Crypto industry’s top stablecoin issuer, Tether, seems to be moving in the direction of taking over the world. And I’m all for it!

Two days ago, the company made a surprising announcement that it just bought a 9.8% stake in Latin American agricultural giant Adecoagro. The purchase was worth around $100 million.

Adecoagro is one of Argentina’s largest milk producers, handling over 550,000 liters of milk daily. It also runs sugarcane fields spanning more than 193,000 hectares in Brazil, producing ethanol and refined sugar.

Plus, they’re into renewable energy too.

Tether’s getting into the real world, not just limiting itself to crypto. And by all accounts, it is also sitting on a fat pile of cash.

As of August, Tether’s reserves were around $118.4 billion, with $5.3 billion in excess reserves. The company also made a cool $5.2 billion in profit just from the first half of the year. It’s insane!

Tether’s market cap is at $114 billion, and it has been flexing its financial muscles all year. Now let’s talk about what these guys are planning and where they even came from.

The origin

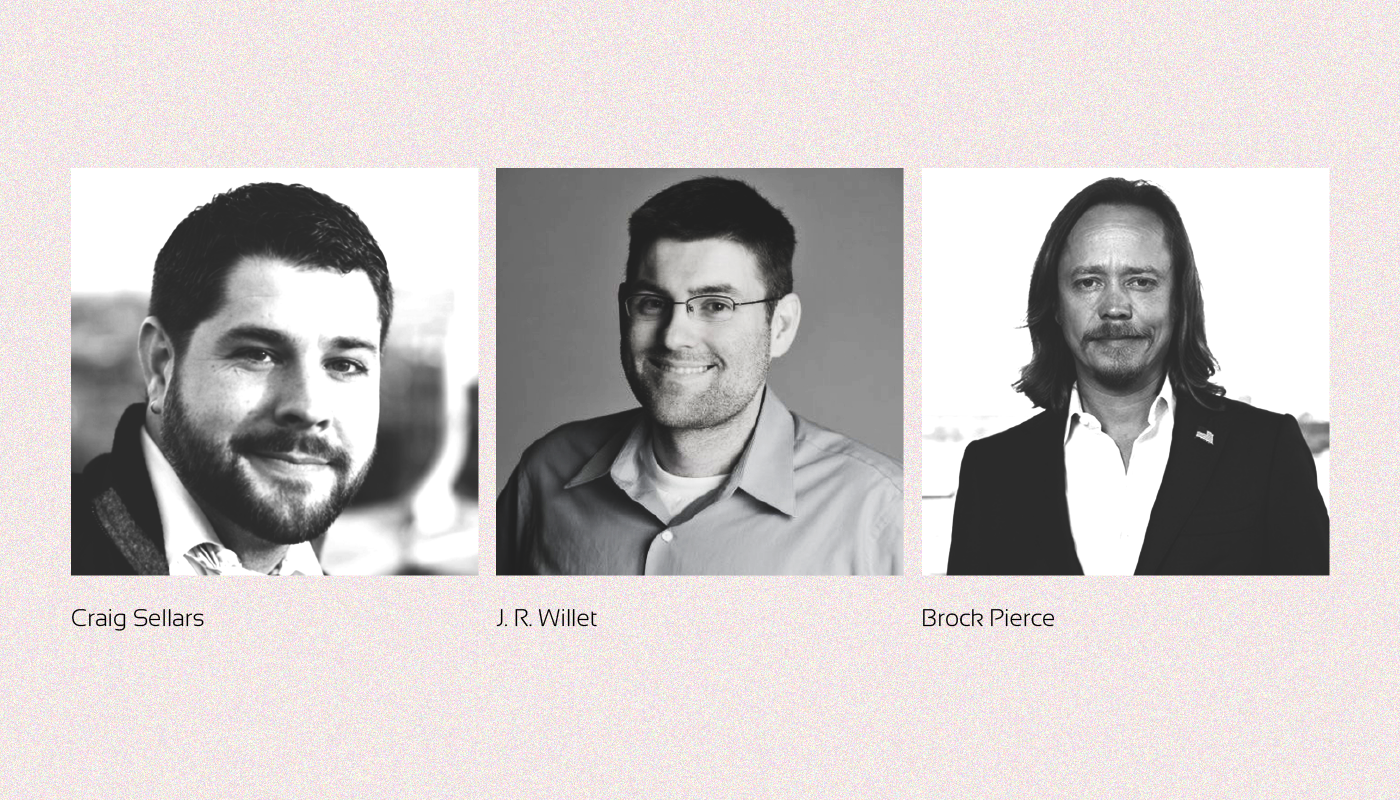

Tether was not always “Tether.” In 2014, it started as Realcoin, in Santa Monica. Brock Pierce, Reeve Collins, and Craig Sellars were behind it, with the first tokens launched on Bitcoin’s blockchain in October 2014 using the Omni Layer Protocol.

Realcoin used Bitcoin’s infrastructure for things like contracts and exchanges, trying to take advantage of Bitcoin’s unprecedentedly strong security.

