Crypto adoption keeps growing globally, with the total number of crypto holders now at 617 million, according to a recent report from a16z.

But only around 60 million of those holders use crypto monthly. The gap is clear, but that means there’s a massive opportunity to activate more holders.

In September, 220 million crypto addresses interacted with blockchain at least once, a huge rise compared to the end of 2023.

Solana leads in active addresses

This surge in activity is led by Solana, which accounted for nearly 100 million of those active addresses. NEAR followed, recording 31 million active addresses.

Coinbase’s L2 network, Base, reported 22 million, while Tron and Bitcoin showed 14 million and 11 million respectively.

Ethereum-based chains also saw action, with Binance’s BNB Chain logging 10 million and Ethereum itself seeing 6 million.

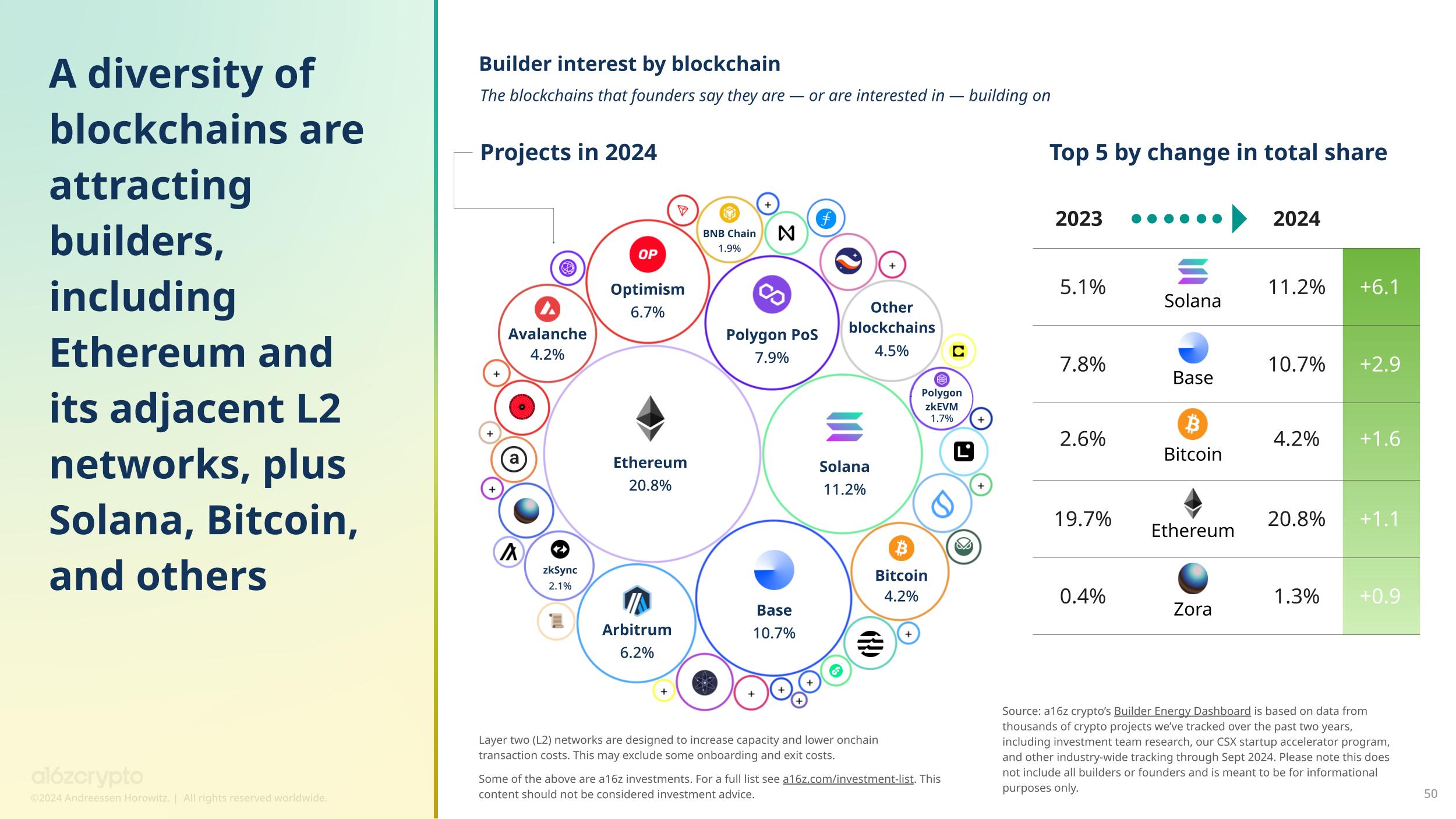

These trends line up with the broader interest in blockchain development. Solana has seen the largest rise in builder interest, jumping from 5.1% last year to 11.2% this year.

Base also made gains, going from 7.8% to 10.7%, and Bitcoin builders grew from 2.6% to 4.2%. Ethereum still dominates, though, with 20.8% of all builders focused on it.

U.S. declines in share

The number of monthly mobile crypto wallet users hit 29 million in June, a new high. The United States leads the share with 12% of users.

But this percentage has been shrinking as more crypto adoption happens outside the U.S. and some projects begin to exclude American users through geofencing for compliance reasons.

Crypto is spreading fast in countries like Nigeria, India, and Argentina. Nigeria has been pushing for regulatory clarity, including incubation programs, and this has fueled a rise in crypto use for everyday transactions like bill payments and shopping.

India, with its massive population and widespread mobile adoption, has become a key crypto market. Argentina, facing currency instability, is seeing its residents turn to stablecoins for financial security.

