House Financial Services Committee leadership have addressed a letter to Jerome Powell, the Chair of the U.S. Federal Reserve, expressing strong criticism of the Fed’s recent moves on advancing legislation geared towards regulating stablecoins.

Representative Patrick McHenry, who holds the position of Chairman of the House Financial Services Committee, has collaborated with French Hill, the Chairman of the Digital Assets and Fintech Subcommittee, and Bill Huizenga, the Chairman of the Oversight and Investigations Subcommittee.

Fed’s actions against stablecoin legislation progress

In a letter that was made public today, there were issues highlighted with the actions undertaken by the Federal Reserve Board through the issuance of two letters, specifically titled ‘Supervisory Nonobjection Process for State Member Banks Seeking to Engage in Certain Activities Involving Dollar Tokens’ (SR 23-8) and ‘Creation of Novel Activities Supervision Program’ (SR 23-7). The Fed released the letters on August 8, 2023, and have elicited concerns among legislators who fear that these actions may erode the progress achieved by Congress in establishing a robust regulatory framework for stablecoins used in payments.

The bipartisan support for the regulatory framework is evident, notably seen in the favorable reporting that the Clarity for Payment Stablecoins Act has received from the House Committee on Financial Services. This legislative initiative establishes a transparent and permissive structure for regulated institutions, including banks within the Federal Reserve’s jurisdiction, to issue payment stablecoins. The framework upholds rigorous standards encompassing transparency, reserves, liquidity, and risk management.

The joint statement alleges that the Fed’s actions indirectly dissuade banks from actively participating in the digital asset landscape, owing to the release of these supervisory and regulatory letters. The authors contend that these letters inhibit banks’ involvement with payment stablecoins and other activities associated with digital assets. That, in turn, is perceived as undermining the intricately crafted legislative framework established for these purposes.

Moreover, as detailed in the Novel Activities Supervision Program (SR 23-7), the Federal Reserve’s approach is being criticized for introducing unnecessary and intricate regulatory hurdles for banking institutions seeking involvement with crypto assets. Critics argue this approach might result in a de facto prohibition on banks’ participation in the digital asset sector. That, in turn, could stifle innovation and impede economic growth in this emerging domain.

The letter accuses the Fed of bypassing administrative procedures, raising concerns about transparency and accountability. This bypass of notice and comment processes may impact the effectiveness and legitimacy of regulatory measures, potentially impacting the notice and comment process.

Fed’s clarity on banks transacting in stablecoins

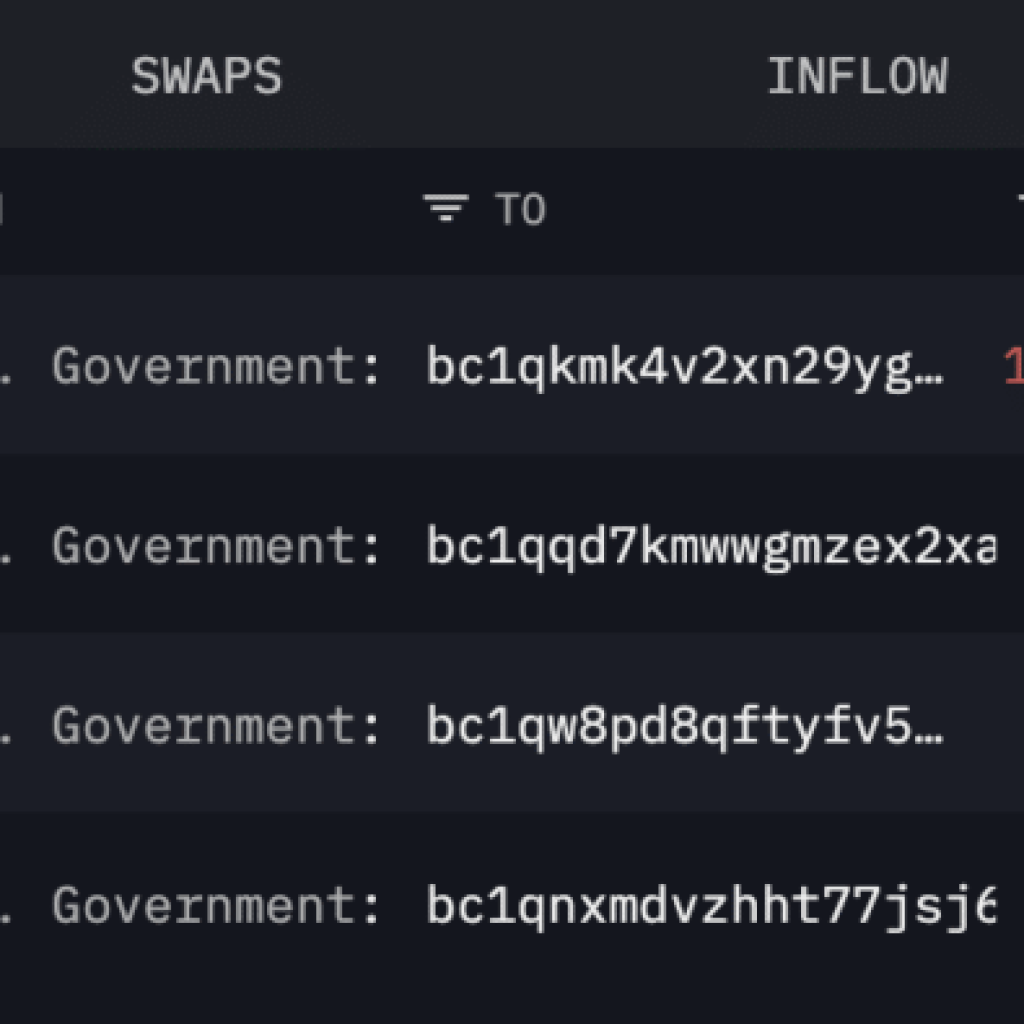

As part of its latest supervisory efforts, the U.S. Federal Reserve outlined new regulations for state banks within its system regarding the issuance, possession, or transactions involving dollar-backed tokens, including stablecoins, used in payment facilitation. The central bank’s directive requires these state banks to secure written supervisory Nonobjection from the Federal Reserve before engaging in such activities.

Furthermore, the Federal Reserve is establishing a novel supervisory program to oversee crypto-related efforts, blockchain technology, and nonbank partnerships driven by technology. This initiative will complement the existing supervisory processes and enhance oversight of technology-driven actions conducted by banks under its jurisdiction.

This development follows closely after PayPal introduced its stablecoin, a cryptocurrency often tied to traditional assets like the U.S. dollar.

Historically, efforts by prominent mainstream entities to introduce stablecoins have encountered substantial opposition from financial regulators and policymakers. Notably, Meta’s (formerly Facebook) efforts to launch the Libra stablecoin in 2019 faced regulatory pushback due to concerns about potential disruptions to global financial stability.