Level up your crypto trading game with margin trading steps to turn market ups and downs into your winning moves while navigating involved risks.

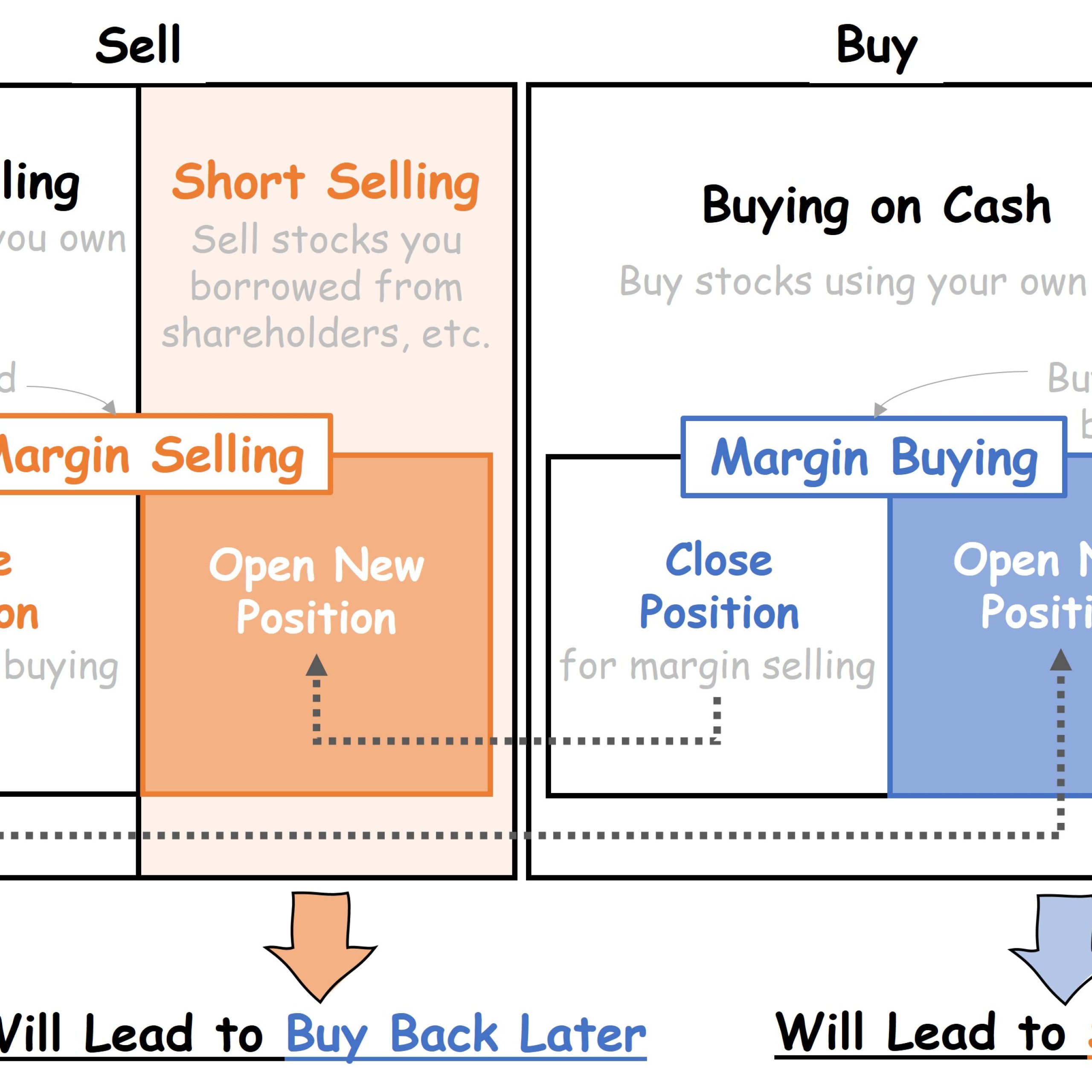

Crypto margin trading allows traders to borrow funds (called leverage) to increase their trading positions. Understanding how crypto margin trading works with long and short positions is essential for maximizing potential profits.

This article explains what crypto margin trading is, how it works with long and short positions and what exchanges support it.

A long position, or going long, is a strategy in which a trader or investor purchases an asset, such as stocks or cryptocurrencies, believing its price will increase. Long positions can benefit investors since they can purchase assets at a lower price and sell them at a higher price, thus profiting from the difference between the two. This strategy is based on a favorable market and an expected asset value increase.