Since the onset of Bitcoin and the years that followed, digital coins have prided themselves as a hedge to volatility, but gold has stood the economical test. Gold (XAU) rose on Wednesday as reports indicated that a perfect storm was brewing, causing the U.S. Dollar, Treasury yields, and Asian equities to fall.

What does Fitch have to do with the us market downturns?

Futures on U.S. equities declined on Wednesday after Fitch downgraded the country’s long-term rating and as traders continued to evaluate the most recent collection of second-quarter earnings results.

Futures on the Dow Jones Industrial Average declined by 110 points, or 0.3%. Futures on the S&P 500 and Nasdaq-100 declined by 0.5% and 0.8%, respectively.

Tuesday night, Fitch Ratings lowered the United States’ long-term foreign currency issuer default rating from AAA to AA+, citing “expected fiscal deterioration over the next three years.”

A hectic earnings week continued. Advanced Micro Devices gained 2% prior to the opening bell due to better-than-anticipated results. CVS Health gained 2% as a result of robust earnings and cost reductions. In the meantime, SolarEdge Technologies fell 12% after revenue expectations for the second quarter were not met.

These changes followed a lackluster first trading day of August. The S&P 500 fell 0.27 percent on Tuesday, while the Nasdaq Composite fell 0.47 percent. At one point in the session, the Dow Jones Industrial Average gained 71.15 points, or 0.2%, and attained its highest level since February 2022.

Earnings season is well into its second quarter, with results exceeding expectations. According to FactSet data, 82% of S&P 500 companies that have reported have posted positive surprises. The earnings gains have bolstered investor optimism, extending the year’s recovery.

Gold outshines Bitcoin as a hedge against volatility

Amid the ongoing market turmoils, investors in the United States of America have resulted to gold as a hedge to inflation in crypto’s stead. Fitch’s decision was based on concerns about the country’s fiscal deterioration and growing debt burden over the next three years. As investors lost faith in the economy, they flocked to the protection of gold, thereby increasing its demand.

In the past, a credit rating downgrade caused markets to erupt in panic. However, this time the initial response appeared to be more subdued. Nonetheless, experts are keeping a close watch on the situation’s development, recognising its potential impact on the markets in the future.

Historically, gold denominated in U.S. dollars has been favoured as a safe haven investment during periods of economic uncertainty and stress.

Gold experienced a 1% decline and a three-week low as a result of the dollar’s strength in response to June’s strong manufacturing and construction data. Despite this temporary setback, all eyes are now on Friday’s non-farm payrolls report, which will be a crucial indicator of the health of the U.S. economy.

Following a robust increase of 209,000 in June, it is anticipated that the number of jobs will rise by another 200,000 in July.

The global gold situation

The U.S. central bankers have acknowledged that higher interest rates will be required for some time, despite their hopes of containing inflation without harming employment prospects.

The increase in interest rates presents a challenge for gold investors because it raises the cost of holding the non-yielding precious metal, which requires funds for storage and insurance.

In addition to the economic situation in the United States, the World Gold Council (WGC) focuses on India’s gold market. The WGC forecasts that India’s demand for gold in 2023 will fall by 10% from the previous year, reaching the lowest levels in three years. Gold’s record-high price is having a chilling effect on the nation’s retail sales.

The decreased gold imports may have broader ramifications, as it may reduce India’s trade deficit and strengthen the rupee.

The gold market continues to be a focal point for investors navigating uncertain economic waters. With global events and economic indicators in play, precious metals buyers and sellers must remain vigilant for potential favorable or bearish outcomes.

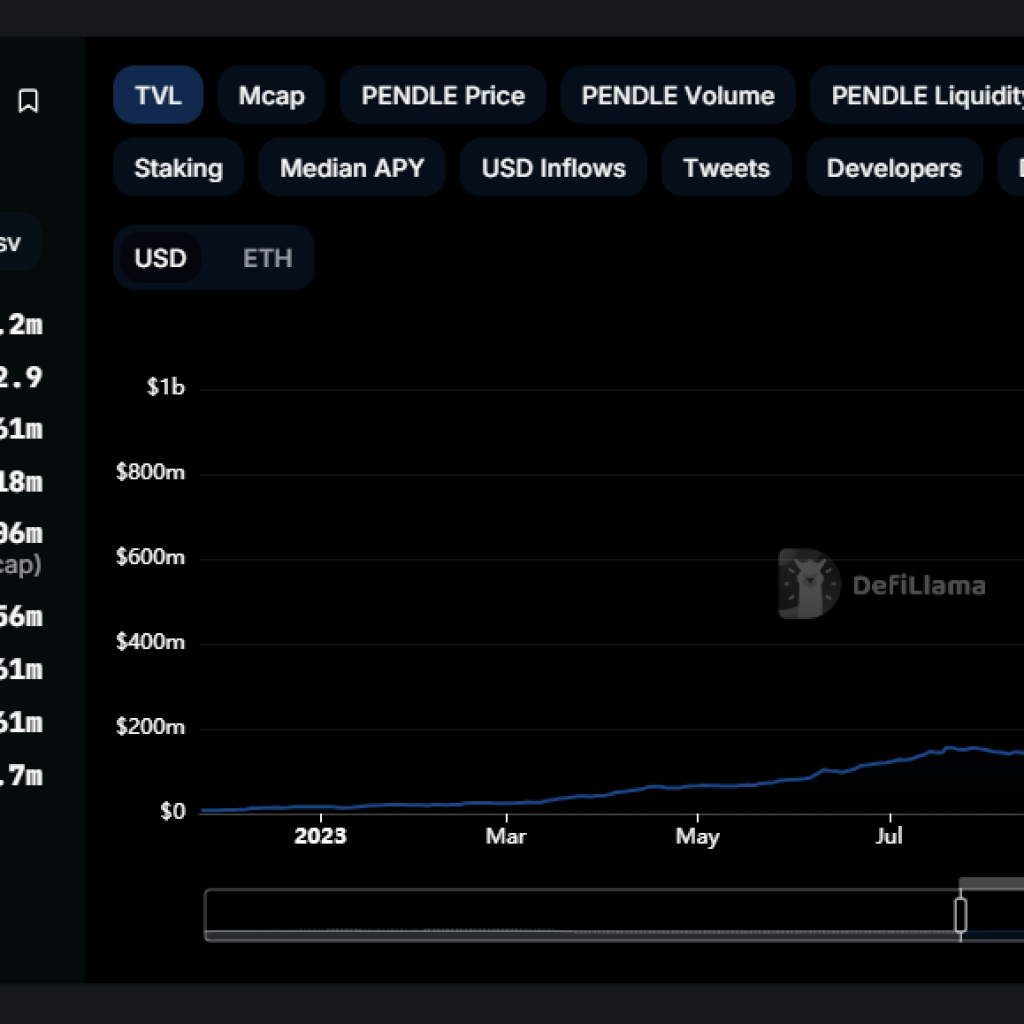

In the meantime, the crypto industry is in a state of limbo with coins dipping and others becoming an overnight success like Worldcoin. According to Binance, the live price of Bitcoin is $29,340.32 per (BTC / USD) with a current market cap of $570.55B. 24-hour trading volume is $ 20.75B USD. Bitcoin is +1.64% in the last 24 hours with a circulating supply of 19.45M.

As per CoinGecko, the global crypto market cap today stands at $1.23 Trillion, a 1.33% increase in the last 24 hours and a 9.8% surge one year ago. As of today, the market cap of Bitcoin (BTC) is at $572 Billion, representing a Bitcoin dominance of 46.64%.