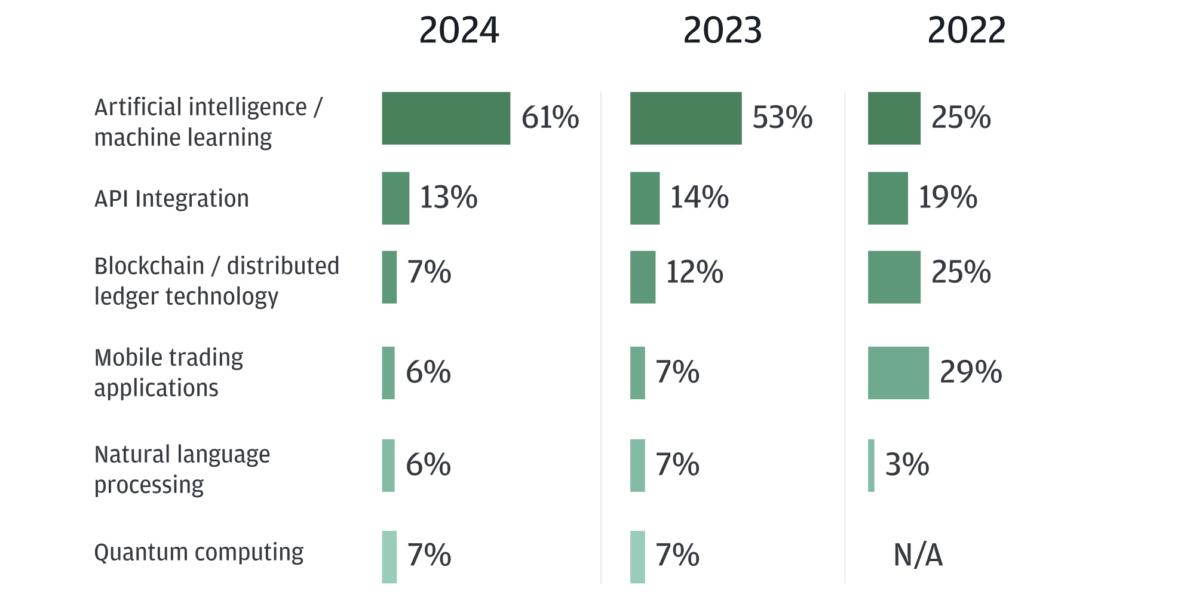

In a recent survey conducted by JPMorgan, institutional investors worldwide have expressed a resounding confidence in the role of artificial intelligence (AI) and machine learning (ML) in shaping the future trading landscape. According to the findings, 61% of the 4,010 institutional traders surveyed across 65 countries anticipate AI and ML to emerge as the most impactful technologies for trading within the next three years.

The survey also revealed a notable shift in preferences towards certain technologies. AI and ML topped the list, followed by application programming interface (API) integration at 13%. Blockchain and quantum computing trailed behind at 7%, with mobile trading applications and natural language processing securing 6% each.

This preference for AI and ML represents a significant increase from just 25% in ranked importance two years ago, indicating a steady ascent in confidence among institutional investors regarding these technologies’ efficacy in trading operations.

