The U.S. Internal Revenue Service has been grappling with crypto tax reporting for years, and they may have a ways to go still.

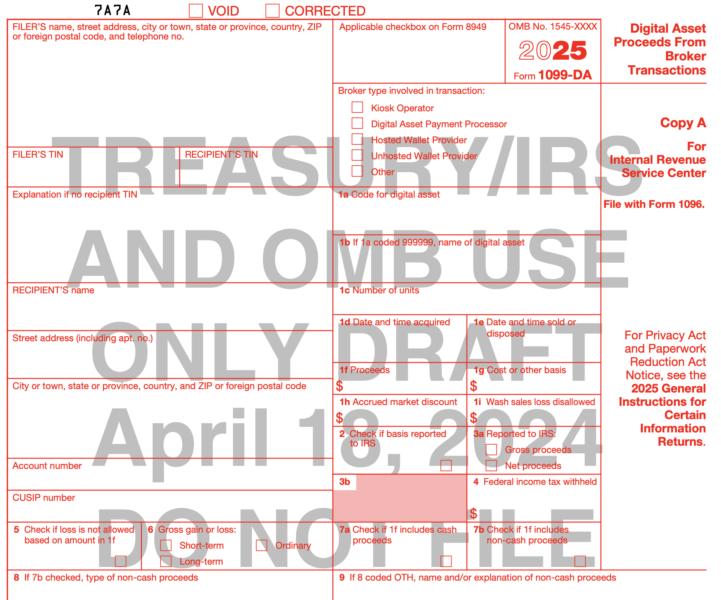

The United States Internal Revenue Service (IRS), the country’s tax service, has released a draft of its new Form 1099-DA “Digital Asset Proceeds from Broker Transactions” for reporting income from digital asset transactions. The form is expected to come into use in 2025 for reporting in 2026.

A broker will prepare Form 1099-DA for every customer who sells or exchanges digital assets. Brokers include kiosk operators, digital asset payment processors, hosted wallet providers, unhosted wallet providers and others, per the form. Copies of the 1099-DA will be sent to customers and the IRS, which will use them for verification purposes.

The form asks for token codes, wallet addresses, and blockchain transaction locations. Under the rule proposed in August 2023, cryptocurrencies, nonfungible tokens and stablecoins are reportable. The rule stated: