The streets and online forums of Argentina are buzzing, not with the usual chatter about football or politics, but about something quite unexpected—Bitcoin. You might think that in a country where the dollar has long been king, such a shift would be unthinkable. Yet, here we are, witnessing a significant pivot as Argentinians increasingly cozy up to the idea of stashing their savings in BTC rather than the US greenback.

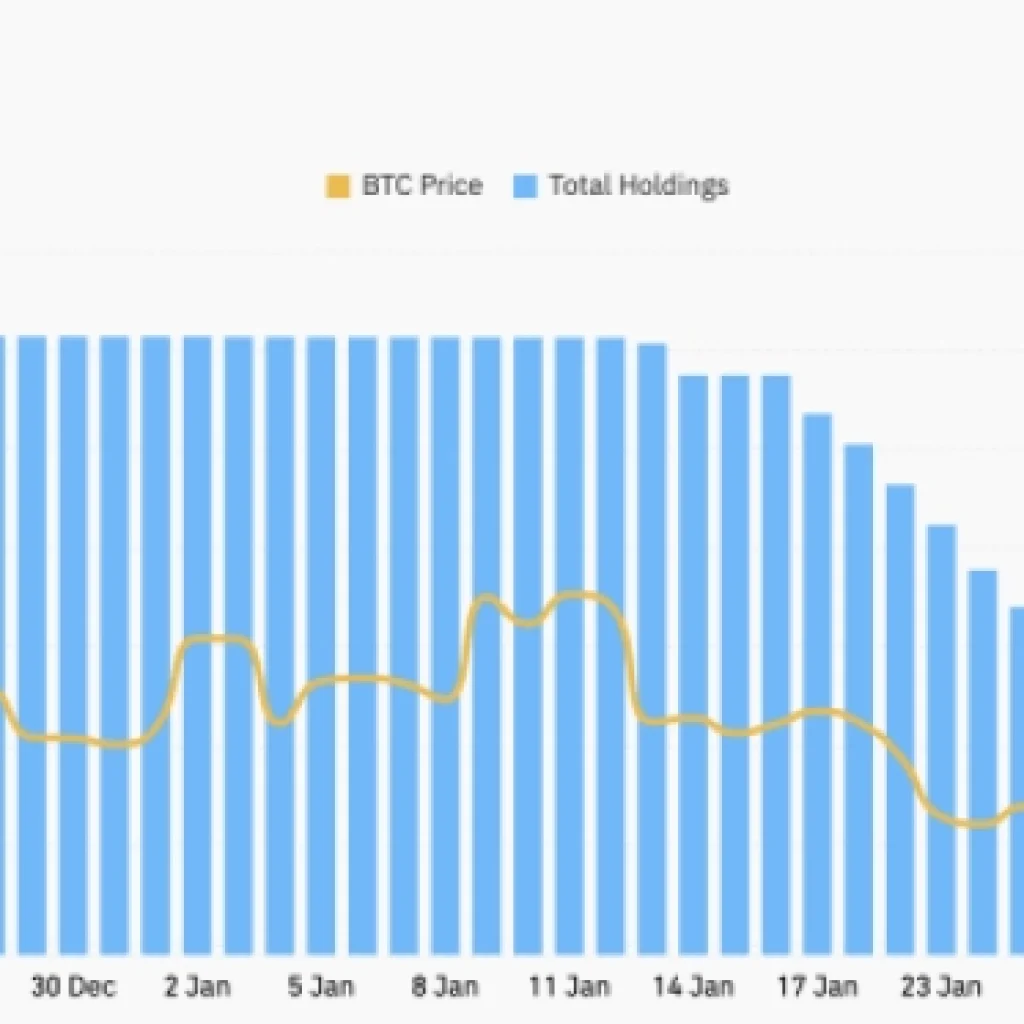

For years, the dance of exchanging pesos for US dollars was as Argentine as tango. However, recent developments suggest a new rhythm is taking over. Data from local cryptocurrency exchange Lemon throws a spotlight on this shift, revealing a surge in Bitcoin investments, hitting record figures over the past year. This trend emerges as the country seeks alternatives to the dollar, amidst the financial strategies unfurling under President Javier Milei’s watch.

A Shift Towards Digital Gold

Dollarization has been a hot topic in Argentina, especially with the election of President Milei, a figure who hasn’t minced his words about integrating the US dollar more deeply into the country’s economy. Despite these ambitions and a polite no-thank-you to an invitation from BRICS, Argentinians seem to be charting their own course, turning their backs on the dollar in favor of Bitcoin.

The evidence is in the numbers. Lemon’s recent report highlighted an unexpected surge in Bitcoin transactions, with a record-breaking 35,000 in just one week of March, a stark leap from the 27,000 purchases the week before. This frenzy towards Bitcoin comes at a time when the country’s economy is navigating through troubled waters, with the currency devaluating swiftly under Milei’s administration. The pivot away from stablecoins, which previously accounted for 80% of Argentina’s crypto purchases, underscores a growing appetite for riskier, yet potentially more rewarding, digital currencies.

Local firms like Belo, helmed by CEO Manuel Beaudroit, have observed this trend firsthand, noting a tenfold increase in Bitcoin and Ethereum transactions. Beaudroit’s insights reveal a reactive strategy among Argentinians: buy BTC when the market shows any sign of an upturn. This behavior signals a broader acceptance and understanding of cryptocurrencies as viable economic tools, especially in a volatile economic landscape.

Navigating Through Economic Turmoil

Argentina’s economy has seen better days. The final quarter of 2023 brought a 1.4% shrinkage compared to the previous year, marking a continuous decline over several quarters. Despite beating some analysts’ expectations, this trend paints a bleak picture for President Milei’s administration, which has been pushing a stringent austerity package since taking office.

Facing inflation rates soaring over 275%, stringent capital controls, and rising poverty, Argentina teeters on the brink of a recession. The National Bureau of Economic Research (NBER) in the United States defines a recession as a significant and widespread decline in economic activity lasting more than a few months. By this definition, Argentina is navigating choppy waters, with its economy contracting 1.6% in the full year of 2023.

Amidst this economic backdrop, the country’s agricultural sector, alongside mining and hospitality, has shown resilience, while other sectors like manufacturing, retail, utilities, and finance have faced downturns. Investment, too, has taken a hit, further complicating the economic puzzle Milei’s government is trying to solve.

So, why the turn to Bitcoin? For one, it represents a hedge against inflation—a digital fortress against the devaluation of the peso. Moreover, Bitcoin’s decentralized nature offers Argentinians a semblance of financial autonomy, unshackled from the whims of government policies and global economic trends.