In a groundbreaking joint report by the Hong Kong Trade Development Council (HKTDC) and PwC, Hong Kong’s formidable strides in AI adoption within the financial sector have been lauded, positioning the city on par with other global financial powerhouses.

The report delves into the nuanced landscape of AI integration in finance, examining its applications, potential risks, and the regulatory environment shaping its trajectory. Anchored by insights from 86 finance executives, academia, regulators, and consumers, the report offers a comprehensive outlook on Hong Kong’s AI journey in the realm of finance.

Current state of AI adoption

In the bustling financial landscape of Hong Kong, AI adoption has surged, mirroring the pace set by renowned financial hubs such as New York, London, and Dubai. Financial institutions in the region have eagerly embraced AI technologies, with 80% implementing chatbots for streamlined customer service and enhancing operational efficiency. Also, AI models are being tailored for fraud detection and biometric authentication, fortifying defenses against money laundering and cyber threats.

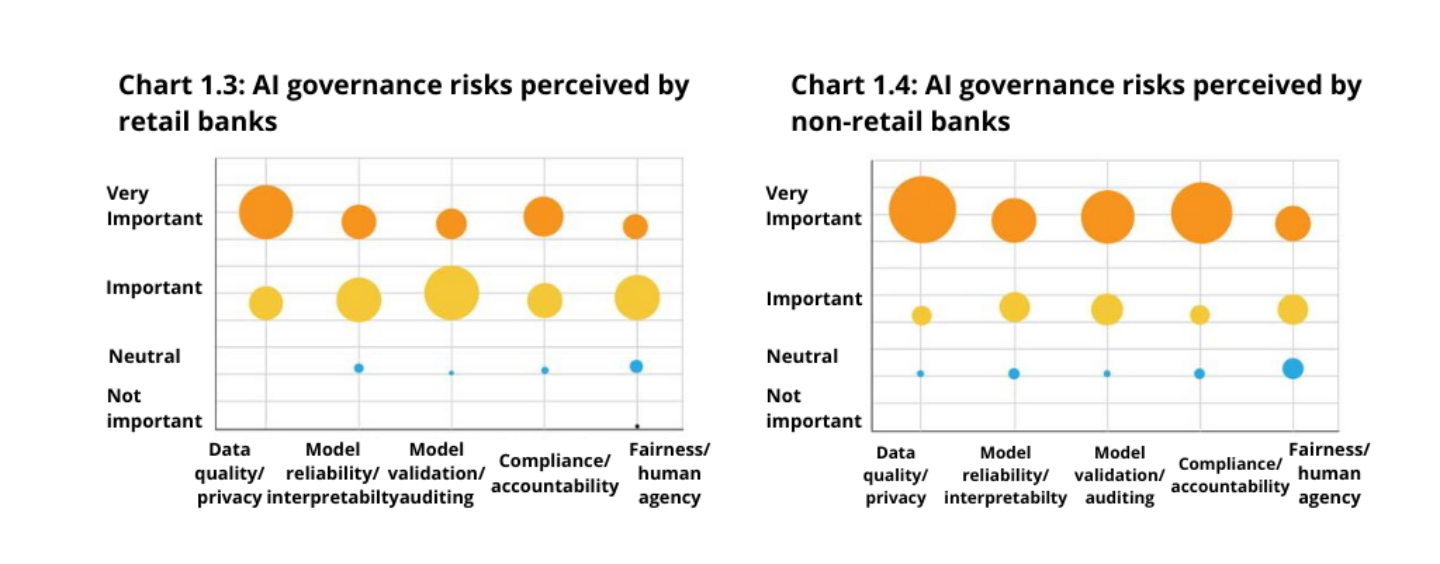

A deeper dive into the survey findings reveals burgeoning AI trends across various facets of Hong Kong’s financial sector, including algorithmic training, claims processing, and risk assessments. However, amidst the optimism surrounding AI integration, concerns loom large. Foremost among these apprehensions is the challenge of data availability and quality, flagged by nearly 70% of respondents as a potential stumbling block for the ecosystem’s advancement.

Cybersecurity and data privacy stand out as pivotal areas of concern, with apprehensions surrounding the potential exploitation of vulnerabilities by malicious actors to compromise sensitive financial information. Criticism has been leveled against the perceived insufficiency of existing AI regulations in Hong Kong, with a notable 35% of respondents expressing the view that these regulations are excessively restrictive for developers. Also, there is a pressing demand for the establishment of more robust regulatory frameworks capable of adeptly navigating the ever-evolving AI terrain.

Guiding Hong Kong’s AI future – Recommendations for success

In order to uphold its competitive advantage and cultivate an environment conducive to innovation in the field of artificial intelligence (AI), the report strongly recommends adopting a nuanced strategy that effectively balances risk with the imperative of fostering innovation. It underscores the significance of implementing regulatory sandboxes, in tandem with a sturdy data governance framework, as indispensable tools to drive AI advancement while simultaneously mitigating potential risks.

Also, the report underscores the importance of fostering collaboration, advocating for joint efforts both within the region and across various sectors. This underscores the necessity of pooling resources and expertise to propel Hong Kong’s journey in AI forward.

As Hong Kong traverses the multifaceted landscape of integrating artificial intelligence (AI) within its financial sector, a fundamental inquiry emerges: How can stakeholders effectively harmonize the dual imperatives of fostering innovation while prudently mitigating risks, thereby safeguarding sustainable growth and resilience amidst the constantly evolving technological paradigms? Within the burgeoning realm of AI’s potential, the trajectory ahead is intricately intertwined with collaborative ventures, conscientious governance frameworks, and an unwavering dedication to leveraging technology for the collective advancement and societal betterment.