The latest draft form eliminated asking US taxpayers the time of day a crypto transaction occurred and identifying the “broker type.”

The United States Internal Revenue Service (IRS) has updated its draft form for taxpayers to report digital asset transactions starting in 2026.

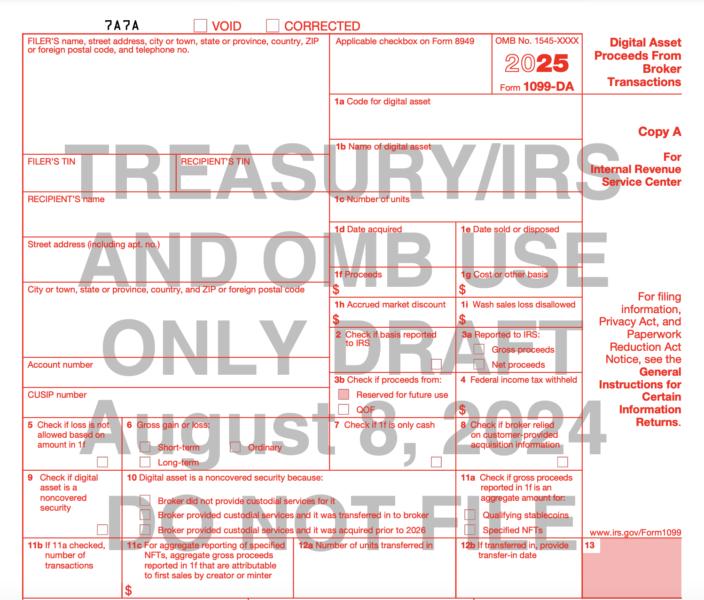

In an Aug. 8 notice, the IRS released a draft of Form 1099-DA, “Digital Asset Proceeds From Broker Transactions.” The form, if approved by the tax service, the form would allow US taxpayers to report crypto transactions from 2025 by the filing deadline in April 2026.

Compared to the draft released in April, the latest proposed 1099-DA removed a box asking taxpayers to identify the “broker type” for digital asset transactions. It eliminated asking filers for the precise time of day the transaction occurred rather than just the date. The draft also removed spaces for taxpayers to report wallet addresses and transaction IDs.