The former CEO of Binance.US, Catherine Coley, testified in the US Securities and Exchange Commission (SEC) case against crypto exchange Binance, which provides information about the exchange’s activities. Investors in crypto are steadfast despite the regulatory moves as bitcoin recovers. According to the entity’s US arm over 100 over-the-counter trading pairs will also be discontinued. Concerns about the industry’s viability and the need for more open regulations in the US are raised by the regulatory onslaught.

Binance.US regulatory standoff raises concerns for the crypto industry

Catherine Coley, the former CEO of Binance.US, who goes by the alias “BAM CEO A” in the SEC lawsuit against Binance, has maintained a low profile following her departure. She was previously involved in providing testimony to the SEC in 2022 during their investigation into insider trading at the company.

That testimony has been presented once more as an exhibit in the SEC’s most recent legal action against the crypto exchange. Exhibit 86, in this case, contains passages from Coley’s 2022 evidence, which had page numbers varying from 135 to 336, indicating that the hearing was protracted. These parts mostly cover the dissolution of Binance and Binance.US, which was the subject of significant allegations in the SEC case.

Catherine Coley held the position of CEO at Binance.US from its establishment in 2019 until her departure in 2021. According to the SEC lawsuit, Coley was hired by Binance CEO Changpeng Zhao, also known as “CZ.” However, she quickly became dissatisfied with Binance’s lack of independence in the US, as mentioned in her testimony cited in the lawsuit from 2022.

I wanted full independence of everything, but that wouldn’t necessarily be possible or be possible at that time, given our reliance on some of those components [in four service-level agreements with Binance.com].

Catherine Coley

The SEC lawsuit highlights Catherine Coley’s dissatisfaction with the lack of independence at Binance.US from the company’s launch in 2019 until her departure in 2021. Her testimony from 2022, in which she expressed her displeasure, is cited in the complaint.

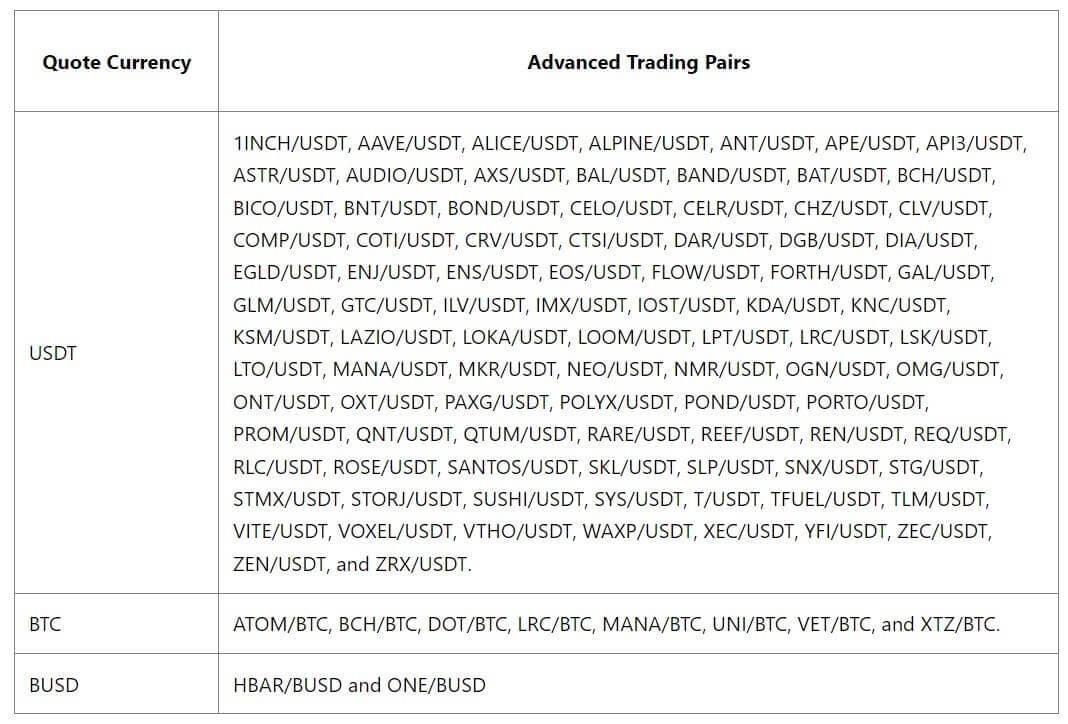

In a statement on June 7, the troubled crypto exchange, the US arm, said that it would stop offering over 100 over-the-counter trading pairs and delete advanced trading pairings for those assets.

On June 8, by 9 a.m. PDT / 12 p.m. EDT, the US will discontinue USDT, BTC, and BUSD advanced trading pairings for digital currencies like Bitcoin Cash, Aave, ApeCoin, Uniswap, Zcash, and others.

The exchange announced that conversion to USD would still be possible. However, the $10,000 maximum trade value has been revised for buy, sell, and convert options. In addition, Binance.US stopped operating its over-the-counter (OTC) trading platform without announcing a return date.

According to the lawsuit the SEC filed a lawsuit against Binance on June 5 for allegedly selling unregistered securities. The U.S. regulator made 13 claims against the exchange, including improper offers and sales of the BNB and BUSD coins, the Simple Earn and BNB Vault products, and its staking program.

In addition, the SEC claims that Binance did not properly register its Binance.com platform as an exchange or a broker-dealer clearing agency. The commission sued Coinbase the following day on similar grounds, asserting that well-known cryptocurrencies sold by the exchange, including SOL, MATIC, and The Sandbox (SAND), qualify as securities. This action came only one day after the commission filed the Binance lawsuit.

Uncertainty surrounding Binance.US’ delisting decision

The SEC had referred to some of the affected trade pairs as crypto security tokens in its lawsuit against the company on June 5. AXS/USDT, ATOM/USDT, COTI/USDT, MANA/BTC, and MANA/USDT are some of these trading pairings.

It was unclear whether Binance US’s choice to delist certain trading pairs was influenced by the SEC’s designation. As of the time of publication, Binance US had not reacted to CryptoSlate’s request for comment.

The evidence SEC has on Binance

According to the complaint, a number of crucial federal securities laws’ registration-related clauses are also allegedly violated:

Zhao was identified as the control person for the operation of unregistered national securities exchanges, broker-dealers, and clearing agencies by Binance and BAM Trading. These activities included the unregistered offer and sale of Binance’s own crypto assets, such as the so-called exchange token BNB, the so-called stablecoin Binance USD (BUSD), certain crypto-lending products, and a staking-as-a-service program.

Exchange, Broker, and Clearing Agency Unregistered

The SEC’s complaint, which was filed in the U.S. District Court for the District of Columbia, alleges that starting at least in July 2017, Zhao-controlled Binance.com and Binance.US operated as exchanges, brokers, dealers, and clearing agencies, generating at least $11.6 billion in revenue from sources including transaction fees from customers in the United States.

Crypto assets unregistered offer and sale

The SEC levied charges against Binance for making unauthorized offers and sales of BNB, BUSD, and cryptocurrency loan products called “Simple Earn” and “BNB Vault.” The SEC also accused BAM Trading of selling Binance without first registering the offer.Program for US staking as a service.

Access to Binance.com by U.S. investors remains unrestricted

According to the SEC’s complaint, Zhao and the exchange established BAM Management and BAM Trading in September 2019 as part of a complex scheme to circumvent American federal securities laws by claiming that BAM Trading independently ran the Binance.US platform and that Americans couldn’t use the Binance.com platform.