The world is undergoing a digital transformation, and no sector epitomizes this shift quite as dramatically as the financial industry with the rise of cryptocurrencies. Amidst the global interest in digital currencies, former President Donald Trump has articulated a vision to turn the United States into the crypto capital of the world. This stance is a notable shift from his earlier skeptical comments on digital currencies. To understand this transformation and its potential implications, it’s crucial to explore Trump’s evolving perspective on cryptocurrency, the broader political and economic context, and the steps necessary to achieve this ambitious goal.

Trump’s Evolving Stance on Cryptocurrency

Historically, Trump has expressed skepticism about cryptocurrency trading. In a famous tweet from July 2019, he stated, “I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.” This sentiment was echoed by many policymakers who viewed cryptocurrencies cautiously, primarily due to concerns over their volatility, the potential for facilitating illicit activities, and the lack of regulatory control.

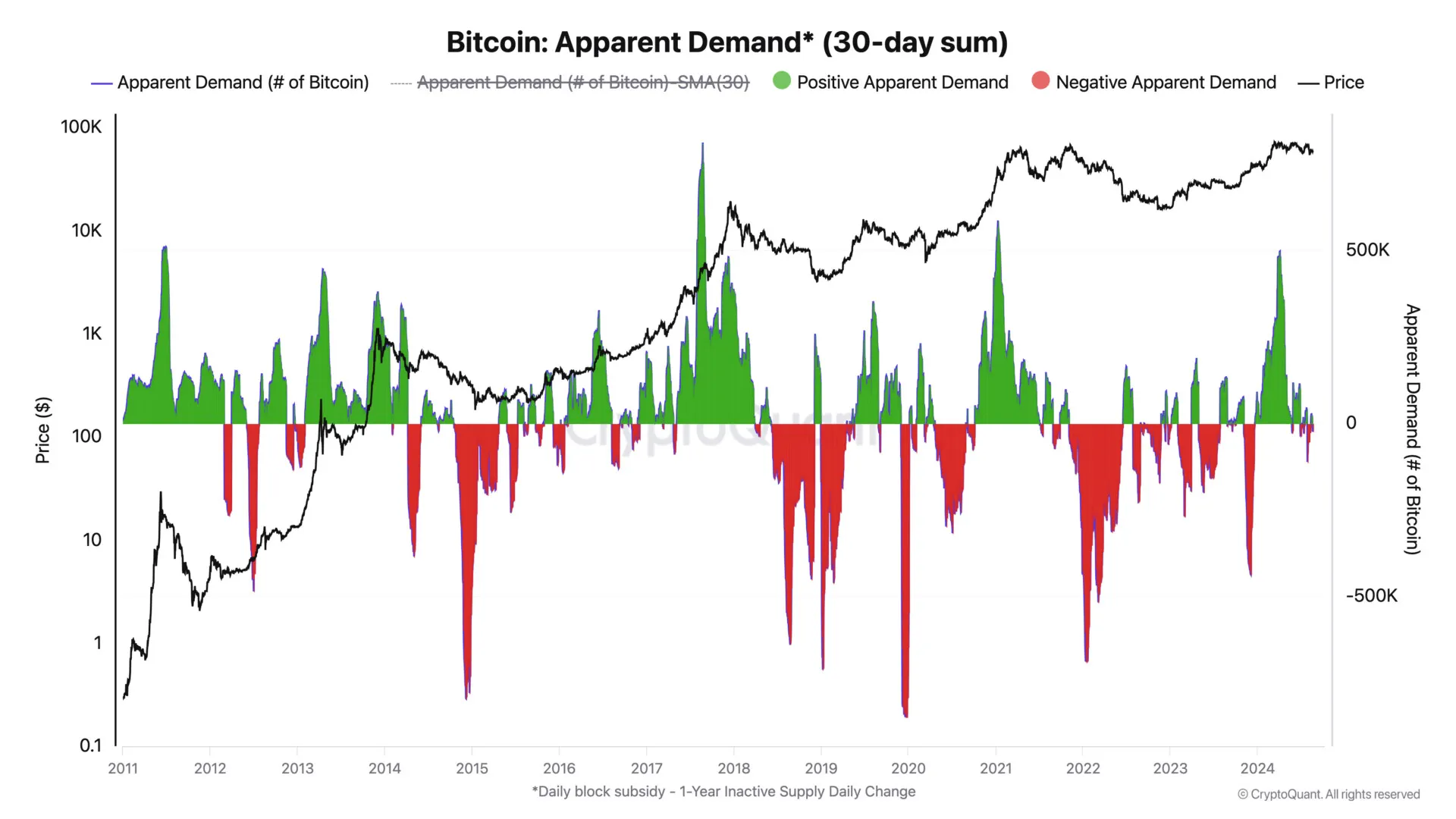

However, like many political figures, Trump’s views on specific issues have evolved. As the cryptocurrency market matured and global interest surged, Trump began to see the potential economic and strategic benefits of embracing digital currencies. His shift in perspective reflects a broader trend among politicians and financial leaders who recognize the transformative power of blockchain technology and the increasing legitimacy of cryptocurrencies in the global financial system.

The Political and Economic Context

The U.S. has long been a global financial leader, with Wall Street representing the epicenter of traditional finance. However, the rapid rise of financial technology (fintech) and digital currencies poses both a challenge and an opportunity for American financial dominance. Countries like China are making significant strides in developing their digital currencies and blockchain capabilities, while other nations, including Switzerland and Singapore, are creating favorable regulatory environments to attract crypto businesses.

Trump’s ambition to make the U.S. the crypto capital of the world can be seen as a strategic move to maintain and enhance the country’s global financial leadership. By fostering innovation in the crypto space, the U.S. could ensure its dominance in a rapidly evolving financial landscape, attract international talent, and create new economic opportunities.

Steps to Achieve Crypto Capital Status

To transform the United States into the crypto capital of the world, a multifaceted approach encompassing regulatory reform, technological innovation, and strategic investments is necessary.

Regulatory Clarity and Innovation

