The integration of artificial intelligence (AI) and cryptocurrency is heralding a new era of technological advancement, as highlighted in a recent Grayscale Investments report by Will Ogden Moore. Grayscale’s latest report says this synergy, marked by the impressive performance of AI-related crypto assets, is expanding the scope of blockchain applications beyond traditional payment systems.

Grayscale Research Report Illuminates the Collaborative Future of AI and Cryptocurrency

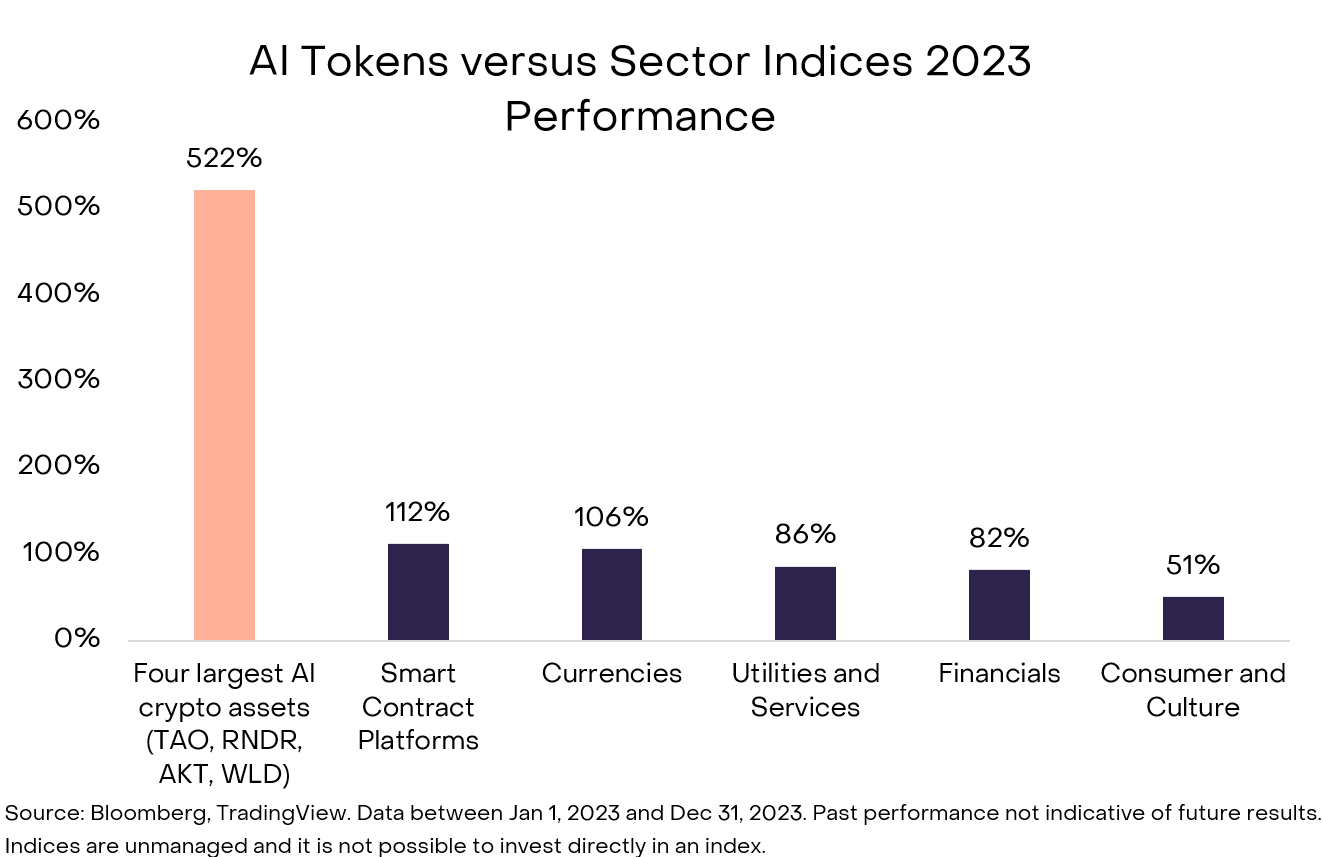

Grayscale Investments’ research report emphasizes the potential of this intersection to address future AI-related societal challenges, including concerns over data privacy and the centralization of power. According to the Grayscale researcher, Will Ogden Moore, AI-adjacent cryptocurrencies have shown significant growth, outperforming traditional sectors within the crypto ecosystem.

“Specifically, the four largest AI-adjacent crypto tokens by market cap (TAO, RNDR, AKT, WLD) are up 522% in the last year, outperforming the Utilities and Services Crypto Sector (+86%) over the same period,” the report notes.

Grayscale’s analysis points to the critical need for accessible, competitive, and transparent AI development, mirroring the core principles of blockchain technology. The report discusses various viewpoints, including those from industry experts, on how blockchain could play a crucial role in establishing checks and balances in AI governance.

“The Openai incident underscores the potential dangers of centralized control over pivotal technologies,” the study explains. “For Grayscale Research, this begs a critical question: how do we ensure that AI development is accessible, competitive, and transparent?”

The Grayscale report further highlights the use of blockchain in combating the rise of misinformation and deepfakes, especially in politically sensitive contexts like elections. It showcases initiatives using blockchain protocols to verify content authenticity, thus enhancing trust and transparency in digital information.

One of the major concerns in AI development is bias in AI models. The Grayscale report sheds light on decentralized networks like Bittensor, which aim to reduce bias by incentivizing diverse pre-trained models. This approach fosters an open and collaborative environment for AI innovation, potentially mitigating the negative impacts of bias and promoting a more equitable AI landscape.

For instance, several studies have shown that AI language models, such as Chatgpt, may exhibit a left-leaning political bias. A paper published in the National Center for Biotechnology Information argued that algorithmic bias against people’s political orientation can arise in AI systems. The University of Washington and Carnegie Mellon University revealed that AI language models have been trained on left-leaning data.

Finally, the report emphasizes the importance of democratizing AI development to prevent monopolization by tech giants. It discusses how decentralized compute marketplaces, such as Akash and Render, are enabling broader access to AI development resources. By connecting GPU owners with AI developers, these platforms are making AI development more accessible and competitive, countering the trend of centralization in the tech industry.

In conclusion, Grayscale’s and Moore’s research report illuminates a transformative phase where AI and cryptocurrency coalesce, fostering a landscape ripe for innovation and societal benefit. This union is not only redefining blockchain’s utility but also addressing critical challenges in AI governance and development. By leveraging decentralized networks and marketplaces, this synergy promises a more equitable, transparent, and diverse technological future.

What do you think about Grayscale’s report concerning the synergy of AI and crypto assets and blockchain networks? Share your thoughts and opinions about this subject in the comments section below.