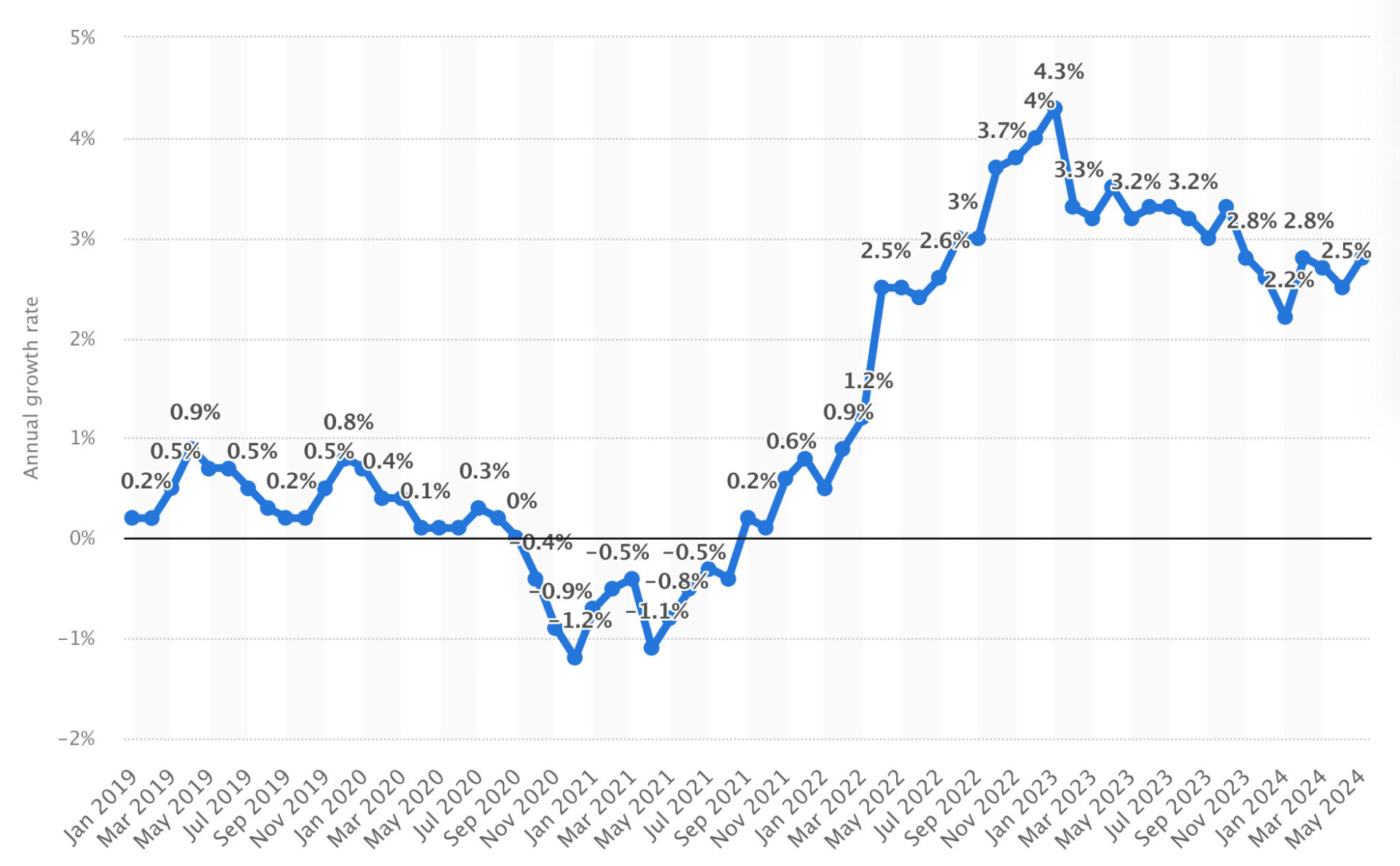

Japan’s inflation is on the rise, driven primarily by soaring energy costs. This increase may push the country’s central bank to consider raising interest rates in the upcoming months. According to the Ministry of Internal Affairs, consumer prices, excluding fresh food, rose 2.5% in May compared to the previous year, a jump from April’s 2.2%.

Although this figure slightly missed economists’ expectations, it remained above the Bank of Japan’s 2% target for the 26th consecutive month.

A staggering 14.7% surge in electricity prices was a key factor behind this inflation spike. The main inflation gauge has accelerated after two months of deceleration, giving the central bank more reason to consider raising interest rates. This deceleration indicates businesses’ reluctance to raise prices further, as higher costs have dampened consumer demand.

Meanwhile, the Bank of Japan (BOJ) has indicated that it will provide more details about its plans to reduce bond buying next month, which may include a potential rate hike.

Governor Kazuo Ueda has kept his options open, suggesting that an interest rate increase could be on the table if the data supports such a move. He recently stated that, depending on economic and financial conditions, there is a good chance the policy rate will be raised in July.

However, there is also reason for caution.

Prices are influenced by both upside and downside factors. One of the main drivers pushing prices higher is the weak yen. Japan’s currency has been trading close to its 34-year low against the dollar for much of the past month.

Related: Japanese banks will boost crypto liquidity: Arthur Hayes

The ongoing gap between Japanese interest rates and those of its global peers is expected to maintain pressure on the yen against a range of currencies, thereby refueling import-driven price hikes.

Trade data for May revealed that Japan’s trade deficit widened to more than ¥1 trillion ($6.3 billion) due to the weak currency inflating import bills. Governor Ueda has emphasized the need to monitor how the yen and import prices affect the economy.