One of the primary challenges facing the cryptocurrency market in the U.S. has been the lack of precise regulation. Cryptocurrencies exist in a gray area, causing uncertainty for investors and businesses. Trump’s plan would need to establish a comprehensive regulatory framework that provides clarity, encourages innovation, and protects investors.

Defining what constitutes a cryptocurrency, a security token, and a utility token.

Streamlining regulations between agencies such as the SEC (Securities and Exchange Commission), CFTC (Commodity Futures Trading Commission), and IRS (Internal Revenue Service) to eliminate contradictory guidelines.

Involving industry stakeholders in the regulatory process ensures that the rules are pragmatic and conducive to innovation.

Tax Incentives and Support for Crypto Startups

Favorable tax policies could be introduced to attract crypto businesses and foster innovation. Tax Offering reduced capital gains taxes on cryptocurrency investments to attract individual and institutional investors.

Providing grants and funding opportunities to blockchain startups to stimulate development and research in the field. Establishing crypto-specific incubators and accelerators to nurture early-stage startups.

Public-Private Partnerships and Collaboration

A synergistic relationship between the public sector and private enterprises is crucial for fostering a thriving crypto ecosystem.

Partnering with leading tech companies and blockchain firms on projects with broad public benefits, such as developing secure digital identities and decentralized public services.

Establishing advisory committees composed of blockchain experts, economists, and technologists to guide public policy on crypto issues.

Education and Workforce Development

A knowledgeable workforce is essential to leading in any technological field. Increasing educational and professional development opportunities can help build expertise.

Introducing cryptocurrency and blockchain technology courses in universities and colleges across the country.

Offering certification programs for professionals to gain expertise in cryptocurrencies and blockchain technology.

Funding research initiatives at academic institutions to explore new advancements and applications of blockchain technology.

Infrastructure Improvements

A robust digital infrastructure is fundamental for the growth of cryptocurrency and blockchain technology.

Ensuring high-speed internet access across the country to facilitate seamless digital transactions and decentralized applications (dApps).

Creating centralized hubs in key cities where crypto businesses, developers, and innovators can collaborate, potentially simulating the ecosystem found in Silicon Valley for tech startups.

International Cooperation and Leadership

The United States must engage with international partners and peers to consolidate its position as the global crypto capital.

