According to statements made by the company’s CEO, Grayscale, a prominent crypto investment firm, has signaled its openness to exploring mergers and acquisitions (M&A) opportunities. This announcement reflects the company’s strategic stance amid a dynamic and evolving crypto landscape.

As a leading player in the digital asset management space, Grayscale’s interest in M&A activities underscores its commitment to growth, innovation, and adaptation to market trends. The CEO’s remarks highlight the firm’s proactive approach to capitalizing on synergistic partnerships and strategic alliances within the crypto industry.

Grayscale’s M&A game plan

Grayscale Investments, a manager of crypto assets, has been bombarded with inquiries pertaining to mergers and acquisitions since its prominent legal triumph over the Securities and Exchange Commission a year ago.

During an interview with CNBC’s Andrew Ross Sorkin, Grayscale CEO Michael Sonnenshein responded that his company is open to contemplating deals when asked whether it would still be an independent company in two years.

Sonnenshein told CNBC, “Our eyes and ears are open, and sometimes people are approaching us about strategically working together […] But nothing to announce this morning.”

Sorkin observed that major financial institutions such as BlackRock are expanding their presence in the crypto space. Grayscale is a veritable behemoth in the industry, managing approximately $23 billion in assets exclusively through its Bitcoin Trust ETF (GBTC).

The broader investment community, according to Sonnenshein, paid attention to Grayscale’s August court victory over the SEC.

In contrast to Grayscale’s proposed conversion of its Bitcoin Trust (GBTC), judges of the DC Circuit Court of Appeals deemed the SEC’s approval of Bitcoin futures funds was “arbitrary and capricious.”

The decision, which the SEC elected not to appeal, effectively precluded the SEC from further rejecting spot bitcoin ETFs on the basis of justifications it had previously provided.

Grayscale dumps $175M Bitcoin on Coinbase

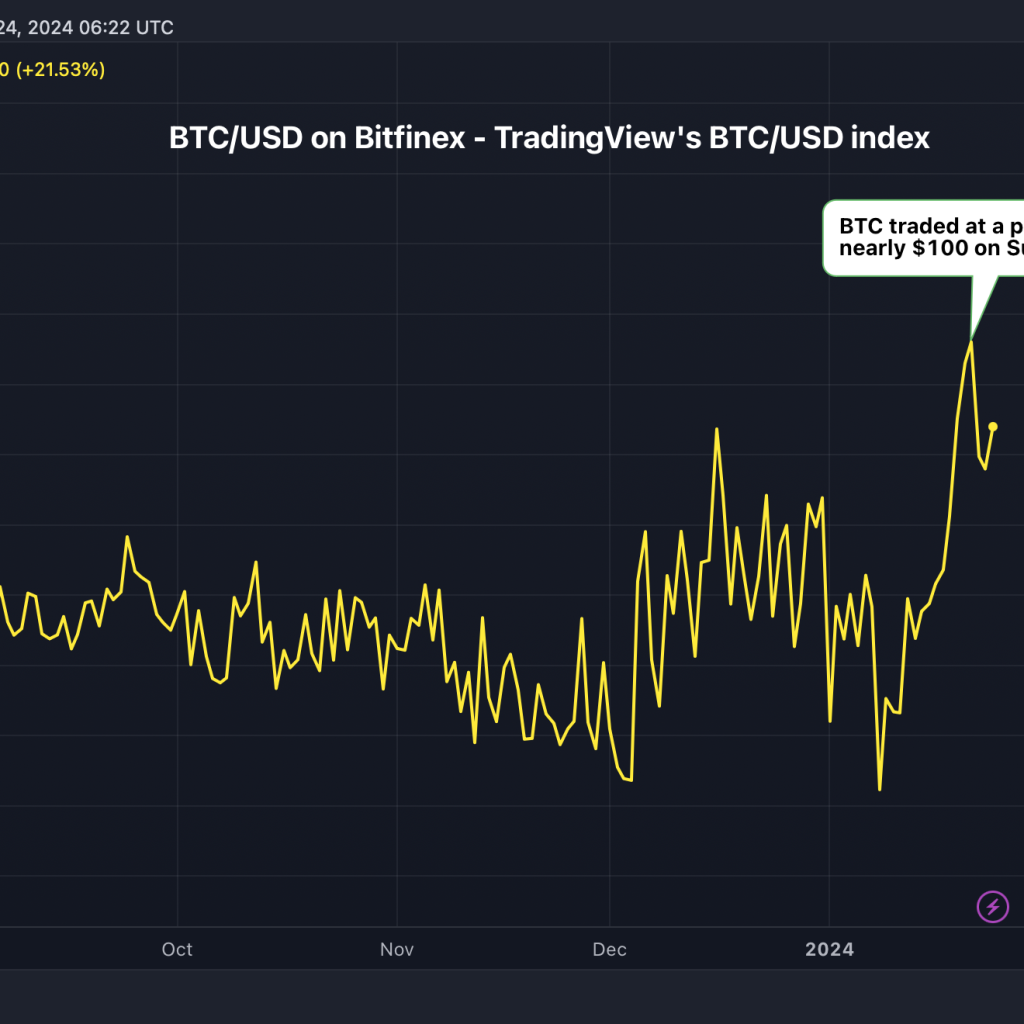

Although the price of Bitcoin has remained above $50,000 for the past three days, this has resulted in a 2.65% decline. The pre-halving rally inspires cryptocurrencies as they recover from the gloomy days following the listing of ETFs; it accounts for a nearly 20% increase in February. Nevertheless, Grayscale, a provider of digital asset management, is beginning to veer off course despite the recent surge.

Arkham documented a noteworthy transaction wherein Grayscale executed a substantial Bitcoin transfer at 22:12 UTC+8 on February 23. The exchange happened when 3,443.1 BTC was deposited into the Coinbase Prime Deposit account.

This transaction is of particular significance on account of its considerable value, which is estimated to be around $175 million at the moment, or $50,920 at the Bitcoin price.

At this time, the precise causes of the rapid capital outflows that have been observed are unknown. On the contrary, a conceivable rationale might be that investors opted to divest their holdings in order to exploit the gains stemming from the recent upswing in market values—particularly subsequent to a prolonged commitment of their capital to the fund.

GBTC distinguishes out among US-based spot Bitcoin ETFs because of its comparatively high management charge of 1.5%. This price is substantially greater than that of its competitors, such as BlackRock’s IBIT, which charges 0.12%. However, BlackRock has revealed plans to change IBIT’s fee structure, rising it to 0.25% in the next 12 months.

The difference in management fees may be an important consideration for investors when deciding between investment choices since lower fees often correlate to higher net returns over time, making products like IBIT more appealing to cost-conscious investors.