Crypto takes center stage in U.S. Politics

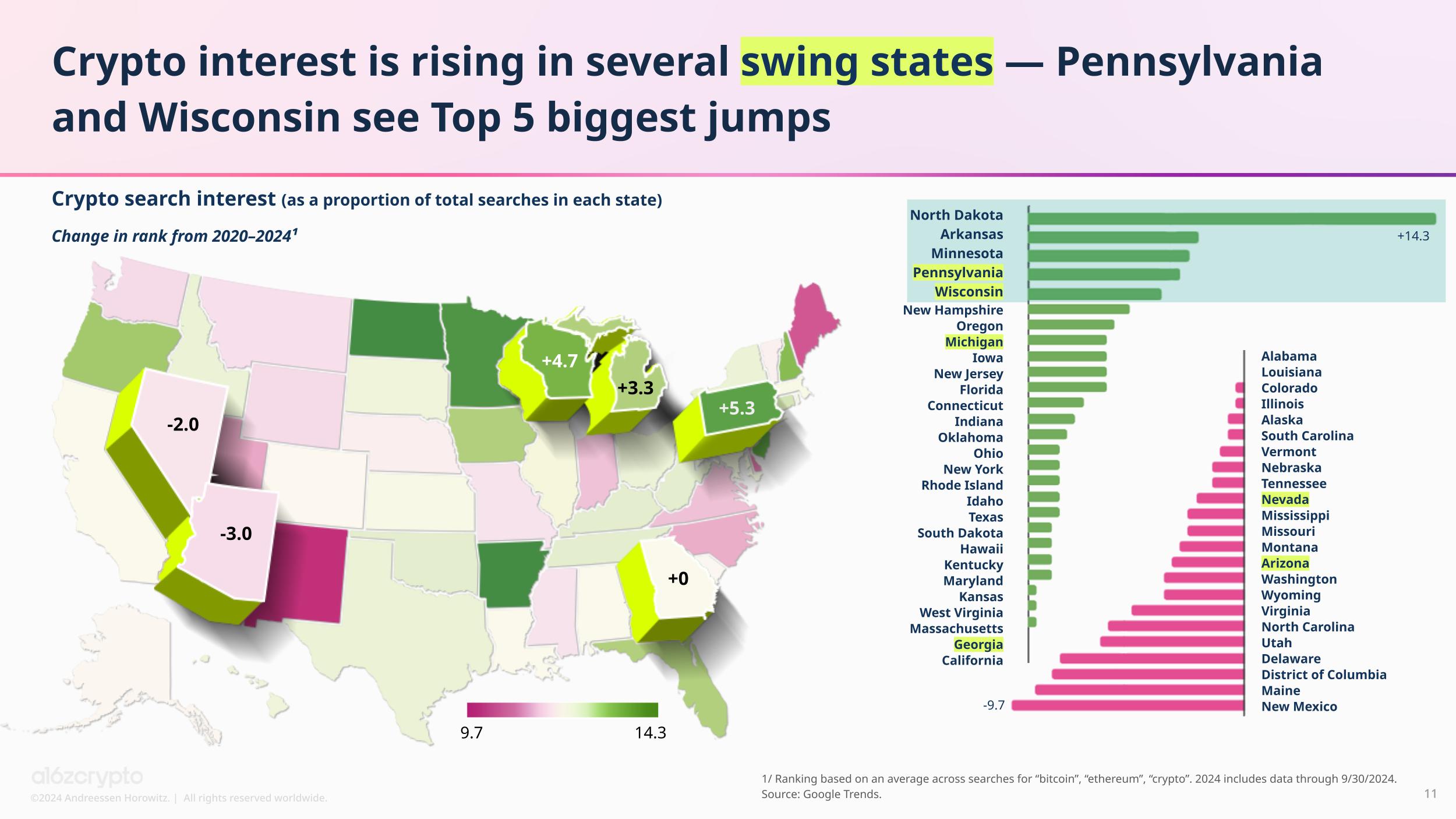

Crypto is now a hot topic in U.S. presidential elections. Interest in crypto has surged in key swing states like Pennsylvania and Wisconsin.

Pennsylvania showed the fourth-largest jump in crypto-related searches, with Wisconsin following at fifth place. Michigan ranked eighth in crypto interest growth. Both candidates have been vying for the community’s votes.

In a big year for crypto legislation, the House of Representatives approved the Financial Innovation and Technology for the 21st Century (FIT21) Act with bipartisan support.

This bill, which now waits for Senate approval, could provide the regulatory clarity that crypto entrepreneurs have been asking for.

At the state level, Wyoming passed the Decentralized Unincorporated Nonprofit Association (DUNA) Act, giving legal recognition to DAOs (Decentralized Autonomous Organizations) while allowing them to operate without compromising on decentralization.

