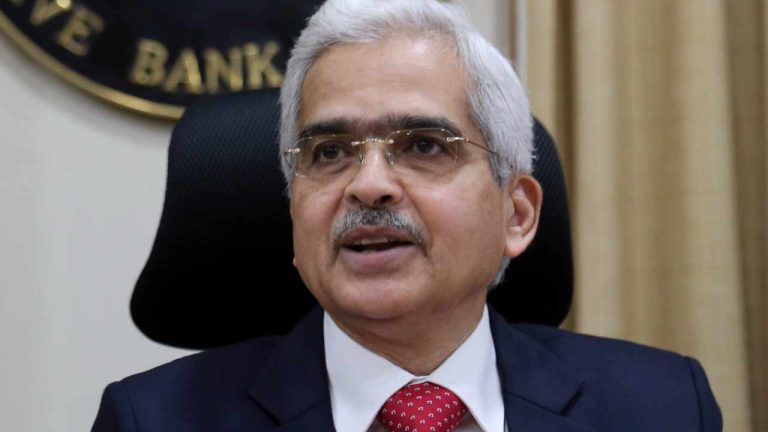

Reserve Bank of India (RBI) Governor Shaktikanta Das has revealed that India’s central bank digital currency (CBDC) now has around 1.5 million users. In addition, over 300,000 merchants are currently accepting payments in digital rupees, and the pilot is being operated through 13 banks in 26 cities.

RBI Governor’s Digital Rupee Update

Reserve Bank of India (RBI) Governor Shaktikanta Das provided an update on the progress of India’s central bank digital currency (CBDC) pilot on Wednesday at this year’s Global Fintech Fest in Mumbai. The Indian central bank began its digital rupee pilot for the wholesale segment in November last year, followed by a pilot in the retail segment in December.

The RBI governor revealed that India’s central bank digital currency trial has been rolled out to approximately 1.46 million users. He added that the digital rupee pilot is being operated through 13 banks in 26 cities, and over 300,000 merchants accepted payments in CBDCs as of Aug. 31.

Das further detailed that the RBI has enabled full interoperability of CBDC with UPI QR codes, noting that the central bank is targeting 1 million daily CBDC transactions by December this year, which will provide it with sufficient data points for analysis.

In February, RBI Deputy Governor T. Rabi Sankar said that 50,000 users and 5,000 merchants had adopted the central bank’s digital currency. By July, he shared that the user base had surged to 1.3 million, with 300,000 merchants accepting the digital rupee.

Moreover, RBI Executive Director Ajay Kumar Choudhary said Sunday on the sidelines of the G20 Leaders’ Summit that the Indian central bank is likely to launch a CBDC pilot for transactions for interbank borrowing or call money market by October. India holds the G20 Presidency this year. Choudhary was quoted by local media as saying:

The RBI will introduce the wholesale CBDC in the call market either this month or next month.

Choudhary believes that the e-rupee will rival cryptocurrency, stating in March that India’s central bank digital currency will act as an alternative to cryptocurrency. Last December, Sankar claimed that India’s CBDC should be able to do anything crypto can do without risks.

What do you think about the progress of India’s central bank digital currency? Let us know in the comments section below.