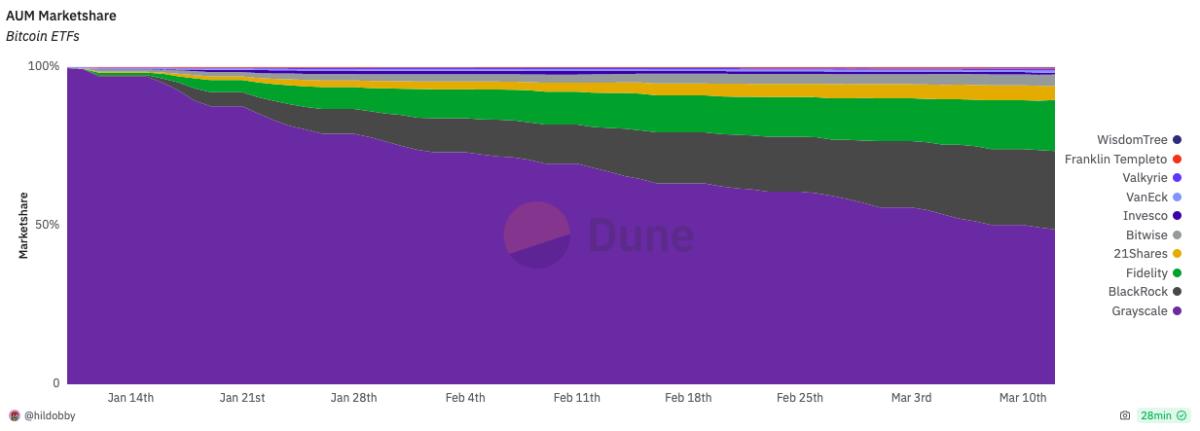

Grayscale’s slice of the Bitcoin ETF pie has fallen below 50% for the first time since it was converted alongside the launch of nine new ETFs in January.

Crypto asset manager Grayscale’s spot Bitcoin (BTC) exchange-traded fund (ETF) has fallen below 50% market share for the first time since spot Bitcoin ETFs began trading in the United States on Jan. 11.

As of March 12, the total assets under management (AUM) in the Grayscale Bitcoin Trust (GBTC) slumped to $28.5 billion — with Grayscale now accounting for 48.9% of the total $56.7 billion held between ten U.S. Bitcoin ETFs, according to Dune Analytics data.

On the first trading day of the ten U.S. spot Bitcoin ETFs, Grayscale’s fund accounted for around 99.5% of their total AUM.