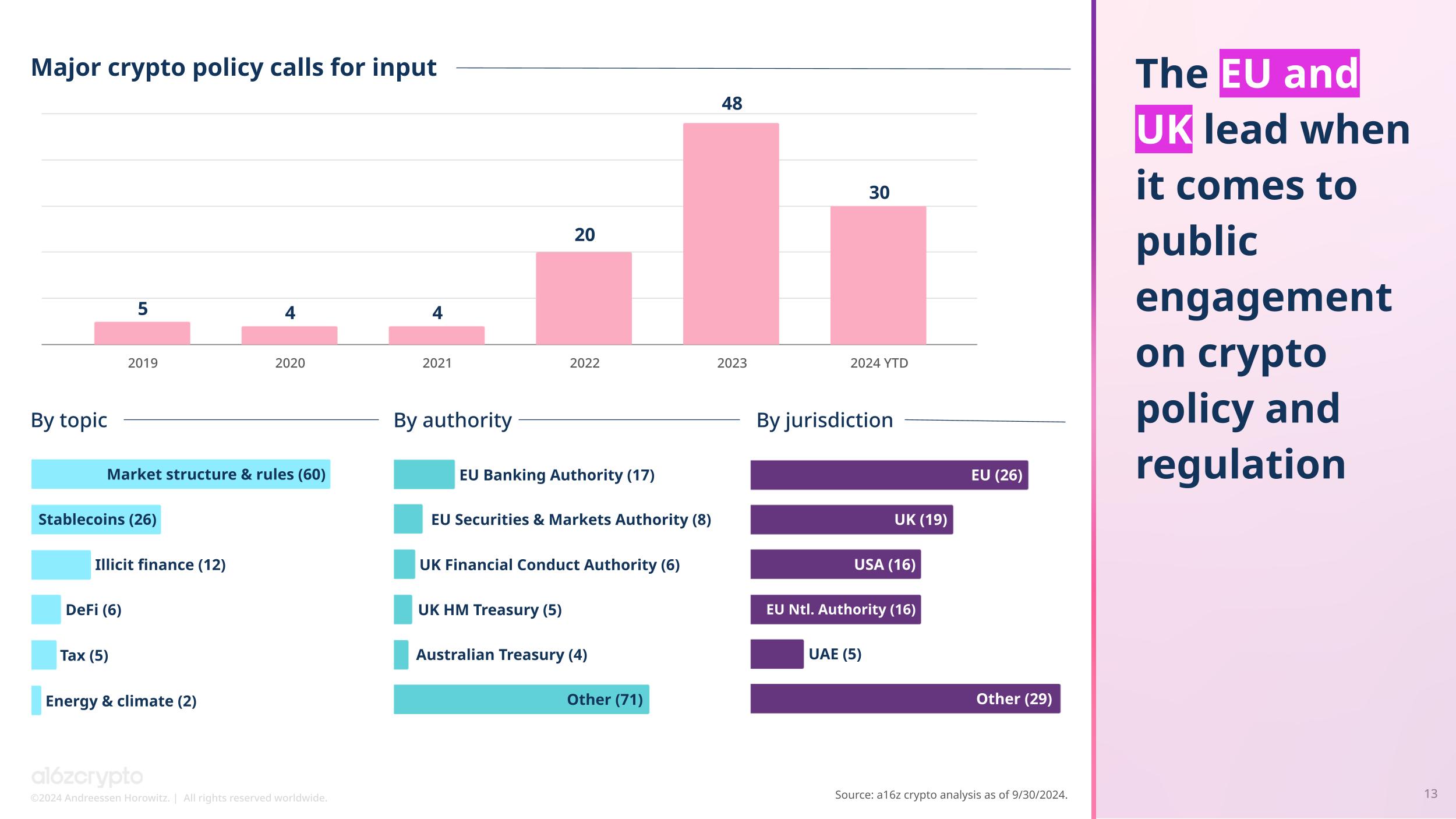

Across the Atlantic, the EU and the UK have taken a proactive approach to crypto policy. The European Union’s Markets in Crypto Act (MiCA) became the first comprehensive crypto law in Europe and will be fully implemented by the end of the year.

Stablecoins: The most popular crypto product

A16z says stablecoins have proven to be one of crypto’s most useful tools. As of now, stablecoins have processed $8.5 trillion in transaction volume across 1.1 billion transactions. In comparison, Visa handled $3.9 trillion over the same period.

Stablecoins are also strengthening the U.S. dollar’s position globally. More than 99% of all stablecoins are denominated in dollars, with the euro coming in at a distant second with just 0.2%.

Stablecoins have also become major holders of U.S. debt, ranking in the top 20, even surpassing places like Germany.

The reason stablecoins are thriving is thanks to major infrastructure upgrades. Blockchains are now processing more than 50 times the number of transactions per second compared to four years ago.

Ethereum’s latest upgrade, Dencun (EIP-4844), launched in March, has drastically reduced fees for Layer 2 networks.

Zero-knowledge (ZK) proofs are also playing a huge role in blockchain scaling. These cryptographic proofs allow computations to happen off-chain while still ensuring they’re correct.

The report pointed out that the cost of verifying ZK proofs has gone down, while their popularity has risen. Meanwhile, there’s over $169 billion locked in DeFi protocols right now.

