- IOTA price is down 4% in the past 24 hours and trades near $0.30.

- The IOTA team announced a key partnership in Singapore,but is the price set to bounce or dip futher?

IOTA’s price has declined 5% in the past 24 hours to trade near a key support level. The slip now has weekly gains cut to just 2% while the altcoin has turned red on the monthly time frame.

The IOTA token trades at $0.31, down from recent highs of $0.41. This cryptocurrency is also one of the worst performing since the 2017 bull market. Per data from CoinGecko, IOTA is down more than 94% since its all-time high above $5.25 reached over six years ago.

On Tuesday, IOTA announced a major partnership with Tenity as it looks to tap into the growth potential in the Real-World Assets (RWAs) and DeFi sectors. The APAC Accelerator is a 12-week program that will see select startups receive $50k in grants.

📣 Big news from Singapore! We’ve teamed up with @tenity_global to launch the #IOTA APAC Accelerator, a 12-week program to empower the next generation of DeFi pioneers.💪

Find out how you can apply & receive a $50,000 grant 👇 https://t.co/R4EQAVaX4O pic.twitter.com/rKQp9jJqDa

— IOTA (@iota) April 9, 2024

Despite this and other recent key developments, price remains largely devoid of any strong momentum.

IOTA price – bounce or dip?

Bitcoin’s run to the new all-time high above $73k in March catalysed strong gains for most altcoins. Ethereum for instance reached a multi-year peak above $4,000 while Solana, BNB and even Dogecoin soared.

IOTA did manage to break above $0.30 during the broader market spike in March. However, it remained well below its 2021 highs above $2 and as a result has dropped out of the top 100 by market cap.

Can IOTA’s price recover to the last bull market highs and potentially eye a retest of its ATH?

IOTA chart outlook

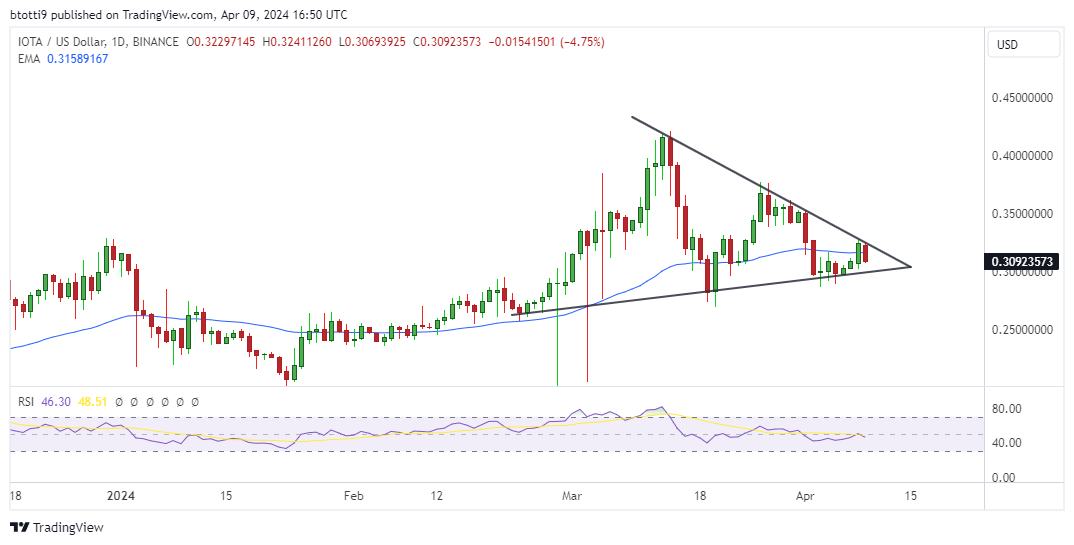

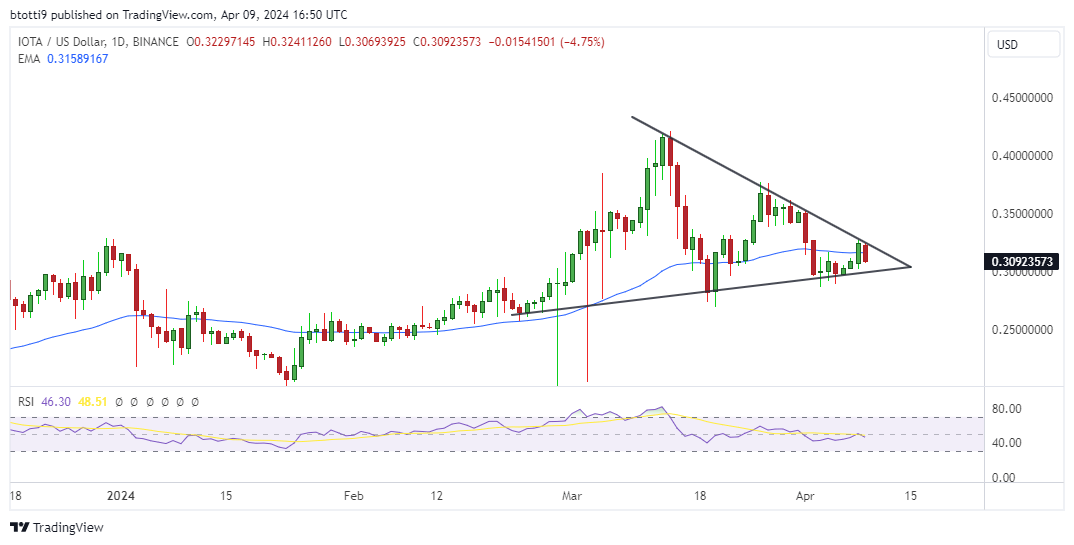

IOTA/USD on the weekly chart is below the 50-week EMA and the RSI is trending lower below 50.

A symmetrical triangle pattern is also formed on the daily chart, with price capped by a downtrend line since mid-March.

If price breaks out from the upper trend line, IOTA could retest levels at $0.35 and potentially $0.41 to allow for a bullish breakout in line with the broader market.

On the flipside, a breakdown for IOTA from the lower trend line would indicate a bearish trend. In this case, a drop to $0.20 is possible, below which bears could target October 2023 lows of $0.13.

The post IOTA price nears a key support: Can bulls bounce on key news? appeared first on CoinJournal.