As global liquidity continues its uptick, gold and the S&P 500 are leading the other asset classes into what could be a coming year of continued strong performance. Bitcoin, the most correlated asset to global liquidity, is likely to follow, and surpass all other assets in this kind of environment.

Gold is seen as real money once again

Gold has been the hedge in difficult financial periods for much of civilised times. When governments and their central banks have overspent, gold has always been the go-to asset to protect one's wealth. However, since the 70s, banks have managed to successfully suppress the gold price, and many started to believe that the dollar was king, and that gold had become an antiquated currency that was no longer viable.

That said, how many dollars have been printed into circulation since those times? Trillions of dollars of paper currency have flooded markets over the years as debasement has become rife, and it is for this reason that gold is once more being seen as real money, and governments and private investors are buying it once again.

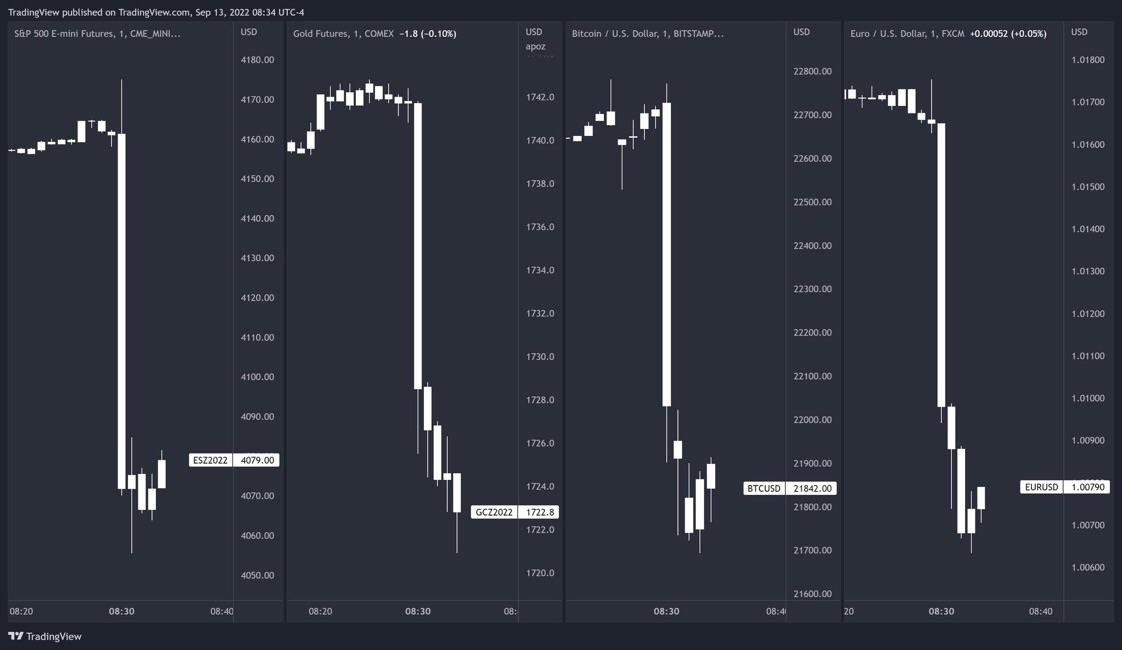

Source: TradingView

The gold price is heading much higher if the above chart has anything to say about it. After breaking through the ascending trend line, the price is now in a parabolic upwards move. A next major target overhead, now that gold is in price discovery, is the 2.618 Fibonacci at $3,340. It is to be wondered how much less purchasing power the dollar will provide once gold gets there?

S&P 500 ultra-bullish if it breaks up out of ascending channel

Source: TradingView

The S&P 500 is a vastly different kettle of fish to gold, but its upward trajectory is just as strong. There is criticism of the S&P 500, in that most of its strength comes from only the seven top US companies, and it is for this reason that they are nicknamed “the magnificent seven”.

Nevertheless, this stock market has been in a firm upward trend since October 2022, and is even threatening to break out of its rising channel, which if it manages to do so, would be extremely bullish. The major target for the S&P 500 would be the 2.618 Fibonacci at $6,970.

$BTC lagging - but this could change soon

Source: TradingView

Bitcoin is a bit of a laggard compared with the previous two asset classes, given that a definitive breakout is yet to occur. However, that said, the $BTC price is currently attempting to rectify this situation, and should it break out of its bull flag, and confirm above, this asset has the potential to outperform gold, S&P 500, and all other assets.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.