Leading international discussions on developing global crypto standards and regulations to ensure interoperability and facilitate cross-border transactions.

Incorporating digital currency provisions into international trade agreements to encourage the use of cryptocurrencies in global commerce.

Collaborating with international law enforcement agencies to combat fraud, money laundering, and other illicit activities associated with cryptocurrencies, ensuring global trust in the system.

Potential Challenges and Criticisms

Transforming the U.S. into the world’s crypto capital is not without challenges and criticisms. Potential obstacles include:

Volatility and Risk

Cryptocurrencies are known for their significant price volatility, which can deter mainstream adoption and investment. Policymakers must address these risks by promoting stablecoins and developing hedging instruments that can help mitigate this volatility.

Security Concerns

The decentralized nature of blockchain technology and cryptocurrencies is a double-edged sword. While it enhances security and reduces the risk of centralized failures, it also introduces new attack vectors. Ensuring robust cybersecurity measures and resilient infrastructures is vital to protect users and maintain trust in the system.

Regulatory Hurdles

The process of regulatory harmonization is complex and time-consuming. Bringing together regulatory bodies with varying mandates and viewpoints will require significant effort, negotiation, and potential legislative changes.

Public Perception and Education

Public understanding of cryptocurrencies is still relatively limited. Misconceptions and lack of knowledge can hinder mass adoption. Initiating broad educational campaigns to inform the public about the benefits and risks of cryptocurrencies will be crucial.

Political Opposition

Implementing sweeping changes to favor cryptocurrencies might face opposition from various political factions concerned about financial stability, national security, and economic equity.

Trump’s Strategic Vision

Trump’s vision to turn the United States into the world’s crypto capital is a strategic move that reflects both the growing importance of digital currencies and the desire to maintain America’s position as a global financial leader.

By providing regulatory clarity, fostering innovation, incentivizing startups, and collaborating internationally, this vision could potentially transform the financial sector and the broader economy. While challenges remain, addressing them head-on could open up many opportunities. For instance, reduced regulations could attract international crypto firms and encourage domestic innovation, leading to advances in blockchain technology that could have far-reaching benefits across various sectors, from supply chains to voting systems and beyond.

Economic Impacts and Benefits

Positioning the U.S. as the global leader in cryptocurrency could have a profound economic impact. For example, it could help with job creation.

The crypto industry would create numerous high-paying jobs in technology, finance, legal services, and academia.

A favorable environment for cryptocurrencies could attract billions of dollars in domestic and international investment, stimulating economic growth.

Cryptocurrencies have the potential to provide financial services to unbanked and underbanked populations, fostering greater economic inclusion.

Embracing cryptocurrency could also prepare the U.S. for the future needs of global finance. It could give the country a significant edge in developing and implementing technology that could benefit various sectors, from healthcare to energy, ensuring a competitive advantage.

Conclusion

The ambition to turn the United States into the crypto capital of the world is bold—yet attainable. It represents a dramatic shift from Trump’s earlier skepticism and a response to the growing significance of digital currencies in the global economy. Achieving this vision will require a balanced approach that fosters innovation while addressing legitimate concerns about security and regulation.

Transforming the broader financial landscape will demand cooperation across government entities, private sector innovation, and global diplomatic efforts. For the U.S. to lead in this new era of digital finance, it must combine visionary policy-making with practical, inclusive measures that build public trust and industry confidence.

As the world stands on the brink of a digital financial revolution, the actions taken today will determine the economic leaders of tomorrow. If successful, Trump’s vision could cement the United States as a financial powerhouse and a trailblazer in the burgeoning field of cryptocurrencies and blockchain technology, setting a precedent for others to follow.

Disclaimer

Opinions stated on CoinWire.com do not constitute investment advice. Before making any high-risk investments in cryptocurrency, or digital assets, investors should conduct extensive research. Please be aware that any transfers and transactions are entirely at your own risk, and any losses you may experience are entirely your own. CoinWire.com does not encourage the purchase or sale of any cryptocurrencies or digital assets, and it is not an investment advisor. Please be aware that CoinWire.com engages in affiliate marketing.