 and June 2023.

The report disclosed that this surge in crypto activity coincides with the country’s economic challenges, including a notable depreciation in the naira’s value. The financial instability has driven many Nigerians towards digital currency, particularly Bitcoin and stablecoins, which offer more stability and predictability than the volatile naira.

Stablecoins, digital tokens pegged to fiat currency, such as the US dollar and Euro, have become increasingly popular in Nigeria, offering a hedge against the erratic nature of the digital currency world. However, the rapid growth in digital currency adoption has been without challenges.

In October 2022, the Nigerian digital currency community faced a setback when a popular influencer rug-pulled a project called Stimmy Coin, a parody of the US stimulus checks.

Despite this challenge, the Central Bank of Nigeria (CBN) lifted restrictions on banks and financial institutions operating accounts for virtual asset service providers (VASPs) in December.

This move signaled the CBN’s intention to foster a regulated digital currency environment in the nation. However, the latest strict rules imposed on banks limit the excitement of the lifted ban as it restricts where the rescinded prohibition can be utilized.

Featured image from Unsplash, Chart from TradingView