Diminished interest in cryptocurrency trading

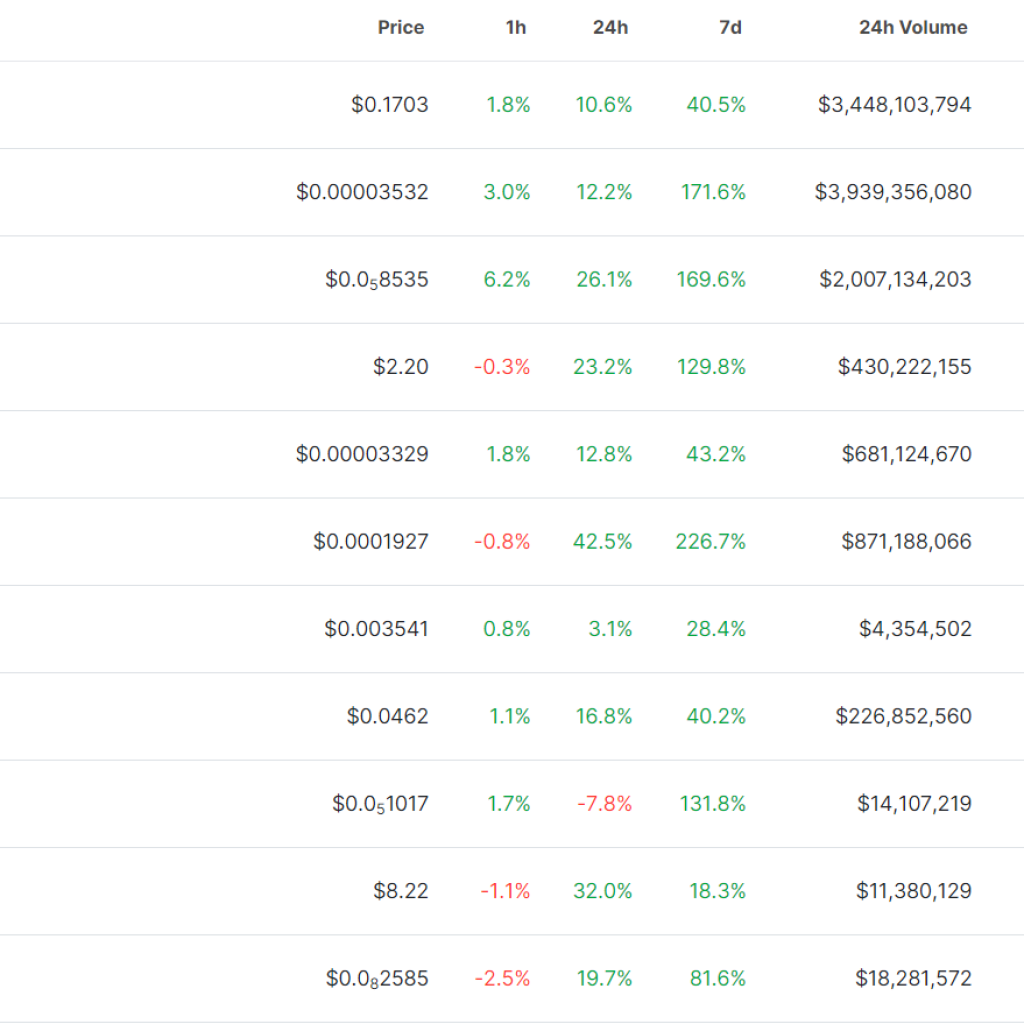

While the enthusiasm for AI and ML grows, institutional interest in cryptocurrency trading appears to wane. The survey indicates that 78% of institutional traders have no plans to engage in cryptocurrency trading within the next five years, a notable increase from 72% in 2023. Conversely, the percentage of respondents already involved in or considering crypto trading has seen a modest uptick from 8% to 9% in the same period.

JPMorgan’s controversial stance on cryptocurrency

JPMorgan’s stance on cryptocurrency has been controversial in recent years. Despite being named an authorized participant in one of BlackRock’s fastest-growing spot Bitcoin exchange-traded funds, CEO Jamie Dimon has remained critical of cryptocurrencies like Bitcoin. This skepticism is reflected in the survey results, where institutional traders affiliated with JPMorgan are reluctant to venture into cryptocurrency markets.

The survey conducted by JPMorgan underscores the growing confidence among institutional investors in the transformative potential of AI and ML in trading operations. As these technologies continue to evolve and demonstrate their efficacy in optimizing trading strategies and mitigating risks, institutional players are increasingly inclined to incorporate them into their investment frameworks.

However, the diminishing interest in cryptocurrency trading suggests a more cautious approach to emerging asset classes, particularly in the face of regulatory uncertainties and market volatility. Despite the growing popularity of cryptocurrencies among retail investors, institutional traders appear to favor more established and regulated markets for the time being.

JPMorgan’s position as a leading financial institution and its continued skepticism towards cryptocurrencies reflect the broader sentiment within the traditional finance industry. While the potential benefits of blockchain technology and digital assets are recognized, regulatory compliance, security, and market stability concerns continue to temper institutional enthusiasm.

In navigating the rapidly evolving landscape of financial markets, institutional investors must balance embracing innovation and managing risks. As AI and ML become increasingly integral to trading strategies, institutions must remain vigilant in evaluating emerging technologies and adapt their approaches accordingly to maintain a competitive edge in an ever-changing market environment.