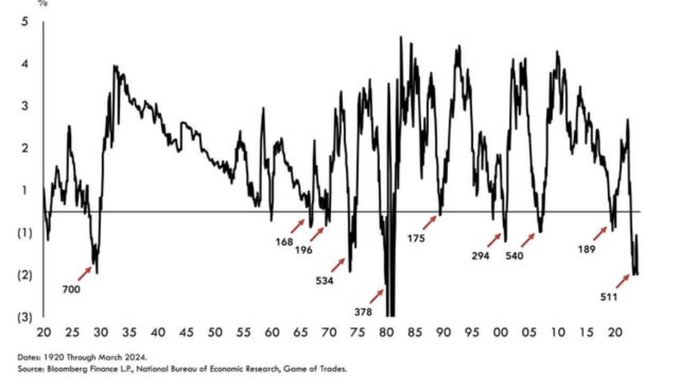

Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […]

Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […]

Historic Yield Curve Inversion Reaches 656 Days, Echoing Pre-Stock Market Crash Patterns

Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […]

Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […]