As early as November 2022, the Internal Revenue Service (IRS) has encouraged taxpayers to take simple steps before the end of the year to make filing their 2022 federal tax return easier. With a little advance preparation, a preview of tax changes, and convenient online tools, taxpayers can approach the upcoming tax season with confidence.

Filers may visit the Get Ready webpage to find guidance on what’s new and what to consider when filing a 2022 tax return. They can also find helpful information on organizing tax records and a list of online tools and resources. But what about crypto taxes? The lack of clarity about the nature of crypto can make crypto tax complex, especially if the crypto transaction records are a huge mess.

This guide will walk you through IRS guidance on crypto assets, how to fill out crypto tax forms, and what tools can help in the calculation. A review of the distinctions of crypto tax in the US and other countries makes you appreciate the efforts being made by regulatory bodies. We will also provide you with links to information to ensure that you comply with local tax laws. Let’s get started!

Also Read:

- Cost Basis in Crypto Tax Payment (Hard Calculations and Simple Ways to Save)

- IRS discusses crypto tax rates for US merchants

- CryptoTrader.Tax: Easy-to-use cryptocurrency tax calculator

- United States Treasury exempts crypto miners from IRS reporting laws

- What is crypto tax-loss harvesting?

- American student billed $400k tax over crypto trading

- Australian government released a new update on crypto tax

Do I need to report crypto assets when filing taxes?

The long and short answer is YES – because it’s the law, and it is also in your best interest to be in the good books of tax authorities. Crypto is subject to capital gains tax upon disposal and ordinary income tax when earned. Remember, when major exchanges send you a Form 1099, they file an identical copy with the IRS.

The American infrastructure bill requires all cryptocurrency exchanges to provide customers and the IRS with 1099-B forms. However, this may cause additional tax reporting problems due to cryptocurrency’s unique properties.

For instance, the United States Internal Revenue Service (IRS) treats cryptocurrency as property for tax purposes, and transactions involving cryptocurrency are subject to capital gains tax. This means that if you sell or exchange cryptocurrency for a profit, you may need to pay taxes on those gains. Similarly, if you sell or exchange cryptocurrency for a loss, you may be able to claim a capital loss on your taxes, which could offset other capital gains you have realized during the year.

So, what’s the point here? You must report your cryptocurrency transactions on your taxes if you have realized gains or losses from buying, selling, or exchanging digital assets. This includes transactions made through exchanges as well as peer-to-peer transactions.

While it might be easy to pass the buck of reporting to exchanges, these platforms usually fail to match the very high standards utilized by traditional investment platforms. However, compliance has improved with each passing year, with authorities demanding more reporting and transparency from exchanges. The IRS, in this regard, is seeking an improved budget to widen its tax net further and strengthen the enforcement of crypto taxation.

At this point, you might be thinking, “Do I need to report crypto on taxes if it isn’t investment-based?” If this has crossed your mind already, you are on the right track because all sorts of crypto use cases are subject to digital assets taxation, at least in the eye of the IRS. Assuming you bought some Bitcoin worth $5,000 and made gains of about $700 from holding the same, the IRS categorizes this as a capital gain, and such must be reported and taxed accordingly.

What about salaries and wages paid in crypto? Those must be reported too. Activities as simple as buying coins and using them to pay for goods and services must also be filed in your tax returns. In addition, if you earn money via crypto mining, it is subject to income tax during mining, but when disposed of at a later time, it is taxed as capital gains.

The bottom line: You must let the numbers all out. Keeping good records of your cryptocurrency transactions is integral to reporting them accurately on your tax return. This includes keeping track of the date of each transaction, the type and amount of cryptocurrency involved, and the value of the cryptocurrency in U.S. dollars or as required at the time of the transaction. You may also need to provide additional information, such as the purpose of the transaction and the identity of the other party involved.

How to report crypto taxes in 5 simple steps

If you have ever filed tax returns on conventional capital assets like bonds or stocks, then the procedures for crypto-associated taxes should be familiar. Typically, reporting crypto on taxes can be done in five easy steps (for pros); perhaps the opposite for newbies – but nothing to worry about; we have simplified the entire process as best as possible.

Let’s dive into the details of each step.

Step 1: Calculate the capital loss and gain

To calculate capital gains and losses for cryptocurrencies, you need to track how the value of your assets has changed over time, i.e., the difference in value at the time of sale and its cost basis. The value at sale is the amount you received from disposing of your assets, either by sale or swap, while the cost basis is the amount you paid to purchase the tokens, including brokerage, transaction, or gas fees.

Therefore, Capital Loss/Gain = Sale Price at Disposal – Cost Basis (cost price)

(If the result is positive, you have a capital gain. If the result is negative, you have a capital loss.)

For example, let’s say you bought one bitcoin for $10,000 (charges inclusive) and sold it for $15,000. To calculate your capital gain, you would subtract the cost of the cryptocurrency ($10,000) from the sale price ($15,000), resulting in a capital gain of $5,000. Similarly, suppose the cost basis exceeds the value at the sale. In that case, the resulting difference is considered a capital loss that must be recorded and reported, as it may offset capital gains from other transactions or reduce your taxable income up to certain limits.

Capital gain and loss calculations are rather simple with few logs of trades and known cost basis. The process becomes quite puzzling as the transaction volumes (buy/sell orders) become larger and/or cost basis are challenging to churn out. This scenario, in particular, can be handled automatically using some financial tools, as you will find out soon.

It’s important to note that capital gains and losses for cryptocurrencies are taxed as either short-term or long-term, depending on how long you held the cryptocurrency before selling it. Generally, a cryptocurrency held for more than one year is considered a long-term asset, while a cryptocurrency held for less than one year is considered a short-term asset. Long-term capital gains and losses are taxed differently than short-term capital gains and losses.

Have you calculated your losses or gains yet? It’s time to record the numbers!

Step 2: Fill out the crypto tax forms – IRS Form 8949

First, what is a crypto tax form? A crypto tax form is a tax form that is used to report and pay taxes on capital gains or losses from cryptocurrency transactions. In the United States, for instance, the Internal Revenue Service (IRS) requires taxpayers to report capital gains and losses from cryptocurrency transactions on their tax returns using Form 8949: Sales and Other Dispositions of Capital Assets.

On Form 8949, you will need to report the following:

- Date of the transaction

- The type and amount of cryptocurrency involved

- The sale price and the cost basis of the cryptocurrency.

- You will also need to indicate whether the transaction resulted in a capital gain or loss and whether the gain or loss is short-term or long-term (different forms exist for either short or long-term assets).

- If you have multiple cryptocurrency transactions, you may have to complete more than one Form 8949.

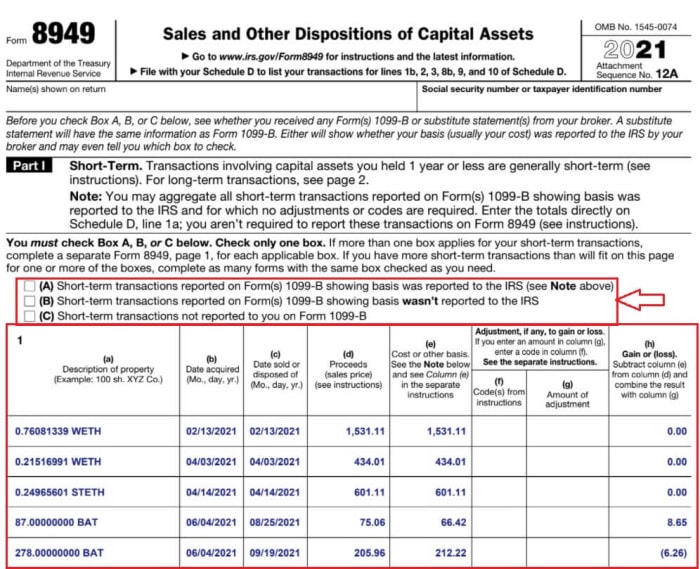

The sample Form 8949 below describes the filling out of short-term (less than one year) trades for WETH, BAT, and STETH. Form 8949 for long-term (more than one year) trades can also be filled out in the same manner.

Before filling out Form 8949, you want to take a careful look at the section after Part 1 and check the boxes appropriately. If your preferred exchange provides you with a Form 1099-B, which is not often the case, you’ll check boxes A or B. If otherwise, check box C.

After filling out the trades, you must also calculate the total net loss or gain and include them in the bottom section of the form.

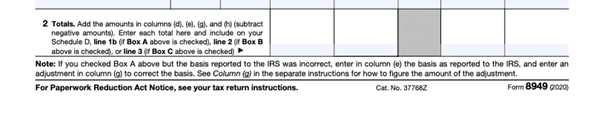

Step 3: Transfer totals from Form 8949 to Schedule D

Once you have completed Form 8949 for all your cryptocurrency transactions, you will need to transfer the aggregate gain or loss on the form to Schedule D (Form 1040 or Form 1040-SR): Capital Gains and Losses. Form Schedule D is a tax form used to report and calculate the net capital gain or loss on assets within a certain taxable period, which is the difference between your total capital gains and total capital losses as transferred from Form 8949.

Depending on your scenario:

- On Schedule D, you will need to enter the total short-term capital gains and losses from Form 8949 in the appropriate boxes on the “Short-term capital gains and losses” section of the form.

- Next, you will need to enter the total long-term capital gains and losses from Form 8949 in the appropriate boxes on the “Long-term capital gains and losses” section of the form.

- Finally, take the difference between column (e) and column (d), and combine the outcome with column (g) to obtain the net gain or loss.

Apart from the short and long term, Schedule D (Form 1040) lets you fill in gains and losses from estates, partnerships, and trusts from Schedule(s) K-1.

Step 4: Report crypto income – airdrops, wages, staking income, mining, etc

In most cases, profits earned from cryptocurrency transactions are often classified as capital gains; however, there are instances where they qualify as ordinary income – such as proceeds from crypto lending, mining, staking, airdrops, referral bonuses, or wages. The method of reporting crypto income will depend on the type of income.

- For instance, coins earned through wages, airdrops, or gambling are usually reported on Schedule 1: (Additional Income and Adjustments to Income).

- Cryptocurrencies earned from lending interest rewards or staking should be reported on Schedule B: Interest and Ordinary Dividends.

- For independent contractors, partnerships, sole proprietors, and other business entities, crypto payments received concerning a job or mining activities are often classified as self-employment income and must be reported using Schedule C: Profit or Loss From Business. Before filing these payments as income tax, it is possible to deduct operating costs like electricity bills and equipment costs, in the case of miners.

Step 5: Complete your crypto tax return

Now that you must have successfully filled out Form 8949, transferred the aggregate calculations to Schedule D, and reported your crypto income using the appropriate document, it’s time to pass on your tax returns to the IRS.

How to report Bitcoin on taxes

Cryptocurrency tax regulations vary from country to country. In general, the tax treatment of cryptocurrency depends on the specific circumstances and how the cryptocurrency is being used. Some countries have explicitly addressed the tax treatment of cryptocurrency, while others have yet to issue formal guidance. Let’s look at the approach in some EU states and Asia and juxtapose them with what’s obtainable in the United States.

How to report crypto taxes in Germany

In the eye of the Bundeszentralamt für Steuern (Federal Central Tax Office or BZSt), the profits from trading cryptocurrencies such as Bitcoin, Binance Coin, Ethereum, and the like are comparable to proceeds from selling artworks and other valuable items. This approach has its positives in the sense that profits earned from disposing of crypto assets can be exempted from taxation under certain circumstances.

When it comes to reporting crypto on taxes in Germany, there are some guidelines to consider:

- The profit or income realized from the disposal of cryptocurrencies.

- The custody time of the assets.

- The taxation method used – FIFO (First-in, First-out) or LIFO (Last-in, First-out). The former assumes that the first cryptos purchased are the first ones sold, while the latter assumes that the last cryptos purchased are the first ones sold. Either method yields considerably different outcomes, and the preferred approach will differ on a case-by-case basis. It is important to note that German law does not prescribe any method.

- Also, report your crypto losses, as the German Tax Act allows you to offset taxes on current or future gains with past losses.

The following conditions apply:

If an individual has had Bitcoin and co. in custody for more than 12 months, the sale or use of such is tax-free – the value of the profit, regardless of the volume, realized from the sale does not have to be declared in a tax return. However, an exception exists for this condition if crypto is your source of income, such as mining, staking, or lending. In this case, the tax-free holding period is bumped to 10 years.

Typically, if you have disposed of your BTC, ETH, or BNB coins within 12 months of acquiring them, the profits realized are tax-free below 600 Euros. If the dividend exceeds the limit of 600 Euros, it will be subjected to full taxation – even if it is 601 Euros, taxes must be paid on the entire profit. These conditions do not include business entities, as they do not have exemptions for cryptocurrencies held for one year+.

How to report Bitcoin on taxes in India

Before 2022, the government of India and the Income Tax Department (ITD) had no official position on the classification of crypto-related assets, and neither did they hold a stance on the taxation of Bitcoin and other such assets. Since April 1, 2022, the Indian authorities have acknowledged the existence and use of cryptos in India by categorizing them as Virtual Digital Assets (VDA) and establishing a new tax finance act.

- Cryptocurrency activities such as spending, trading, or selling will attract a 30% tax on profits.

- The FIFO and average cost basis accounting methods are approved for use.

- Buying cryptocurrencies with INR is tax-free, except if the purchase is through a peer-to-peer platform or international exchanges that will attract a 1% Tax Deducted at Source (TDS).

- HODLing crypto is tax-free.

- 30% tax payable on crypto-to-crypto and crypto-to-stablecoin buy trades.

- Disposing cryptocurrencies for fiat (INR) attracts a 30% tax rate and an additional 1% TDS deductible by Indian-based crypto exchanges or the buyer (on P2P platforms).

- Profits realized from selling crypto for crypto are subject to 30% tax and 1% Tax Deducted at Source for the seller.

- Transferring cryptocurrencies between your own wallets is tax-free since there is no transfer of VDA, but transfer charges may be subject to taxes.

- Income taxes are chargeable on new tokens from hard forks. When spent, swapped, or sold, a 30% income tax is payable. For soft forks, you do not receive new assets anyways, so there is no tax.

- For airdrops, income tax is payable, but when spent, swapped, or sold, a 30% tax applies.

- Crypto gifts and donations are tax-free, but income tax is applicable when the gift exceeds RS50,000.

- Coins from mining and staking are taxed as income, and a 30% tax applies when spent, swapped, or sold.

Crypto activities can be reported in India using the ITR-2 form for capital gains or ITR-3 for business income. However, the ITR-2 and ITR-3 forms do not provide dedicated space for reporting crypto income or gains. The Schedule CG and ITR-2 AY 2022-23 Form can be used, at least until the ITD provides a dedicated form for reporting crypto taxes.

How to report crypto taxes in the UK

The United Kingdom does not have a Bitcoin or cryptocurrency tax. Instead, you will have to pay either a Capital Gains Tax or an Income Tax on any profits you make from your cryptocurrency holdings. Your tax liability in crypto will be determined by the nature of the crypto trades you make. Paying Income Tax is a requirement if you have any kind of taxable income (earning in crypto). Taxes on capital gains are levied on anyone who is deemed to have made profits from crypto activities such as spending, selling, or swapping. Taxes are varied at up to 20% depending on specified thresholds.

To report cryptocurrencies in the UK, follow this procedure:

- Calculate your cryptocurrency taxes. But first, you must know your capital losses, gains, expenses, and income.

- Register with the HRMC government gateway online to file your taxes.

- Complete the Self Assessment Tax Return (SA100 form) and file any income.

- Indicate if you made gains or losses as appropriate.

- Submit the form online to the HMRC.

Note that deadlines may be attached to completing these forms, and you should check the HMRC’s website for more information.

How do crypto taxes compare in the US?

The Internal Revenue Service (IRS) has issued guidance on cryptocurrency taxation in the United States. According to the IRS, virtual currency is treated as property for tax purposes, and general tax principles applicable to property transactions apply to transactions using virtual currency.

This means that the sale or exchange of cryptocurrency is subject to capital gains tax, and the tax rate will depend on how long the cryptocurrency was held before it was sold or exchanged. For short-term capital gains, tax rates will be within the range of 0-20%, and for short-term capital gains and ordinary income category, the tax rate will be between 10-37%

In contrast, some countries, such as Germany, have taken a more lenient approach to cryptocurrency taxation. In Germany, cryptocurrency is treated as private money, and transactions involving cryptocurrency are subject to a tax of up to 45% plus a 5.5% Solidarity. However, this tax rate only applies to capital gains that exceed 600 euros per year.

Other countries like Australia have adopted a more comprehensive approach to cryptocurrency taxation. In Australia, cryptocurrency is treated as property, and transactions involving cryptocurrency are subject to capital gains tax. However, the Australian Taxation Office (ATO) has issued guidance on calculating the taxable gain or loss on cryptocurrency transactions, and certain exemptions and concessions are available for certain types of transactions.

It’s important to note that the tax treatment of cryptocurrency may change over time as governments continue to evaluate and update their policies. It’s always a good idea to seek guidance from the relevant tax authority regarding cryptocurrency taxation.

How to file crypto taxes efficiently

There are several steps you can take to file your cryptocurrency taxes quickly and efficiently:

1. Keep organized records

Make sure you have all the necessary information to accurately report your cryptocurrency transactions, including the dates of the transactions, the type and amount of cryptocurrency involved, and the purchase and sale prices. Using a digital or physical ledger to track this information may be helpful.

2. Use a tax preparation software

Various tax preparation software programs can help you accurately calculate and report your cryptocurrency gains and losses. These programs often include step-by-step guidance and can save time by automatically importing information from exchanges and wallets. Some of this software include Koinly, CoinLedger, CoinTracking, Cryptiony, and TurboTax, to mention a few.

Koinly is a cryptocurrency tax solution software that helps users manage and report their capital gains and losses on crypto transactions. It allows users to import their transaction history(API or CSV files) from various exchanges (Binance, Coinbase, and 350+), including support for DeFi platforms and NFT transactions. Koinly’s services are designed to help individuals and businesses properly account for and report on their cryptocurrency transactions, ensuring compliance with tax laws and regulations.

CoinLedger is a company that provides cryptocurrency accounting and tax services. The platform offers a range of services, including tracking and reporting cryptocurrency transactions for tax purposes, preparing tax documents for cryptocurrency transactions, and providing guidance on cryptocurrency tax laws and regulations. CoinLedger supports Coinbase, Kraken, Binance, Uphold, and more. However, NFT and DeFi taxes cannot be calculated using Coinledger.

CoinTracking is a crypto tracking and tax reporting software that analyzes trades and provides real-time profit and loss reports, realized and unrealized gains, and much more. It features 13 tax calculation methods, depending on an individual’s scenario, and the supported import/export files are PDF, CSV, API, JSON, and XML. The software also supports calculating transactions on major exchanges like Binance, Kucoin, and Kraken, but not DeFi and NFT tax calculations.

3. File your tax return early

The sooner you file your tax return, the faster you can resolve any issues or questions that may arise. Filing your tax return early also reduces the risk of facing penalties for filing late.

4. Seek the assistance of a tax professional

If you are unsure about how to report your cryptocurrency transactions or have complex tax issues, you may seek the assistance of a tax professional. A tax professional can help you accurately report your cryptocurrency taxes and may be able to offer guidance on tax planning strategies.

Following these steps can help ensure that your cryptocurrency taxes are filed accurately and efficiently.

Conclusion

Understanding how to report cryptocurrency taxes is essential to being a responsible cryptocurrency investor or user. Cryptocurrency transactions are subject to taxation just like any other form of property. It is important to properly account for and report these transactions to ensure compliance with tax laws and regulations.

Using a platform like CoinLedger can help make reporting cryptocurrency taxes more effortless and efficient. CoinLedger offers a range of services, including tracking and reporting on cryptocurrency transactions, preparing tax documents, and providing guidance on cryptocurrency tax laws and regulations. By registering with CoinLedger, you can take advantage of their expertise and experience in cryptocurrency taxation, giving you the best possible experience in reporting your crypto taxes.

Finally, it is always a good idea to consult with a tax professional or refer to your jurisdiction’s tax laws and regulations for guidance on your specific situation.