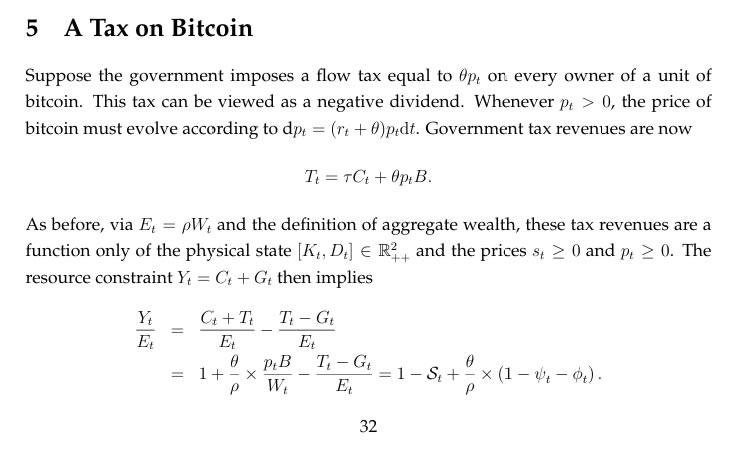

The Federal Reserve Bank of Minneapolis suggests that a ban or tax on Bitcoin could ensure its ability to run permanent budget deficits.

A recent research paper by the Federal Reserve Bank of Minneapolis has suggested that assets such as Bitcoin would need to be taxed or banned for governments to maintain deficits.

In an economy where the government tries to maintain permanent deficits using nominal debt, the presence of Bitcoin (BTC) creates problems for policy implementation, the Minneapolis Fed stated in a working paper released on Oct. 17.

Bitcoin introduces a “balanced budget trap,” an alternative state where the government is forced to balance its budget, the Fed claimed.