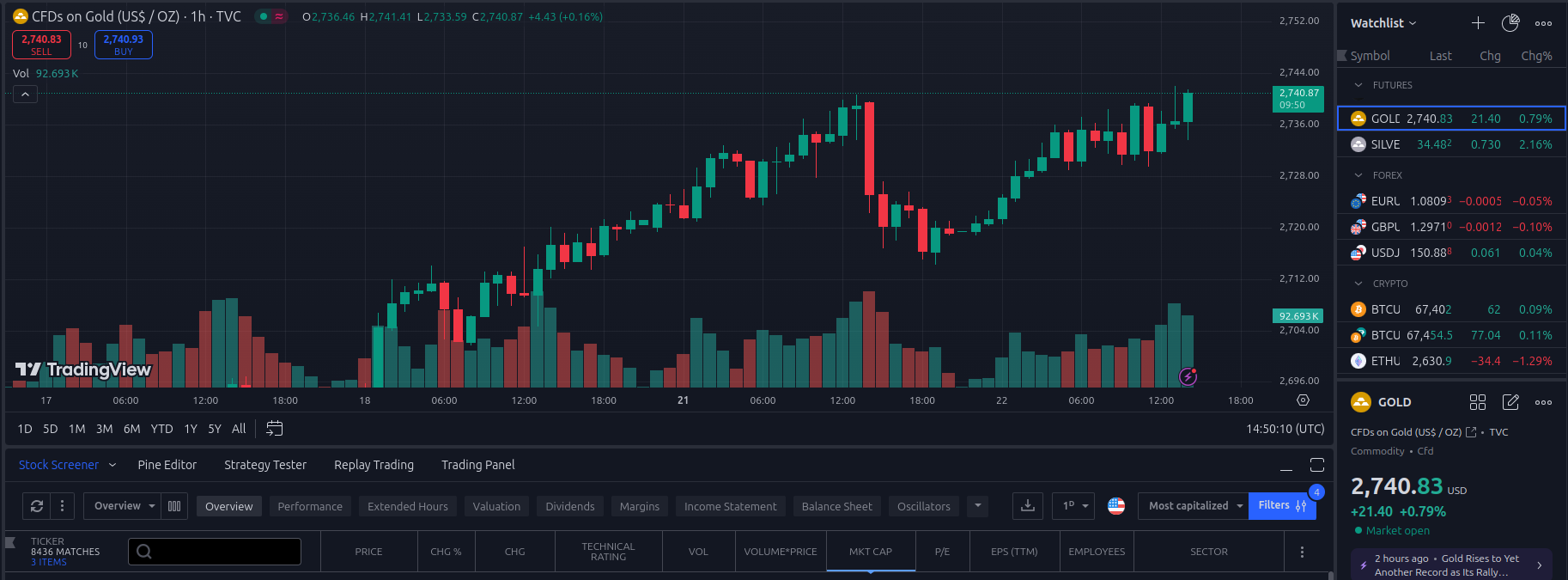

On October 22, 2024, gold prices surged to a historic high, surpassing $2,740 per ounce. This milestone marks a significant moment for investors, reflecting a combination of economic factors and geopolitical uncertainties that have driven demand for the precious metal to unprecedented levels.

Factors Behind the Record-High Price

- Geopolitical Tensions

The surge in gold prices can be largely attributed to heightened global uncertainties, particularly conflicts in the Middle East. As tensions escalate, investors seek safe-haven assets to protect their wealth. Historically, gold has served as a reliable hedge during periods of conflict, which has once again proven true in 2024. - Central Bank Demand

Another key factor influencing the gold market has been increased purchases by central banks, especially in BRICS countries (Brazil, Russia, India, China, and South Africa). These nations have been diversifying their reserves away from U.S. dollars and into gold, leading to substantial demand growth. The strategy is part of a broader effort to reduce reliance on the U.S. dollar and strengthen currency reserves with a more stable asset. - Weakening U.S. Dollar

The U.S. dollar’s decline has also played a pivotal role in pushing gold prices higher. When the dollar weakens, gold becomes more attractive to investors holding other currencies, which typically results in higher demand and higher prices. The dollar’s depreciation this year, driven by economic uncertainties and monetary policy concerns, has further buoyed gold. - Interest Rate Expectations

With the Federal Reserve indicating potential rate cuts in 2025, the outlook for gold remains bullish. Lower interest rates generally benefit gold because they reduce the opportunity cost of holding non-yielding assets like gold. This anticipated monetary easing has made gold an appealing option for investors looking for stability amidst market volatility.

The Outlook for Gold Moving Forward

While gold’s rise to its all-time high is significant, the future remains uncertain. Analysts suggest that ongoing central bank policies, geopolitical developments, and changes in global economic conditions will continue to influence gold prices. Some forecasts are optimistic, with projections reaching as high as $3,000 per ounce by late 2025, assuming geopolitical risks persist and central bank demand remains strong.

Conclusion

The record-breaking gold price in October 2024 reflects the broader economic landscape, with uncertainties driving investors toward safer assets. Whether the trend will continue depends on a range of factors, including interest rate changes, geopolitical stability, and central bank actions. For those considering gold as part of their investment strategy, the current environment presents both opportunities and risks worth considering.

For more detailed insights and the latest updates, check the original article here: bitlyfool.com.