Tether’s founders had big plans, too. They wanted to work with banks, exchanges, and ATM providers to make their vision work globally.

However, by November 2014, they ditched the Realcoin name and went with Tether. Then, things really took off. The company issued three main tokens backed by fiat currencies—USD Tether (US+), Euro Tether (EU+), and Yen Tether (JP+).

At the time, it was not backed by any independent audits. Tether was incorporated in the British Virgin Islands and set up offices in Switzerland, but unfortunately, it didn’t show much transparency.

Tether’s big boom

Between 2015 and 2018, Tether exploded in size. It was listed on Bitfinex, and from 2017 to 2018, the amount of Tether tokens grew from $10 million to $2.8 billion.

During that time, Tether accounted for about 80% of Bitcoin trading volume, and people used it everywhere to swap into crypto.

Of course, this kind of growth draws a lot of unwanted attention.

By 2018, when Tether’s price dropped to $0.88 briefly, it scared a lot of traders. There were concerns about credit risks, and people started dumping their Tether for Bitcoin.

Later in 2018, things got worse. The Wall Street Journal reported that one of Tether’s owners, Stephen Moore, was involved in using fake invoices and contracts to get around banking rules in China. Tether’s reputation took a hit, and it released a statement calling the Journal’s claims inaccurate and misleading.

That worked as well as you’d imaginee.

Tether today

In 2019, Tether overtook Bitcoin in trading volume, and by 2021, it was responsible for about half of all Bitcoin trades. That’s wild. But it’s also drawn the attention of regulators.

Tether got fined for not having full reserves during 2016–2018 and for failing to show proof of its assets. The company claimed that all its tokens were backed 1-to-1 by fiat currency.

But when it revised this in 2019, it turned out that Tether was only 74% backed by actual reserves. The rest? Receivables and other assets.

In 2021, the company settled a lawsuit with the New York Attorney General’s office for $18.5 million without admitting wrongdoing. It wasn’t a great look, but the company kept pushing forward.

“I’ve been vocal about my concerns regarding regulations that require stablecoins to hold significant reserves in uninsured cash deposits. Such mandates could endanger the financial stability of those relying on USDT, and I believe there are better ways to ensure safety without compromising access for millions of users.”

While other crypto companies struggled in 2022, Tether emerged looking stronger. Circle, its closest competitor, also struggled with growth.

In October 2023, Paolo Ardoino, Tether’s Chief Technology Officer, got the nod to become CEO, succeeding Jean-Louis van der Velde.

But just as Paolo’s promotion was announced, the Wall Street Journal dropped yet another bombshell report alleging Tether’s involvement in some pretty dark stuff: money laundering, terror financing, and sanctions evasion.

The report claimed Tether was used to finance Hamas, pay Chinese fentanyl suppliers, fund North Korea’s nuclear program, and even buy sanctioned Venezuelan oil for Russian oligarchs.

Tether responded by publishing a blog post, denying all the accusations. The post emphasized how it had helped freeze $835 million in assets linked to theft and worked with governments on criminal investigations.

Somehow, the company emerged unscathed from that fiasco.

During a February 2024 congressional hearing, Congressman Tom Emmer from Minnesota called the Wall Street Journal report “erroneous,” citing federal reports that showed a much smaller amount of crypto was being used by these groups.

Despite the bad press, Tether kept pushing forward with its plans. In May 2023, it announced a Bitcoin mining operation in Uruguay, a country that gets over 98% of its electricity from renewable energy sources like wind and hydropower.

That’s smart, considering how much energy Bitcoin mining uses and how much flak the crypto industry gets for environmental damage.

By November 2023, Tether committed to investing half a billion dollars over six months to become one of the world’s top Bitcoin miners. Part of this investment came from a $610 million credit facility extended to Northern Data AG, a publicly traded Bitcoin mining company in Frankfurt.

Tether went on to sign a memorandum with the Government of Georgia to create a special fund for local startups to develop blockchain technologies in the region.

In December 2023, Lugano, Switzerland started accepting cryptocurrencies, including Tether, for paying taxes, fines, and other invoices, cementing its place in global financial systems.

Transparency issues

Even before the crypto-cursed year that 2022 turned out to be, people were already accusing Tether of not being clear about its reserves, and some weren’t sure if it even had the fiat backing it claimed.

Tether kept saying the company would get audited, but it never happened. The closest Tether got to an audit was in July 2022 when it started releasing quarterly reports through BDO Italia.

The Wall Street Journal wasn’t impressed, saying these reports were just “snapshots” of Tether’s assets at specific times. It wasn’t enough for the critics, but then Tether started to turn things around.

By 2022, it was already a big player in crypto, issuing USDT on blockchains like Ethereum, Solana, Tron, and Algorand. Tether wasn’t just tied to Bitcoin anymore.

Tether’s presence grew in ways nobody expected, and its reach grew faster, making it critical to daily crypto trading volumes.

