Hong Kong has allowed retail investors to trade crypto under its new rulebook for the sector, accelerating efforts to develop a digital-asset center even as the industry and regulators clash in other Asian nations.

Tuesday, the Securities and Futures Commission (SFC) of the city presented the findings of a consultation on retail participation. Beginning on June 1, when a new licensing regime for virtual-asset platforms goes into effect, the agency will allow individual investors to purchase and sell larger tokens like bitcoin and ether.

Hong Kong positions itself as a global crypto hub

Hong Kong intends to reposition itself as a crucial crypto hub in the region by reopening retail trading. Given its relations with the People’s Republic of China, a historically anti-crypto nation, experts suggest that the new crypto rules could serve as a playbook for the PRC to adopt.

The regulatory requirements for trading platforms for virtual assets will encompass “suitable” onboarding procedures, disclosures, and other elements. Tokens that will be traded on these platforms will be required to meet a “minimum criteria” that will make retail investors less susceptible to market manipulation.

On June 1, platforms can begin applying for a license, while those “who do not plan to do so should proceed to an orderly closure of their business in Hong Kong,” according to a statement released by the SFC on Tuesday.

According to reports, HasKey Pro and OSL, two licensed crypto exchanges in Hong Kong, have already formed partnerships with local securities brokers to facilitate the trading of crypto assets by institutional investors.

After June 1, when an updated anti-money laundering law goes into effect, it will be illegal for unlicensed exchanges in Hong Kong to sell crypto products to retail or institutional investors.

From the beginning of next month, it will be illegal to serve advertisements for unlicensed crypto exchanges, which include prominent opinion leaders who promote such platforms, according to SFC officials. Hong Kong’s SFC also added that using fraudulent or “reckless” means to induce another person to acquire virtual assets would also constitute a violation of the law.

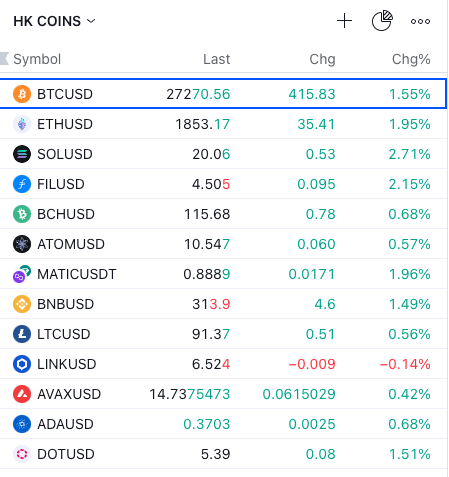

Here are the tokens eligible for trade in Honk Kong

Trading crypto brought a cold freeze to investors after the SBF-FTX saga last year. Hong Kong Financial regulatory bodies have taken major steps ahead of the retail market open day. City officials have pledged in recent months to put in place sufficient safeguards to prevent the meltdowns the industry experienced last year.

Our regulations will be tight […] We will let the industry develop and innovate. We will let them create the ecosystem here, and that actually brings a lot of excitement […] But that doesn’t mean light-touch regulation. If any participant [thinks] that the regulation is too tight, they’re welcome to go elsewhere.

Eddie Yue Wai-man, Chief Executive of the Hong Kong Monetary Authority (HKMA)

However, there are still obstacles to the expansion of the industry. Several crypto companies, for example, have reported difficulties opening a bank account in Hong Kong. Hong Kong’s de facto central bank, the Hong Kong Monetary Authority, conducted a meeting at the end of April urging banks to permit crypto-related businesses to open operational accounts for purposes such as paying salaries.

As these bodies figure out the best way for companies to be operation, here are some eligible coins retailers can look towards trading. According to reports, Bitcoin and Ethereum will be available for trade come June 1st, 2023. It’s clear that the market is trading coins that come as USD pairs.

According to CoinMarketcap, BTC’s price stands at $26,749.34 with a live market cap of $518,462,481,700. Ethereum’s price stands at $1,817.52 with a live market cap of $218,580,349,132. Other coins include:

According to CoinMarketcap, SOLUSD’s price sits at $19.51 with a live market cap of $7,726,047,488. The live Filecoin (FILUSD) price today is $4.46, with a live market cap of $1,900,318,474. The live Bitcoin Cash (BCHUSD) price today is $112.98, with a live market cap of $2,191,852,814.

Moving on, the live Cosmos (ATOMUSD) price today is $10.36, with a live market cap of $2,966,205,799. There is a USD exception; MATICUSDT could be eligible for trade in Hong Kong markets. According to Binance, the live price of BNB is $ 308.06 per (BNB / USD), with a current market cap of $ 48.01B USD.

The live Litecoin (LTCUSD) price today is $86.40, with a live market cap of $6,306,471,347. The live Chainlink (LINKUSD) price today is $6.35, with a live market cap of $3,286,052,424. The live Avalanche (AVAXUSD) price today is $14.36 USD, with a 24-hour trading volume of $110,089,700 USD.

According to Binance, the live price of Cardano is $ 0.3640989 per (ADA / USD) today, with a current market cap of $ 12.70B USD. The live Polkadot (DOTUSD) price today is $5.30, with a live market cap of $6,312,658,758.