Unlike spot Bitcoin ETFs proposed by other asset managers, Hashdex applied to convert an existing crypto futures ETF to hold spot Bitcoin.

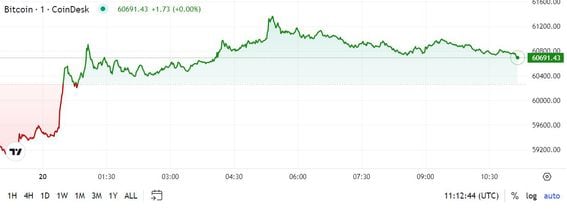

Multiple asset managers filed S-1 form amendments on Jan. 8 as part of the process to receive approval for listing shares of a spot Bitcoin (BTC) exchange-traded fund on United States-based exchanges. Notably, of the many firms that applied, crypto asset management company Hashdex didn’t issue an amended form in the early morning filings.

On Jan. 8, asset management firms including Valkyrie, WisdomTree, BlackRock, VanEck, Invesco and Galaxy, Grayscale and ARK Invest and 21Shares filed their amended S-1 forms with the U.S. Securities and Exchange Commission (SEC), a key move toward potential approval of a spot BTC ETF. While Hashdex filed a 19b-4 amendment form alongside the aforementioned firms on Jan. 5, it was not included in the Jan. 8 filing round, leading to speculation about the status of its spot Bitcoin investment vehicle.

According to a Jan. 8 X (formerly Twitter) post from Bloomberg ETF analyst Jeff Seyffart, Hashdex’s Bitcoin ETF application differed from those of other firms in that it was applying to convert an existing crypto futures ETF. Hashdex submitted its application to the SEC in August, proposing a Bitcoin futures investment vehicle that could also hold spot Bitcoin.