“I understand that part of the FUD surrounding Tether was due to our previous naivety. We believed that if we did good work, the doubts would fade. Now, we realize the importance of transparency and communication to build trust in our operations and the broader cryptocurrency ecosystem.”

— Paolo Ardoino

In January 2024, Howard Lutnick, CEO of Wall Street giant Cantor Fitzgerald, told Bloomberg that concerns about Tether’s reserves were misplaced, assuring that “they have the money.”

That was also when Howard revealed to the world that his company was acting as the custodian for Tether’s reserves, which brought a bit of legitimacy, something the stablecoin issuer desperately needed.

Back to the present day, Tether continues to face allegations of being used for illicit activities.

According to blockchain analytics company TRM Labs, Tether was the most used stablecoin for criminal activity throughout 2023, connected to $19.3 billion in illicit transactions.

That was a large drop from 2022 when the number was $24.7 billion.

The restructuring

In February 2024, the company announced Tether Edu, a new education division focusing on teaching blockchain and digital technologies, especially in underserved regions like Africa, Latin America, and Asia. The goal was to provide training in blockchain, design, AI, and coding, wanting to bridge the education gap in these areas.

By the first quarter of this year, the company’s net profits were $4.52 billion, with most of that coming from US Treasury securities. Tether also made massive profits from its positions in gold and Bitcoin.

In April, the company announced a $200 million investment from its excess reserves into Blackrock Neutro, an American brain-chip company. Blackrock Neutro develops brain-to-computer interfaces, which allow people to control computers and prosthetic arms without moving.

In May, Tether announced a major restructuring. It split into four divisions—Finance, Data, Power, and Edu—to reflect its growing scope of operations.

These new divisions cover everything from traditional finance to renewable energy and digital education, taking us back to the question in the headline: Could Tether take over the world?

Tether in today’s global economy

Let’s be real. The global economy isn’t looking great. And it hasn’t for the better part of five years. The World Bank says global growth will dip to 2.4% by year-end, which is one of the weakest performances we’ve seen in thirty years.

Why? High interest rates, sluggish global trade, and geopolitical disasters like the conflicts in Ukraine and the Middle East. These issues hit businesses, workers, and governments hard, leaving a lot of instability across the board.

On top of that, inflation remains a massive problem. America’s annual inflation rate was at 2.9% in July 2024, with a month-over-month increase of 0.2% seen in August.

The core inflation rate, which excludes food and energy, stands at 3.2% year-over-year. Over in the Eurozone, inflation is at 2.6%. The UK’s is at 3.5%. Canada and Japan are both at 3.0%.

Developing economies are getting hit even harder. In fact, about 40% of low-income countries are projected to be poorer than they were before the pandemic.

If you add crippling debt and an urgent need for trillions in investments, it’s quite clear that the economic picture is rough.

And THAT is where Tether comes in.

For starters, it can help with cross-border transactions, particularly in regions where the local currency is unstable. Think Venezuela, Nigeria, Argentina, and Brazil, where its impact is already in full effect.

USDT could provide a stable medium of exchange, bypassing traditional banking hurdles and currency fluctuations.

But it doesn’t stop there. Tether has the potential to push financial inclusion to the next level.

By offering a digital dollar that’s easily accessible via smartphones, people in developing regions who don’t have access to traditional banks can now access financial services. Millions of unbanked individuals could be empowered to participate in the economy, which would ultimately strengthen growth.

Then there’s the massive investment gap in emerging markets. The World Bank has pointed out that $2.4 trillion per year is needed to meet global development goals.

Tether could play a role here by investing in infrastructure and development projects, providing liquidity and stability that attract further investments into these low-income regions.

“The stability of the dollar is crucial for emerging markets, and USDT is among the top three global buyers of short-term U.S. Treasury bills. This integration of digital currencies with traditional markets is essential for fostering global economic resilience.”

— Paolo Ardoino

Another way Tether could contribute is by mitigating the impact of inflation. With hyperinflation wrecking economies in certain regions, USDT can offer a reliable store of value.

Let’s not forget about remittances. Many families in conflict-affected areas rely on money sent from abroad to survive. Tether can make these transactions faster and cheaper.

This kind of economic empowerment can help ease the social unrest that comes from poverty and lack of opportunity.

Tether has also been working on compliance, including solutions for the “Travel Rule,” which requires sharing customer information for cross-border transactions.

This helps build trust between nations and financial institutions, creating a more stable environment for international transactions. But it could also make it easier for criminals to party.

Though, as I was writing this article, I got an email with the announcement that Tether, TRON and TRM Labs have joined forces to establish the T3 Financial Crime Unit to combat illicit activity associated with the use of USDT on TRON.

In the weeks since its launch, the initiative, in collaboration with law enforcement, has frozen over $12 million in funds linked to a range of criminal activities, including a blackmail scam and an investment fraud scheme.

Police have identified at least 11 victims, but as the investigation continues, that number is expected to grow. Seems like Tether is moving in the right direction, and that is to dominate economic activities around the world.