Inverse futures contracts are a type of derivative where traders use the underlying cryptocurrency (like Bitcoin) as collateral but settle profit/loss in a stablecoin (like USDT).

An inverse futures contract is a financial arrangement that requires the seller to pay the buyer the difference between the agreed-upon price and the current price upon contract expiration. In contrast to conventional futures, the seller benefits from price declines.

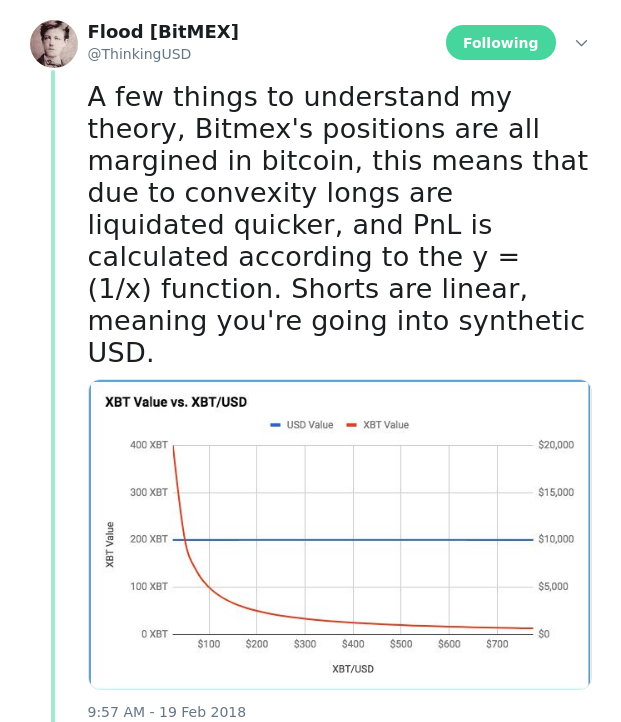

Regardless of the underlying cryptocurrency being traded, the contract value of an inverse futures contract is denominated in a fiat currency such as the United States dollar or a stablecoin like Tether (USDT). There is an inverse relationship between profit and loss (PnL) and the movement of the underlying cryptocurrency’s price.