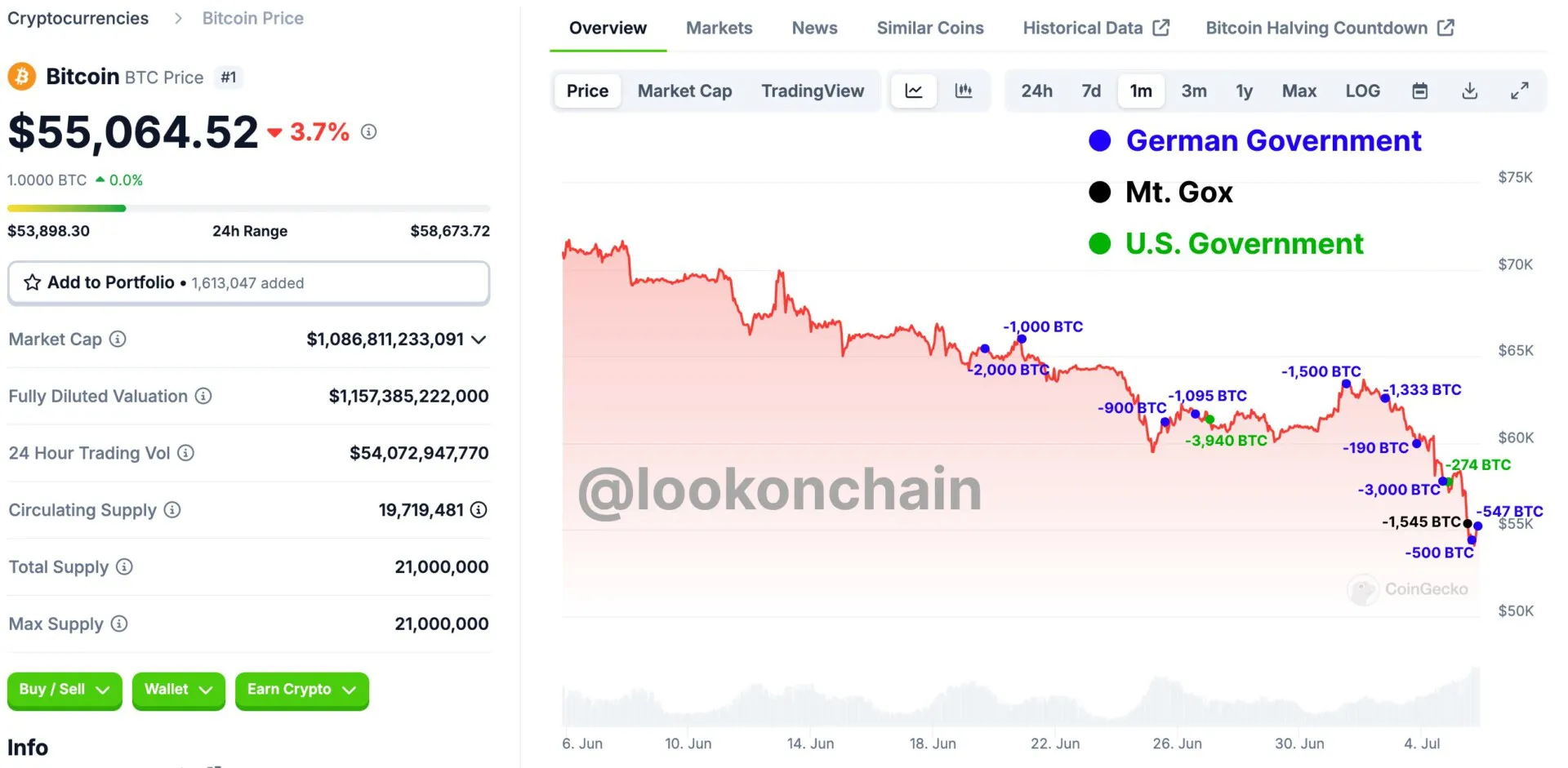

On-chain tracker Lookonchain has reported a massive transfer of 17,788 BTC, valued at $1.08 billion, by the German government, the United States government, and Mt. Gox.

The German government has been transferring BTC daily since July 1. Currently, these entities hold a whopping total of 396,210 BTC, valued at $22.78 billion.

Specifically, the German government holds 41,226 BTC ($2.28 billion), the US government holds 213,297 BTC ($11.72 billion), and Mt. Gox holds 141,687 BTC ($7.78 billion).

Market reactions

The news of these transfers had an immediate impact on the market. Crypto prices took a hit in Asia, with BTC dropping below $54,000 and ETH falling below $2,900.

However, prices rebounded slightly before the US markets opened, with BTC climbing back to $55,000 and ETH reaching $2,950. The volatility was driven by market makers scrambling to buy gamma, leading to a spike in front-end volumes.

QCP Capital noted that the market reacted sharply to the imminent BTC supply increase due to these transfers. Speculators likely oversold in anticipation, causing liquidations around $58,000 in thin markets during the US holiday. The analysts stated:

“Our view is that spot prices have stabilized, suggesting decent support around $54,000. Panic has also died down with front-end volumes easing significantly from 65 to below 50 for BTC and from 80 to 62 for ETH.”

QCP Capital mentioned a rush from clients to deploy Accumulators amidst the price dip and volume spike. This strategy allows investors to collect ETH below $2,700, a 9.6% discount.

The trade idea involves buying ETH spot at $2,680 every week, with a maturity date of September 27, 2024, and an upper barrier of $3,550. The observation frequency is weekly, with a spot reference of $2,960 for ETH/USD.

Are we in a bear run?

Take a look at the BTC/USDt chart below. Notice how the Bollinger Bands are wide, indicating high volatility. The price is currently below the middle band, enforcing the bearish run.

The 50-day MA is below the 200-day MA, forming a “death cross,” which is a strong bearish signal. The MACD line is below the signal line, and both are in negative territory.

However, the histogram shows decreasing negative bars, meaning there is some possibility of the bearish momentum weakening in the near term.

The RSI is at 51.15, which is in the neutral zone. This suggests that the market is neither overbought nor oversold. Note that the RSI has been rising from oversold conditions, indicating a potential recovery.

If the price breaks below the lower band, it could trigger further selling pressure, pushing BTC towards $52,000. Conversely, a move above the middle band ($55,589.69) could indicate a potential reversal.

Reporting by Jai Hamid