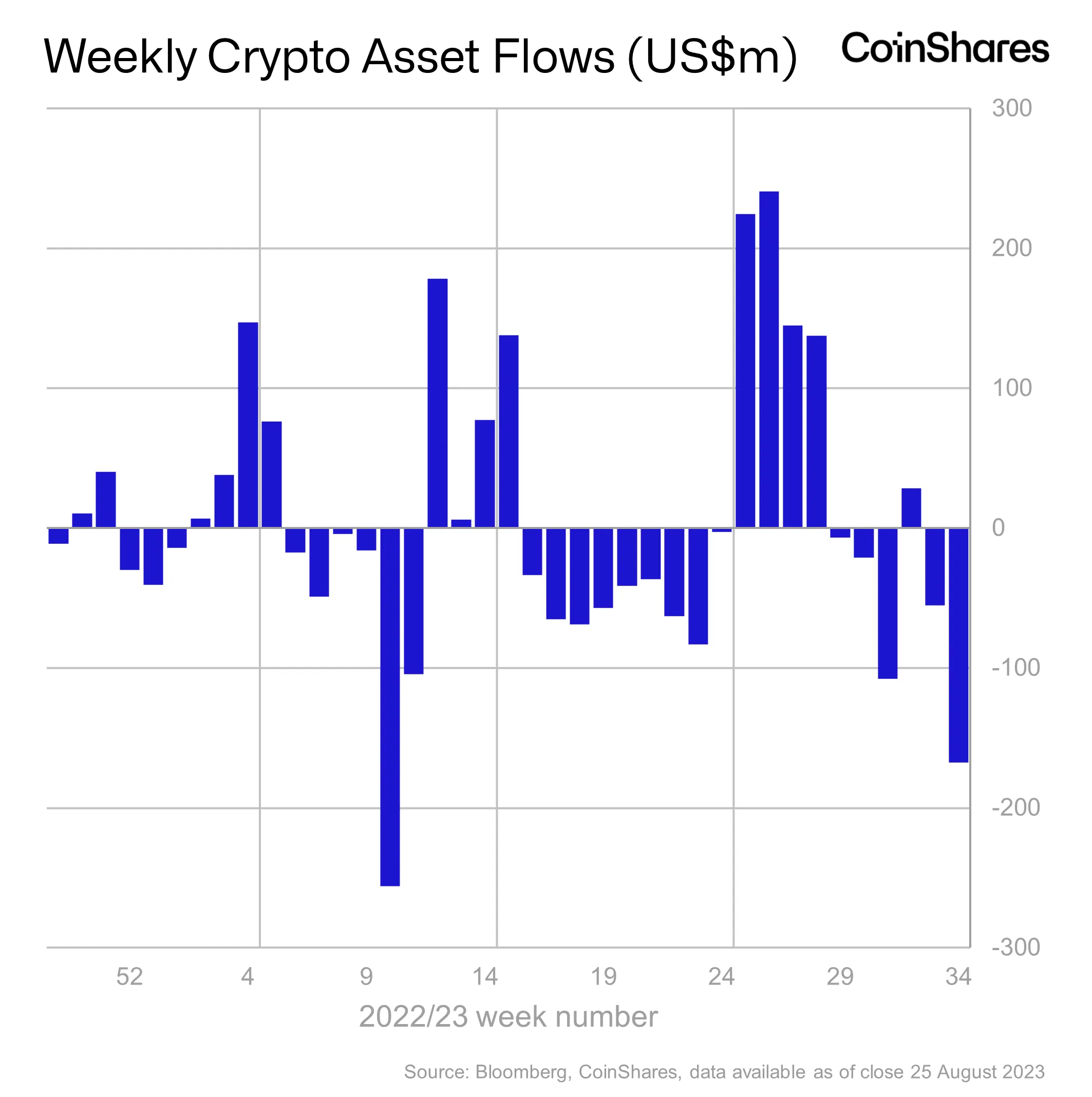

Digital assets manager CoinShares says that the crypto markets suffered their heaviest outflows last week since March.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that digital assets lost $168 million last week, continuing a two-week run of outflows.

“Digital asset investment products saw outflows totaling US$168m, the largest outflow since the US regulatory crackdown of exchanges in March 2023. This August’s outflows now total US$278m in what has been an exceptionally low trading volume market, with investment products trading US$1.3bn for the week, 16% below the year average.”

According to CoinShares, the negative sentiment stems from signs that a spot Bitcoin (BTC) exchange-traded fund (ETF) will likely take longer to approve than hoped.

“This negative sentiment we believe is due to the increasing acceptance that a spot-based ETF for Bitcoin in the US is likely to take longer than many expect, with recent delays being announced by the SEC.”

However, it was reported on Tuesday morning that Grayscale won its lawsuit against the U.S. Securities and Exchange Commission (SEC), with the court agreeing that it was wrong for the SEC to reject Grayscale’s ETF application.

Per usual, BTC took the brunt of the outflows, losing $149 million.

“Regardless, on a net basis flows remain positive for the year at US$265m. Many investors are continuing to sell their short positions, seeing US$4m outflows last week, with the last 18-week run of outflows representing 89% of total assets under management (AuM).”

While Ethereum (ETH) and Binance Coin (BNB) products lost $16.8 million and $0.2 million respectively, other altcoin products fared better. Multi-asset products, those investing in more than one crypto asset, saw inflows of $1.2 million. XRP, Litecoin (LTC), Cardano (ADA) and Solana (SOL) products saw inflows of $0.5 million, $0.4 million, $0.2 million and $0.1 million, respectively.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Institutions Take $168,000,000 out of Bitcoin and Crypto Markets As Hopes of ETF Approval Pushed Back: CoinShares appeared first on The Daily Hodl.