Financial institutions are likely in the process of positioning themselves for the launch of spot Ethereum (ETH) exchange-traded fund (ETF), according to a VanEck analyst.

Matthew Sigel, head of digital assets research at VanEck, says that hedge funds are front-running the approval of ETH ETFs in the US.

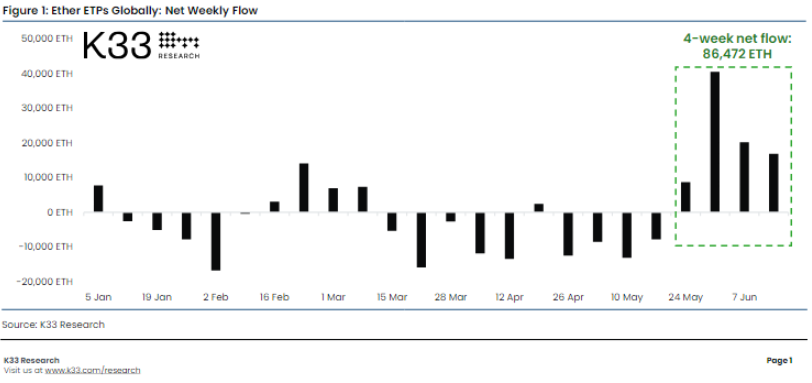

Sigel cites data from K33 Research showing a large spike in inflows to Ether exchange-traded products (ETPs) outside of the United States markets.

“Hedge funds are front-running the ETH ETF approvals, ETH on exchanges is near an all-time low, fundamentals are improving.

I could be eating BBQ HODL hat by July 4th.

And you’re bearish?”

Sigel also shares a chart from blockchain analytics firm CryptoQuant showing a downtrend of ETH supply on exchanges, suggesting an accumulation of Ethereum from large players.

In a recent interview with the Bankless podcast, Sigel says that VanEck is viewing Ethereum as an “open source App Store,” and according to the analyst, it’s not completely unlikely that at some point an ETH ETF could become more successful than the Bitcoin ETFs.

“Now that the SEC has at least theoretically approved spot Ethereum ETFs to trade it’s obviously important to explain the investment case for this asset. Overall, there’s a bigger market for income-producing assets than there are for inert assets like Bitcoin (BTC). So it’s not impossible that in a decade, the market for an Ethereum ETF could be bigger than Bitcoin, but in the meantime, we have to educate traditional financial market participants as to why this asset matters.

There’s a lot of analogies that have been attempted and the one that we’ve honed in on is the ‘open source App Store.’

We think that Ethereum is a productive asset that lets anyone open a storefront on this network, and they can do so at a lower take rate than Big Tech currently charges. So it’s an open-source App Store with payments functionality bundled in essentially for free, and we wanted to explain the mechanics of how that works and put some numbers around the profit and loss (OPNL) statement of Ethereum.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Hedge Funds Front-Running Ethereum ETF Approvals, According to VanEck Analyst appeared first on The Daily Hodl.