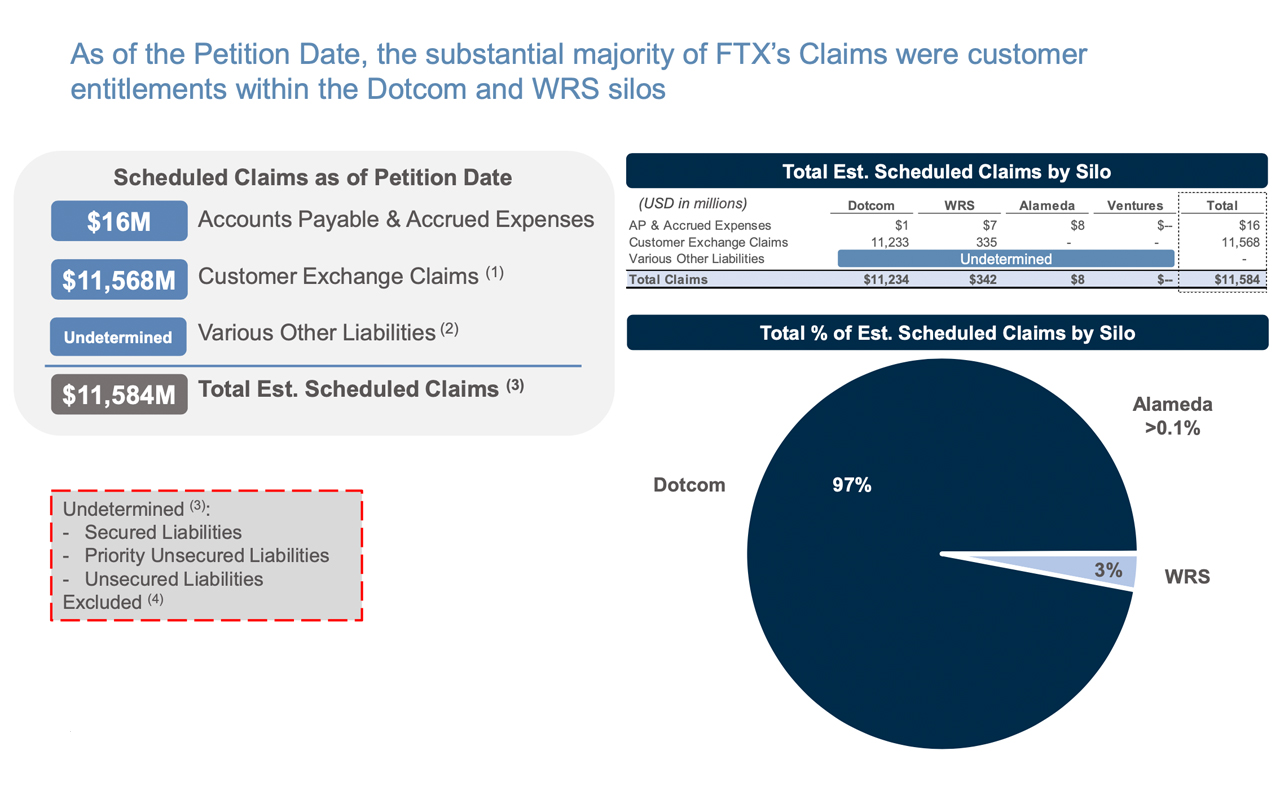

According to a presentation recently submitted by the FTX debtors on March 16, Sam Bankman-Fried’s companies had a $6.8 billion hole in their intercompany balance sheet when they filed for Chapter 11 bankruptcy protection. FTX and its conglomerate of firms have debts of around $11.6 billion, including customer claims and various other liabilities.

FTX’s $6.8 Billion Gap

The FTX debtors have released a third presentation that provides an overview of FTX’s debts and liabilities. The presentation reveals that, while a significant amount of money is owed to customers, FTX and its few subsidiary firms also owe funds to certain vendors, counterparties, and unpaid invoices. Some of the vendors include Margaritaville Beach Resort owned by Jimmy Buffett, Amazon Web Services (AWS), Fairview Asset Management, Stripe, Meta, Trulioo, Spotify, Turner Network Television, and American Express.

Advisers concluded that when FTX filed for bankruptcy, the more than 100 companies under its umbrella had a $6.8 billion gap in their balance sheet. Approximately $4.8 billion of this amount is against a colossal $11.6 billion, according to the presentation. FTX US had a shortfall of about $87 million, despite Bankman Fried’s repeated claims that the U.S. subsidiary was solvent. The disgraced FTX co-founder’s quantitative trading firm, Alameda Research, held the “vast majority of third-party loans,” according to the advisers’ notes.

Alameda had an interesting relationship with many entities and protocols, as it borrowed from “approximately 80 different counterparties.” Furthermore, much of the collateral was based in FTT, SRM, and SOL, and crypto asset volatility “resulted in many lenders issuing margin calls and call notices.” FTX debtors reviewed internal communications, onchain activity, and loan documents and discovered that loans were not recorded in FTX’s historical accounting records. “Additional tracing of wallet and blockchain activity remains an ongoing matter,” the advisers explained.

Forty-nine companies are ghost towns, identified as “dormant” because they have no historical payments or financial information. Advisers say nine FTX entities provided their payment records directly, and 12 FTX entities in Europe and Asia did the same. About 30 of the FTX entities used Quickbooks to keep operational books and records. Regarding political donations, “payments identified on [Federal Election Commission] website that were not classified as donations on the debtors’ books and records,” the presentation notes.

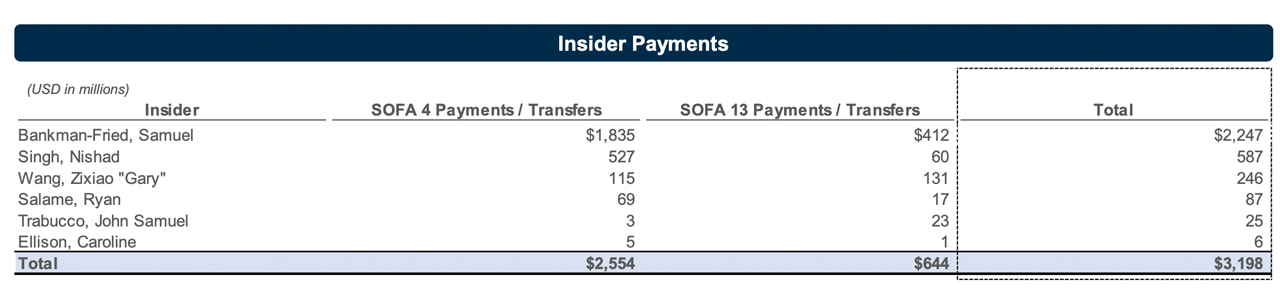

Additionally, a page called “payments to insiders” shows Bankman-Fried was paid roughly $2.247 billion. Former FTX director of engineering Nishad Singh reportedly received $587 million, and FTX co-founder Gary Wang earned $246 million. Former FTX co-CEO Ryan Salame allegedly received $87 million, and Sam Trabucco made $25 million, according to FTX debtors. The former Alameda CEO, Caroline Ellison, received $6 million in payments and loans, as detailed in the payments to insiders spreadsheet.

Overall, FTX debtors discovered major financial and accounting discrepancies within the company, along with substantial payments made to insiders. The situation is opaque, but it’s evident that FTX’s financial problems are more extensive than initially reported. The presentation notes that the financial data was not audited and is subject to change as the bankruptcy proceedings continue.

What do you think this means for the future of FTX and its subsidiaries? Share your thoughts and insights in the comments below.