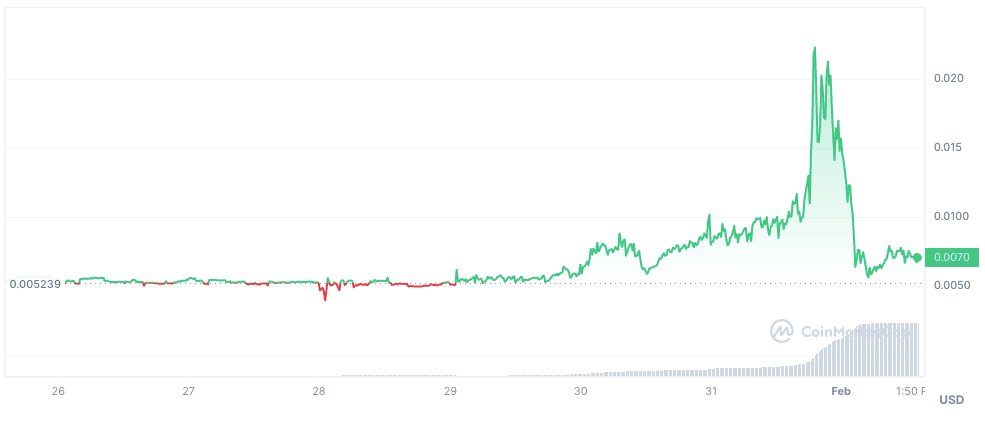

The cryptocurrency market witnessed a significant downturn with the introduction of the JUP token, a new digital asset from Jupiter, a decentralized exchange built on the Solana blockchain. Unlike the usual bullish trend observed with the launch of new tokens, JUP experienced a drastic fall, losing over 63% of its value in the early hours of today. This development has sparked intense debate in the crypto community.

Allegations of mismanagement surface

Critics have raised concerns over the management of the JUP token launch, pointing to actions by the Jupiter team that deviate from standard practices in the crypto space. On X, Adam Cochran, a notable figure in the cryptocurrency analysis sphere, accused the Jupiter team of allocating a disproportionate share of JUP tokens to themselves, which he suggests undermines the token’s market stability and investor confidence. He highlighted that the team allegedly withdrew liquidity prematurely, securing $30 million on the first day without implementing a lockup period for the tokens, which maintained their 50% ownership stake.

Cochran’s allegations are supported by a screenshot of a conversation purportedly with the Jupiter team, where they are accused of removing liquidity from the pool without adequately informing investors. This action, according to critics, could be interpreted as a “rug pull,” a term used within the cryptocurrency community to describe scenarios where developers abruptly withdraw support from a project, leaving investors at a loss.

Jupiter’s response and market reaction

In response to these allegations, the founder of Jupiter, known as “Meow,” has dismissed Cochran’s claims as baseless and lacking in factual evidence, referring to them as mere “shitposting.” Meow has indicated that a comprehensive post-launch analysis is planned to address the concerns raised and outline the next steps for the JUP token.

At the time of press, JUP is trading at $0.5717, according to CoinMarketCao