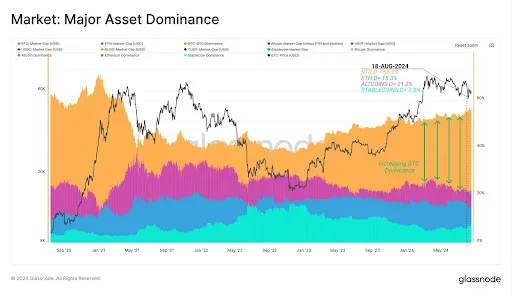

Bitcoin’s market dominance was reported to have risen from 38% in November 2022 to 56% today. Conversely, Ethereum, stablecoins, and altcoins experienced declines of 1.5%, 9.9%, and 5.9%, respectively. The Glassnode report also expounded on the recent decline that affected the crypto market.

Bitcoin has maintained a firm hold on the cryptocurrency market, now commanding an impressive 56% of the total market capitalization. A Glassnode Insights report highlighted the surge while also tracking the performance of other digital assets. Ethereum, stablecoins, and altcoins lost ground to Bitcoin.

Glassnode report reveals crypto asset performance

Capital has progressively shifted towards the leading cryptocurrencies at the top of the digital asset risk curve in the aftermath of the cycle low in November 2022.

Bitcoin continued to show its dominance as the top crypto asset by expanding its market share amidst prevailing uncertainty in the crypto space. Bitcoin surged up to account for 56% of the market capitalization from the 38% figure recorded in November 2022.

Ethereum, the second-largest digital asset in the crypto ecosystem, saw a decline of 1.5% in market share. The decline showed that Ethereum remained relatively unchanged over the two-year period. The top two cryptocurrencies progressed, unlike most other cryptocurrencies, such as stablecoins and altcoins, which experienced steep declines.

Stablecoins decreased from 17.3% to 7.4% over the two-year period. Similarly, altcoins decreased from 27.2% in 2022 to the current share of 21.3%.

The Glassnode report stated that long-term holders have consistently secured profits despite the prevailing volatile market conditions. The report reported that the long-term holders secured around $138 million in daily profits.

Glassnode noted that the daily profit amount represented the capital needed daily to absorb the Bitcoin supply while maintaining the cryptocurrency’s stable prices. Glassnode’s report concludes that an equilibrium is being reached as Bitcoin prices have remained flat over the last few months.

Short-term investors suffered the most losses

Glassnode’s report noted the recent plunge in cryptocurrency prices, which resulted in many investors enduring different degrees of loss. Bitcoin recently recovered to $60,000 after experiencing a plunge of over 15% to a six-month low of $49,500 in the first week of August.

The report stated that HODLing behavior surpassed spending, with the supply held by long-term holders rising rapidly, stating that most of the losses were experienced by short-term holders.

Glassnode’s report identified that the short-term holders were responsible for triggering the downturn due to “panicking.” The short-term holders hold BTC for less than 155 days in this context. Most of these individuals are noted to be experiencing current losses after having bought Bitcoin during the 2024 rally.

The MVRV ratio in a 30-day average for short-term holders dropped below 1.0. The drop indicated that short-term holders are largely responsible for the losses following the market correction. The report also stated that the perceived impact on investor sentiment may be limited in severity.