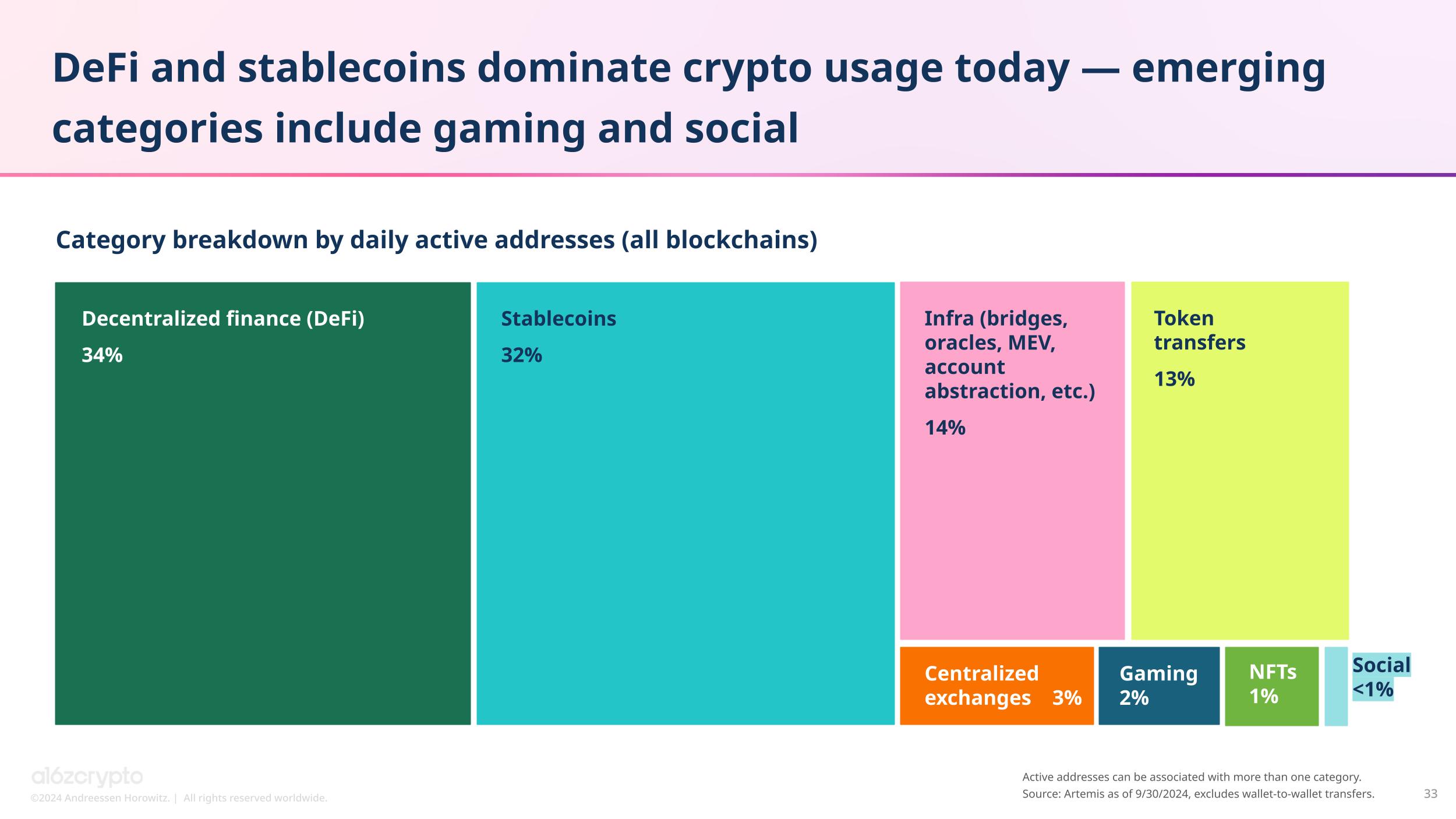

DeFi accounts for 34% of all crypto usage, the highest share of daily active addresses, even higher than stablecoins.

The decentralized exchange space has grown quickly, and now makes up 10% of the spot crypto trading activity. This is a huge change from just four years ago when all trading happened on centralized exchanges.

Since Ethereum transitioned to proof-of-stake, the network’s security has improved, with 29% of all ETH now being staked.

Crypto and AI are crossing paths more than ever. About 34% of crypto projects say they’re using AI, according to the a16z Builder Energy dashboard. One of the key areas for this integration is in blockchain infrastructure.

AI’s growing costs are pushing the technology toward centralization, as only large companies have the resources to train cutting-edge models. Crypto offers a potential solution here, with decentralized networks allowing for shared AI computing power.